The Northern Miner, in association with the Prospectors & Developers Association of Canada, set out to shine a spotlight on Canada’s mining industry for European and U.K. investors with our inaugural Canadian Mining Symposium held at Canada House in London, U.K., on May 9. And as our team returns from across the pond and we get feedback from participants, we’re finding wide agreement that it was a top-quality event filled with memorable discussions and plenty of new contacts and business leads.

Canada House itself proved an exceptional locale for such a meeting, with its central location, superb décor, airport-level security and extremely helpful and gracious staff, who are genuinely enthusiastic about fulfilling their mandate to promote Canadian business overseas. About 200 high-level executives and investors attended — a good number from London, but many also flying in from around the globe.

Canada House in London, U.K., which served as venue for the Canadian Mining Symposium on May 9, 2017. Photo by Martina Lang.

Breakfast welcome for delegates at the Canadian Mining Symposium at Canada House in London, U.K., in May 2017. Photo by John Cumming.

In a video appearance, Canada’s Minister of Natural Resources Jim Carr welcomes attendees of the Canadian Mining Symposium in Canada House in London, as Janice Charette, Canada’s High Commissioner to the U.K., stands at the podium. Photo by John Cumming.

Jim Carr, Canada’s Minister of Natural Resources, welcomed attendees to Canada House via a video greeting, while Janice Charette, Canada’s High Commissioner to the U.K., and Glenn Mullan, president of the Prospectors & Developers Association of Canada, opened the day’s events in person.

Our marquee speakers delivered thought-provoking interviews, starting with Barrick Gold president Kelvin Dushnisky, who told moderator Bill Whitelaw, executive vice-president at Glacier Media, that Barrick in past years had “lost its way in some senses” by “chasing production and the number of ounces, rather than the quality of ounces,” and having too high a debt.

He said Barrick’s restructuring over the past two and a half years has “returned discipline back into the business.” Most importantly, he said, Barrick has returned to a streamlined, decentralized operating model that has been “very effective.”

Northern Miner publisher Anthony Vaccaro presented Ivanhoe Mines executive chairman and founder Robert Friedland with a Lifetime Achievement Award, and then sat down with the mining mogul to get his views on future demand for metals.

Friedland said it will be shaped by increasing demand for clean air and water, especially in urban areas, “which is very good for certain raw materials” such as vanadium, scandium, cobalt, nickel, copper, spherical graphite, lithium, aluminum and what he calls the “king of all metals,” copper.

“We have to think about what a 10% drop in demand for oil will mean for the price of oil,” Friedland said. “We’re in an era of very fundamental and very profound change.” Cars and trucks and trains are going to be made out of aluminum alloys that are cheap and easy to recycle, and that, he said, will be “not so good for iron ore.”

Friedland sees disruptive technology coming to mining, such as traditional, energy-intensive milling being replaced with electromagnetic pulse technology that would consume 1% of the energy. “What a great time to be alive, to change mining and reperceive it.”

Lukas Lundin, chairman of the Lundin Group of Companies, sat down with moderator Gianni Kovacevic, executive chairman of CopperBank, for a freewheeling talk on the wide range of commodities being pursued by Lundin-linked companies.

Lukas Lundin (left), chairman of the Lundin Group of Companies, with moderator Gianni Kovacevic, executive chairman of CopperBank at the Canadian Mining Symposium at Canada in London, U.K., in May 2017. Photo by Martina Lang.

“As I grew up, oil was always a question of supply, but now it’s a question of demand … and oil may slow down a bit,” Lundin said. “But base metals are probably going to remain strong, especially copper, if you think about all these electric cars. Base metals are a good space to be in.”

The diamond mining business, Lundin said, is “very complicated and I don’t know much about it,” and described his success with Lucara Diamond as having been “a bit of luck.”

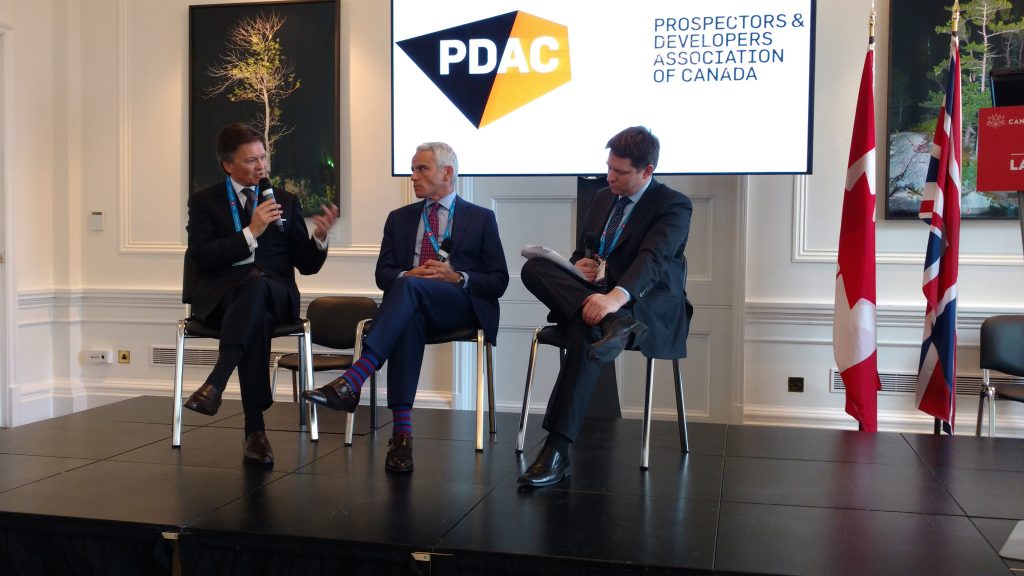

Barrick’s Dushnisky returned to the stage in the afternoon with Goldcorp CEO David Garofalo to discuss how Canadian best practices are moving abroad with moderator Greg Huffman, managing director and global head of mining sales at Canaccord Genuity.

At the Canadian Mining Symposium at Canada House in London, U.K., in May 2017, from left: Barrick Gold president Kelvin Dushnisky and Goldcorp president and CEO David Garofalo in conversation with moderator Greg Huffman, managing director and global head of mining sales at Canaccord Genuity. Photo by John Cumming.

Garofalo emphasized that miners need to drastically reduce their water usage if they are to retain local stakeholder approval for mining operations, particularly where they may negatively impact local agriculture.

During two panel sessions, Rob McEwen executive chairman and “chief owner” of McEwen Mining argued for the virtues of making shareholder value the primary concern for gold mining companies.

“There’s a discipline that’s not in the marketplace in the mining industry, and that is insider ownership of shares,” McEwen said. “Too many management teams have too little invested in their company to guide appropriate growth.”

Sharing a laugh during a panel session at the Canadian Mining Symposium in London in May 2017, from left: Stephen R. Mullowney, managing director & partner, Consulting & Deals, PwC; Patrick Anderson, president and CEO, Dalradian Resources; Rob McEwen, executive chairman, McEwen Mining; Ed Sterck, director, BMO Capital Markets; Ian Pearce, chairman, New Gold; and John Cumming, Editor-in-chief, The Northern Miner. Photo by Martina Lang.

love your e mail