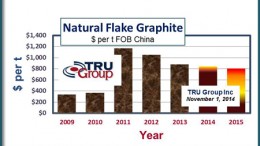

Commentary: As graphite prices stumble, more is needed for new operations to succeed

The latest China monthly graphite export data support the idea of some graphite price stabilization. Natural graphite prices trending lower would bolster their competitiveness against synthetic graphite and accelerate demand.