The Dow Jones Industrial Average advanced 602.59 points or 1.81% to finish the Jan. 23-27 trading week at 33,978.08 and the S&P 500 rose 97.95 points or 2.47% to 4,070.56. Spot gold finished the week at US$1,927.50 per oz., up US$1.20 per oz. or 0.06%.

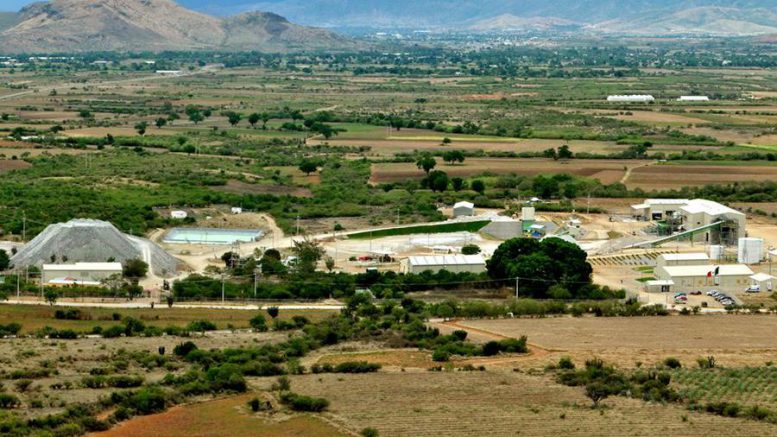

Fortuna Silver Mines gained US15¢ or 4% to US$3.94 per share. The company announced that the Mexican Federal Administrative Court had granted a provisional injunction to Fortuna’s Mexican subsidiary, which allows it to continue to operate the San Jose mine under the terms of the 12-year environmental impact authorization. The company said “it is expected that the Court will decide on the grant of a permanent injunction, within the coming weeks, which would continue in effect until the Court has ruled on the revocation of the EIA.” On Jan. 5 the company reported that the Secretaria de Medio Ambiente y Recursos Naturales (SEMARNAT), was re-assessing the 12-year extension to the environmental impact authorization (EIA) for San Jose that it granted in December 2021. At that time, president and CEO Jorge A. Ganoza noted in a press release that “it is incomprehensible that we find ourselves again having to contest a controversial resolution issued by SEMARNAT. This specific authorization, one of the many under which San Jose operates, was confirmed by the Federal Court last November, with a ruling in our favor against SEMARNAT.” The mine produced 5.8 million oz. silver in 2022.

Shares of Freeport-McMoRan fell US59¢ to US$44.82. The company reported fourth-quarter 2022 net income attributable to common stock of US$697 million or US48¢ per share and full-year net income of US$3.5 billion or US$2.39 per share. Full-year production tallied 4.2 billion lb. copper, 1.8 million oz. gold and 85 million lb. molybdenum. The company generated US$5.1 billion in operating cash flow (net of US$1.5 billion of working capital and other uses) for the year. As of Dec. 31, Freeport had net consolidated debt of US$10.6 billion and consolidated cash and equivalents of US$8.1 billion, resulting in net debt of US$2.5 billion. The company operates seven mines in North America, two in South America, and one of the world’s largest copper and gold mines in the Grasberg minerals district in Central Papua, Indonesia.

Chevron Corp. fell US$1.45 per share to US$179.45. The company declared a quarterly dividend of US$1.51 per share, an increase of US9¢ per share or about 6%. The dividend is payable by Mar. 10. Chevron also announced a US$75 billion stock repurchase program. The program starts on April 1 and has no expiration date. The company noted the latest repurchase plan replaces the board’s previous authorization in January. 2019 to repurchase US$25 billion before Mar. 31 of this year.

Be the first to comment on "US markets post gains over Jan. 23-27 trading week"