Like many other juniors in today’s depressed commodities market, Red Pine Exploration (TSXV: RPX; US-OTC: RDEXF) seems to have a lot more going for it than its 4¢ share price would suggest.

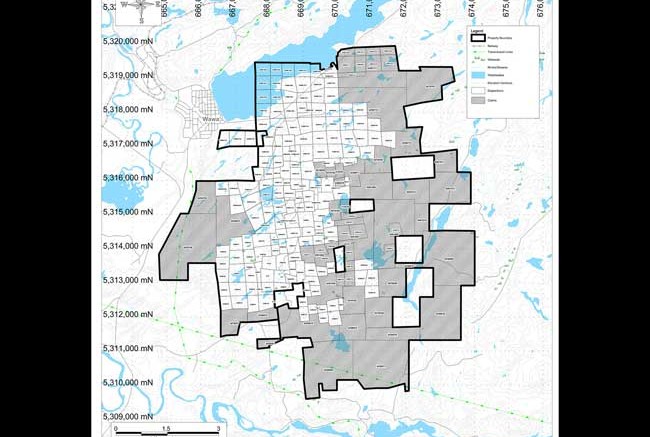

The junior has an option to own 30% of the 1.1 million oz. Wawa gold project, 2 km southeast of the historic mining town of Wawa in northern Ontario. The eight past-producing underground mines on the property, all within 5 km of each other, produced more than 120,000 oz. gold before most of them shut down in the 1930s.

“The average of those past producers was just over 8 grams per tonne, and they were all shallow underground operations,” Quentin Yarie, Red Pine’s president and chief operating officer, explains in an interview. “The area around Wawa was Ontario’s first gold rush.”

Red Pine is operator of the project, which sits 40 km from Richmont Mines’ (TSX: RIC; NYSE-MKT: RIC) Island gold mine, and 100 km from Wesdome Gold Mines’ (TSX: WDO; US-OTC: WDOFF) Eagle River mine. In addition to Red Pine, Augustine Ventures (CNSX: WAW; US-OTC: AUGUF) has an option to earn another 30% stake in the project from Citabar, a privately held company.

On June 10, Red Pine reported an updated resource for the Surluga deposit, one of the past producing deposits on the property, outlining an inferred resource of 19.8 million tonnes grading 1.71 grams gold per tonne for 1.1 million contained oz. gold.

Compared with the previous resource estimate, the new numbers mark a 14.7% improvement in grade and a 1.5% increase in gold content, all within less tonnes of ore. Surluga is also open at depth and along strike.

Yarie says that while the shear-hosted deposit is interesting, “we don’t think it’s the highest-grade material on the property. There are high-grade zones … but there’s more to be found.”

The company started with Surluga because it has seen the most historic drilling and exploration. And he believes that some of the historic underground workings there could still be used. Surluga was last mined in 1989.

In terms of development, the mining executive envisions starting with small open pits, and moving to mining deeper ore shoots underground.

“If you look at Probe Mines, that’s the model,” he says, “except we believe our shallow pits would be higher grade than Probe’s. We’ve got 650,000 oz. over 2 grams [of pit-constrained inferred resource], and for an open pit, that’s good grade. You probably would never take it that deep, but you could follow the ore shoots down. Once you expose them, you can map them better.”

Surluga is open at depth, and the outside pit-constrained resource measures 298,000 oz. gold at 1.07 grams gold for all gold zones located between surface at a vertical depth of 300 metres. The high-grade underground constrained resource totals 114,000 oz. gold at 3.73 grams gold per tonne.

According to a recently completed technical report by Ronacher McKenzie Geoscience, there is more gold mineralization in Surluga’s hangingwall and footwall secondary structures, but its geometry is poorly constrained.

The updated resource was based on 2,007 historical core boreholes (126,067 metres) — drilled between the early 1900s and the 1990s, and core-drilled by Augustine Ventures in 2007 and 2011 — and another 26 core boreholes (5,594 metres) that Red Pine drilled in 2014, and between February and April of 2015.

Over the next year, Red Pine will spend $1.5–2 million on drilling the higher-grade deposits to try to get a handle on how large they are. There are also a number of shallow, sub-cropping gold showings on the Wawa project’s 56.6 sq. km land package, he adds, and they vary in size.

Yarie points out that with the depressed state of the markets, drill costs have come down, and that Red Pine can drill at least 6,000 metres with that kind of an exploration budget.

Red Pine will focus on the top-three targets based on historic data the company has been compiling, and Yarie says he is confident that the company will at least double the resource size without much trouble.

“If you ask me, I think I see something between 2 million and 4 million oz. gold, with grades greater than 5 grams gold per tonne,” he says. “We’re over a million ounces now, so I don’t think it’s going to be hard to get to 2 million oz., to be honest.”

Yarie also points to the property’s attributes, which include nearby road access, a rail line and a 230-kilovolt power line, which crosses the southern part of the property. A second power line intersects the western part of the property.

Red Pine can work on the property year-round, and doesn’t need to build a camp because it is close to the town of Wawa, which also offers ample skilled labour.

As a brownfield with an existing tailings pond, the government has monitored the site for the last two decades.

“The fact that it has been monitored for so long means that it can go into production even faster, and makes it a better target for takeover,” he says. “The challenge is defining a resource there that is attractive to a major or a mid-stream gold producer, and I think we’re well on our way to doing that.”

“It’s nice working on something that has a resource on it,” he adds. “We just need to expand the existing resource into a profitable one.”

Be the first to comment on "Red Pine Exploration updates resource at Wawa project"