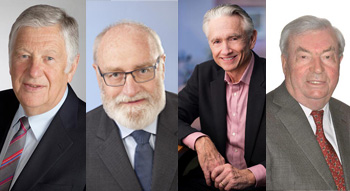

The Canadian Mining Hall of Fame will honour four industry greats at its annual induction dinner on Jan. 15, 2015, in Toronto. This year’s inductees are Peter M.D. Bradshaw, Ronald K. Netolitzky, Ian Telfer and Mackenzie Iles Watson. The Northern Miner is a proud sponsor of the Canadian Mining Hall of Fame. For tickets and information, visit www.mininghalloffame.ca.

Peter M.D. Bradshaw

(b. 1938)

Peter Bradshaw has served the industry with distinction for more than 40 years as a mine finder, company builder, an advocate of collaborative research and science and by working effectively with local and indigenous people.

His early career with renowned Barringer Research gave him a global perspective on mineral exploration and the opportunity to develop and publish details of groundbreaking geochemical processes and exploration methods. In 1979 he joined Placer Development, a predecessor of Placer Dome, and helped advance several projects — most notably the high-grade VII zone at Porgera in Papua New Guinea (PNG). Bradshaw was also the force behind forming the Mineral Deposit Research Unit (MDRU) at the University of British Columbia.

Among his other achievements Bradshaw brought expertise, integrity and energy to the junior sector, first with Orvana Minerals, which developed the Don Mario gold-silver-copper deposit in Bolivia. Later, as co-founder and president of First Point Minerals, he helped discover and identify the commercial importance of a new type of nickel deposit in BC and the Yukon, in which nickel occurs as the nickel-iron alloy, awaruite.

In 1962 Bradshaw earned a BSc in geology from Carleton University in Ottawa and a PhD from Durham University in England (Economic Geology) in 1965.

During the next decade with Barringer Research, Bradshaw helped prove the value of advanced geochemical exploration — in particular the use of selective extractions and soil-profile sampling to improve interpretation, and enhance the signal from buried deposits.

Bradshaw then joined Placer, where the greatest of many accomplishments involved the Porgera project, which was nearly abandoned after a failed feasibility study. Convinced of the potential for a high-grade zone in the bulk-tonnage deposit, Bradshaw launched a low-cost exploration program that led to the discovery of Zone VII, a rich and large “plum.” Porgera became a world-class mine that has produced more than 18 million oz. gold, with potential for more.

The resilience and tenacity shown by Bradshaw at Porgera helped define his career. Still with Placer, at the Misima gold mine — also in PNG — he worked with the government to adopt a marine-tailings disposal system rather than build a tailings dam on the small, rugged and seismically active island. He worked with local leaders to prevent a mass in-migration to the island and the resulting social disruptions, as part of his long-standing commitment to work effectively with local and indigenous people. He also oversaw aspects of the final feasibility study of the Kidston gold mine in Australia, and optioned both Granny Smith in Australia and Omai in Guyana, all of which became significant producers.

Bradshaw’s most enduring legacy is MDRU, the highly successful industry-UBC research collaboration which he co-founded in 1989. Today MDRU is recognized internationally as a centre of excellence in mineral deposits research and training, a fitting tribute to its far-sighted and tenacious first chairman, Peter Bradshaw.

Ronald K. Netolitzky

(b. 1943)

Ronald Netolitzky is an accomplished Canadian geologist who has always been an independent-minded prospector at heart. He recognized and helped realize the potential of the Snip and Eskay Creek properties in northwest B.C., which became two of Canada’s most high-grade precious metal mines. He also helped grow many junior companies and, at last count, was involved in 12 big mergers and acquisitions.

Netolitzky graduated from the University of Alberta with a BSc in geology in 1964 and an MSc from the University of Calgary in 1967. He joined the Saskatchewan uranium rush as a consultant before venturing into junior mining. By 1985, Netolitzky was president of Delaware Resources and seeking a project of merit. The Snip property optioned from Cominco fit the bill, and the first drill program led to a gold discovery. But the 1987 market crash hindered financing and Delaware was taken over by Murray Pezim, and renamed Prime Resources.

Undaunted, Netolitzky turned his attention to a nearby prospect with a fruitless exploration history dating back to the 1930s. After investing in Consolidated Stikine Resources — which held rights to Eskay Creek — Netolitzky teamed up with Calpine Resources, a shell company, which was used to fund an initial $900,000 drill program with money from Prime and Pezim. Results were spectacular, but interest was muted by the deposit’s unusual nature and weak capital markets. Pezim gained control of Calpine and half the deposit, but Stikine held out until Eskay Creek rivals Placer Dome and International Corona launched takeovers for Stikine. Shareholders accepted Corona’s $67-per-share bid. Netolitzky was Stikine’s technical person and one of five controlling shareholders.

Next, as president of Loki Gold, Netolitzky transformed the Brewery Creek project into an open-pit heap-leach operation. This was no small feat, as the Yukon project is located above the Arctic Circle. Brewery Creek poured its first gold in 1996. By this point, Netolitzky had merged Loki with Baja Mining and Viceroy Gold to create an entity with annual production of 200,000 oz. gold. Viceroy went on to acquire the Gualcamayo gold project in Argentina, later sold to Yamana Gold.

Netolitzky received the Bill Dennis Prospector of the Year Award in 1990 and the E.A. Scholz Award in 1996 for his discovery and development achievements. He continued to find opportunities for junior companies. At Spectrum Gold, he obtained rights to the Galore Creek copper-gold-silver project in B.C. and later merged the company with NovaGold Resources. He was the chairman of Brett Resources, which acquired the Hammond Reef gold project in Ontario, later sold to Osisko Mining. He was also involved in many international projects. At Oliver Gold, he helped acquire the Segala gold deposit in Mali, now held by Endeavour Mining. Oliver morphed into Canico Resources, which developed the Onca-Puma nickel deposit in Brazil.

