Stocks fell Mar. 6-10 as investors shifted from concerns over inflation to the outlook for the economy after regulators shut California-based Silicon Valley Bank following losses that prevented it from maintaining enough capital.

The Dow Jones Industrial Average fell 1,481.33 points or 4.4% to 31,909.64 and the S&P 500 dropped 184.05 points or 4.5% over the week to 3,861.59.

Two companies seen as proxies for the wider economy were among the top mining and metals industry decliners last week. Aluminum producer Alcoa plummeted 19% to US$44.91 per share. Steelmaker Cleveland-Cliffs fell 15% to US$19.37 per share.

Pittsburgh-based Alcoa struggled last year with inflation on inputs, posting a loss of US$102 million. “Global turbulence negatively influenced costs for energy and raw materials and we saw significant variance on product pricing between the first and second halves of 2022,” Alcoa president and CEO Roy Harvey said in January.

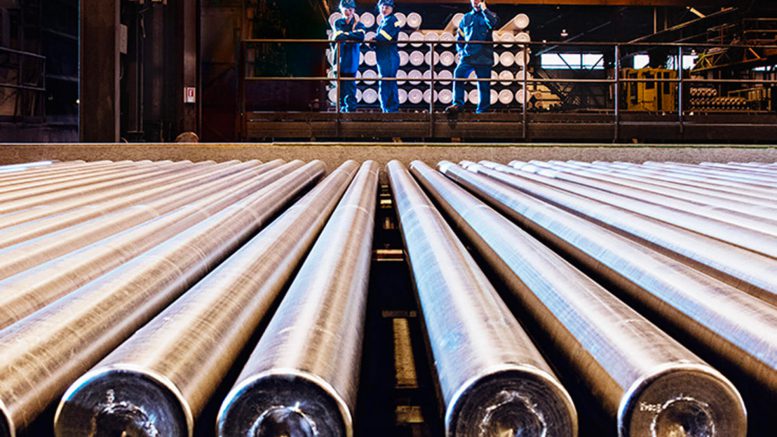

Cleveland-Cliffs, the largest flat-rolled steel producer in North America and the biggest supplier of steel to the continent’s auto industry, said Monday it’s raising its rolled steel prices by about 9%. That followed price increases for its steel plate products in the previous week. Last month the company reported net income fell by more than half to US$1.4 billion last year due to higher costs and lower sales.

Hudbay Minerals tumbled 16% to US$4.55 per share. Production continues at its Constancia copper mine in Peru, which has suffered widespread protests and highway blockades affecting mining operations since the ouster of President Pedro Castillo in December, the company reported last month. Hudbay was left with 25,000 tonnes of copper concentrate unsold in Peru at the end of the fourth quarter, it said.

Still, it posted record gold production in Peru during the fourth quarter and said it was able to keep company-wide operating costs last year comparable to 2021 despite decades-high inflation.

Lithium Americas, which this month began building its US$4-billion Thacker Pass project in Nevada, slid 14% to US$20.82 per share. Construction was allowed to start after a federal court ruled last month the project wouldn’t cause unnecessary harm to the environment and wildlife.

The proposed mine stands to be a major source of lithium in U.S. President Joe Biden’s critical minerals strategy to develop alternatives to relying on metals from China. Automaker General Motors has pledged to invest US$650 million in the project. Thacker Pass and another project in Nevada, Ioneer’s Rhyolite Ridge lithium-boron project northwest of Las Vegas, are being considered for hundreds of millions of dollars in loans from the country’s department of energy.

Teck Resources, which said last month it plans to change its name to Teck Metals after placing its steel-making coal business into a separate company, fell 14% to US$36.82 per share. Teck Metals will focus on growth with low-cost base metals and copper development while the spun-out Elk Valley Resources is to be a high-margin coal producer focused on long-term cash generation, the company said.

Be the first to comment on "Silicon Valley Bank failure knocked NYSE lower last week"