One cannot open the paper or go online these days without seeing articles about the rosy future for electric vehicles (EVs) and grid storage, and the resultant growth in lithium ion battery (LiB) demand.

LiBs are already a $20-billion-per-year market that is growing over 20% annually. This has mainly come from growth in the market for the handheld devices we are all familiar with.

But EVs and grid storage are large markets still in their infancy, and the next generation of battery technology is not yet out of the lab. There is a lot of runway left for LiB growth.

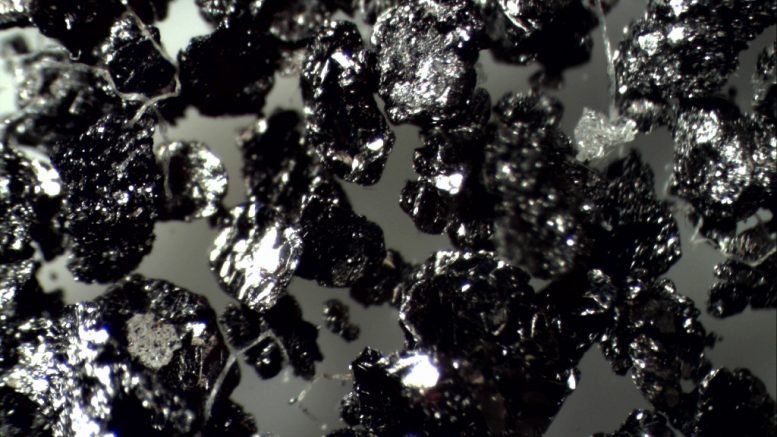

LiBs require three main minerals: lithium, cobalt and graphite, which is the anode material in the batteries. These are small specialty markets, while the EV market is huge. Even modest, conservative adoption rates for EVs would affect demand for these three minerals.

(Meanwhile, copper, nickel and various other mineral producers are now all on the bandwagon. However, while the LiB and EV markets will be important to these producers, they have much less leverage.)

Lithium prices have already taken off, offtake agreements and strategic partnerships have been established, and new mines are being built.

Cobalt prices have also spiked, although the structure of the industry is more problematic, with a looming supply problem and related political complexity in the Democratic Republic of the Congo.

Graphite prices, meanwhile, have not responded much to LiB demand growth for a number of reasons.

First, the 750,000-tonne-per-year flake graphite industry is quite bigger than cobalt and lithium, and it has taken longer for battery demand to have a meaningful impact.

Second, graphite demand is dominated by the steel industry and the slowdown in Chinese steelmaking, which began in 2012, and has to date largely offset rapidly growing battery demand.

Lastly, the Chinese are increasing the production of small-flake graphite (which is used to make LiB anode material), and there is excess capacity.

While it will take time to work through this surplus, substantial graphite production will be required in the future to meet even conservative EV growth projections.

Benchmark Mineral Intelligence tracks LiB manufacturing plants and estimates that over 300 Gigawatt hours of capacity will be added by 2021.

This will require a doubling of flake-graphite production in a relatively short period of time, and multiple new mines are needed to do so.

You cannot believe in the rapid rise in usage of LiBs and EVs without believing in the attendant rise in demand for graphite. Its day is coming.

The current excess Chinese graphite production capacity largely owes to a big, government-owned graphite mine in the Luobei region of Heilongjiang province. It produces 2 million tonnes of ore per year, which it does in just three or four months each summer. The government restricts production based on market conditions and gives an ore quota to 11 privately owned processing plants, which operate at 30% capacity. They almost exclusively produce negative-100 mesh (small flake) concentrates, which are used to make spherical graphite — the anode material in LiBs.

However, Chinese production of large (+80 mesh) and XL (+50 mesh) flake is declining, due to the depletion of resources and stricter enforcement of environmental standards in Shandong province — the main source in China.

Demand for XL flake for the expandable graphite market is growing rapidly — there is a shortage of supply and prices are quite good. Also, the steel industry is recovering, which is increasing demand for large flake and firming up prices.

Graphite prices increased up to 40% in the second half of last year (albeit from a low base) due to the growth in LiBs, a recovering steel market and Chinese production problems. Most notably, the price for +50 mesh XL flake continues to rise due to growing shortages. This has been well covered by Industrial Minerals magazine and Benchmark — the two main sources of pricing information.

The larger supply-and-demand picture is a little trickier, as numbers are all over the map for IM, Benchmark and Roskill. Personally, I get my data directly from the source in China and fill in the rest of the world from the other sources.

The bottom line is that there is an immediate opportunity for large and XL flake production, but these markets are smaller, and there isn’t room for everyone.

But there is room for a small number of new projects that would produce mainly large or XL flake, and have realistic production levels, reasonable capital costs and good economics at current prices.

Ideally, these new mines would be located in politically stable countries, as many advanced projects are in Tanzania and Mozambique — which are often in the news for the wrong reasons.

The graphite juniors that meet all the above criteria make up a very short list.

— Based in Ottawa, Gregory Bowes is CEO of Northern Graphite Corp., which is developing its Bissett Creek graphite project between North Bay and Ottawa in Ontario.

Northern Graphite has completed a full feasibility study for a 70-year mine at Bissett Creek, and says the study shows the project “likely has the best flake-size distribution, highest margin and lowest marketing risk of any new graphite project.”

Visit www.northerngraphite.com for more information.

Be the first to comment on "Commentary: The graphite opportunity within the EV boom"