Netolitzky remains active in gold and uranium exploration, notably in Saskatchewan, where he began his career almost 50 years earlier.

Ian Telfer

(b. 1946)

Ian Telfer earned his reputation as a financially astute and visionary mining entrepreneur by building companies through timely acquisitions and value-driven mergers. The companies that he founded or led — TVX Gold, Wheaton River (later merged with Goldcorp), Silver Wheaton, Terrane Minerals and Uranium One, among others — reached a combined market capitalization of more than $50 billion at their peak.

Telfer’s greatest accomplishment began modestly in 2001, when he saw low gold prices as an opportunity to acquire Wheaton River Minerals and leverage its treasury to buy producing gold mines at bargain prices. The strategy worked so well that Wheaton River soon execute

d a friendly merger with established miner Goldcorp. With Telfer at the helm, Goldcorp grew through mergers and acquisitions to become a world-class gold-mining company.

Born in Oxford, England, Telfer was raised in Canada, and holds a BA from the University of Toronto and an MBA from the University of Ottawa. He worked as an accountant for Hudson Bay Mining & Smelting before becoming a founding partner of TVX in 1983. Telfer’s talents came to industry attention as TVX grew into a global gold miner from an initial base in Brazil.

A decade later he took the helm of Vengold, which suffered along with its peers as gold prices fell below US$300 per oz. By 2001, Telfer sensed a turnaround for gold and pursued Wheaton River Minerals, a junior company with a dormant mine and $20 million in its treasury. This feat — achieved in a capital-constrained market — exemplifies Telfer’s tenacity and negotiating skills. His skills came to the fore again through the purchase of the Luisman mine in Mexico, for a price that was 10 times Wheaton’s market value. Other acquisitions followed, including a significant interest in the Alumbrera copper-gold mine in Argentina.

In 2005, Telfer garnered global attention for engineering a $2.4-billion friendly merger with Goldcorp, beating out a rival bid by Glamis Gold. With Telfer as CEO, Goldcorp then acquired Glamis Gold and the Canadian assets of Placer Dome to become Canada’s second-largest gold producer in terms of market capitalization. A few years later Goldcorp would become the world’s largest.

Telfer is renowned for his ability to raise large sums of money for small companies and identify wealth-creating opportunities. In recent years, he has helped create six companies, with three of these later acquired by larger entities.

Telfer has supported industry organizations, notably serving as chairman of the World Gold Council from 2010 to 2013. His many awards include AME BC’s Murray Pezim Award for perseverance and success in financing mineral exploration, and being named Ernst & Young’s 2007 Western Canada Entrepreneur of the year. He also has a history of philanthropy. His $25-million endowment in 2007 to the University of Ottawa, which led to the creation of the Telfer School of Business, is considered the largest individual donation in Canadian history to a business school.

Mackenzie Iles Watson

(b. 1935)

Geological acumen, entrepreneurial instincts and an engaging personality are some of the qualities that contributed to the extraordinary success achieved by Mackenzie Watson during his 50-year career in the Canadian mining industry.

His track record of discovery includes involvement in the Holloway gold project in Ontario, chromite deposits in the Ring of Fire district and the Strange Lake rare earths project in Quebec. He also built flagship Freewest Resources into a respected project generator and provided leadership and support to junior companies and industry associations.

Watson graduated with a BSc in geology from the University of New Brunswick in 1959, and soon after helped discover the Icon Sullivan copper mine near Chibougamau, Que. His 1970s successes included Lynx Canada’s Long Lake zinc mine in southeast Ontario, the Hébécourt massive sulphide deposit in Quebec, the Ellison gold deposit in Quebec and a thermal coal deposit in New Brunswick. He later became a technical advisor to Q-Vest, which raised $60 million to invest in junior companies during the 1980s.

Watson came into his own after becoming president of Freewest Resources in 1986. The company’s first major triumph was the Holloway gold project east of Timmins. Its discovery led to Freewest being absorbed by Hemlo Gold Mines and development of the deposit as a 1,350-ton-per-day mine. His successor company, Freewest Resources Canada, went on to discover the Clarence Stream sediment-hosted gold deposit in New Brunswick. Freewest later joined a staking rush to the remote James Bay Lowlands of Ontario. Subsequent exploration led to the discovery of the Black Thor and Black Label chromite deposits in the Ring of Fire region, and the 2009 takeover of Freewest by Cliffs Natural Resources. A spin-off company, Quest Uranium, discovered a significant rare earths deposit at Strange Lake in Quebec near the Labrador border.

Watson is the first person to have received the Bill Dennis Prospecting Success Award twice: for numerous discoveries in 1991, and in 2009, as part of the team responsible for chromite discoveries in the Ring of Fire. His success owes much to his willingness to apply new exploration methods and geological concepts. Freewest, for example, was the first to conduct gravity surveys in the Ring of Fire. Watson treated prospectors with respect, which was reciprocated, and shared ideas and information with government geologists. As a result of these alliances, he became the “go-to” person in a number of terranes, most notably the Beardmore-Geraldton, Shebandowan, Hemlo and Ring of Fire districts of Ontario.

Watson gave back to the industry and society in many ways. He provided bursary and scholarship support to his alma mater: the University of New Brunswick and Lakehead University. He mentored young geoscientists and served industry associations with distinction. His greatest contribution to society was his foresight in pursuing projects with economic potential, such as Ontario’s Ring of Fire chromite deposits and the Strange Lake rare earth project in Quebec.

Be the first to comment on "Canadian Mining Hall of Fame to fete mining leaders"