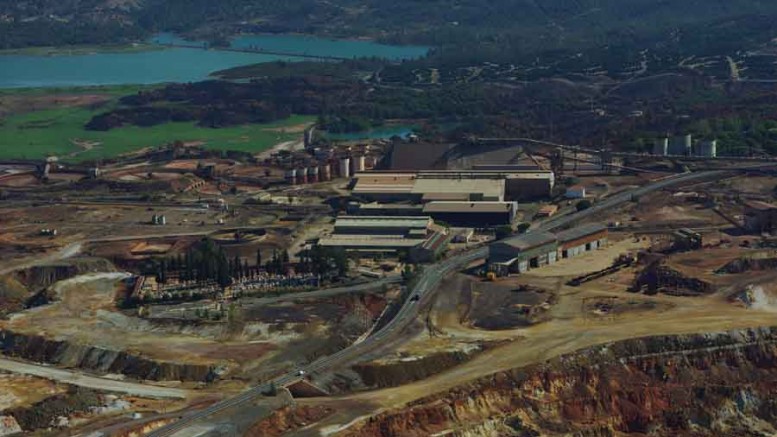

Emed Mining (EMD-T, EMED-L) has closed its second major financing of the year as the company moves towards restarting production at the historic Rio Tinto copper mine located 65 km north of Seville in Andalucia, Spain.

Emed reached an agreement worth US$175 million with banking heavyweight Goldman Sachs (GS-N) in the first week of March. Goldman will provide the company with cash upfront in return for its equivalent value in copper. Once Rio Tinto is up and running Emed anticipates making monthly deliveries totalling 15% of the mine’s production during the first seven years at market copper prices.

In a phone interview, managing director Harry Anagnostaras-Adams says the Goldman deal was chosen from numerous financing options for the project. The company had looked into conventional bank financings, high-yield bonds and convertible debt as alternatives.

“Goldman Sachs knows us quite well,” Anagnostaras-Adams says. “We preferred the Goldman deal because it imposes less equity dilution, and leaves our hedging options open. This particular proposal, from a security point of view, is like a project financing. From a repayment point of view it’s more akin to the old gold approach. It is technically a copper loan.”

Anagnostaras-Adams cites a new financing trend that is comparable to the forward sales of gold assets seen in the early 1990s. Goldman secures a future physical commodity, which will benefit the firm’s derivatives trading business, allowing it to pursue hedging activities. Emed mortgages a portion of its future copper production for start-up capital to get the project running.

“In Goldman’s point of view, they see their resource-lending business as a sort of entry into the copper commodity business,” Anagnostaras-Adams says. “This type of instrument is the beginning. It’s a sign of what I call the ‘securitization of copper.’”

Emed entered into a financing deal in February with Chinese firm Yanggu Xiangguang Copper (XGC). Located in Shandong province, XGC is one of the world’s largest copper-smelting, refining and processing companies. XGC belongs to MK Holding, a privately owned conglomerate operating in various sectors throughout China.

Under the agreement with XGC, Emed will receive US$30 million, including US$15 million through equity purchases and an additional US$15-million debt facility. The Chinese firm will receive a 10% stake in Emed, and rights to 25% of Rio Tinto’s current copper reserves.

According to Anagnostaras-Adams, the relationship with XGC could also pay long-term dividends. “From our point of view the XGC arrangement is not so much about looking to place more copper in China. More so we feel it’s important to have an umbilical cord into China. The country really drives the copper market, and we have a relationship we can develop as time passes.”

With Goldman and XGC on board, Emed has committed 40% of Rio Tinto’s existing reserves in the two financing deals. Assuming XGC opts to exercise its full option agreement, the Chinese deal could potentially be worth US$1.21 billion at current copper prices.

Anagnostaras-Adams estimates initial capital costs at US$200 million, so with the recent rounds of financing, Emed should have the necessary funds to start the ball rolling on the site, pending some permit and land-acquisition issues.

The company must now wait on the regional Junta de Andalucia government for permitting.

It’s not hard to see why Spanish governments are getting behind ventures like Rio Tinto. With an economy struggling under a severe national debt crisis, and a need for more foreign investment, the influx of capital and projected 450 new jobs will help the region.

According to a November 2010 technical report, Rio Tinto has reserves equalling 123 million tonnes grading 0.49% copper totalling 606,000 contained tonnes copper. The mine is projected to produce 37,000 tonnes of copper in concentrate from 9 million tonnes of ore per year through 2026.

Emed has plans to expand exploration at Rio Tinto as operations get up to speed. The project has historically seen as many as five mines in production — the company is currently focused on reactivating the open-pit Cerro Colorado copper-pyrite deposit — and has not had any drilling on site since the 1980s. No drill program has ever gone to depths greater than 150 metres, but it seems Rio Tinto may be harbouring dormant exploration upside.

Anagnostaras-Adams says expansion of the mine’s life past the 14-year mark is very much a company priority.

“If you add up the different orebodies on the property — subject to the caveat we need to do 43-101’s and go in among them and drill them out again — it’s not hard to hypothesize we’ll get another 2 million tonnes copper out of this over the longer term.”

London brokerage house Fox-Davies reiterated a “buy” recommendation for Emed following the announcement of the Goldman financing deal. The firm reduced its London Stock Exchange target price from £0.48 to £0.38 on March 7. Emed currently trades at £0.13.

Shares in Toronto fell to lows of 9¢ in late 2011, but have rebounded over the first quarter of 2012 by 30% to 19.5¢ on trade volumes averaging 666,000 shares per day, and traded at 17.5¢ at presstime.

Be the first to comment on "Emed locks down financing for Rio Tinto revival"