Explorer Banyan Gold (TSXV: BYN) is on track to deliver a second resource estimate early in 2022 for its flagship AurMac property in the Yukon, president and CEO Tara Christie tells The Northern Miner.

She expects a busy six months of news flow ahead as the team wraps up the field season at the early-stage exploration property, which Christie says forms part of an emerging district-scale gold-silver opportunity.

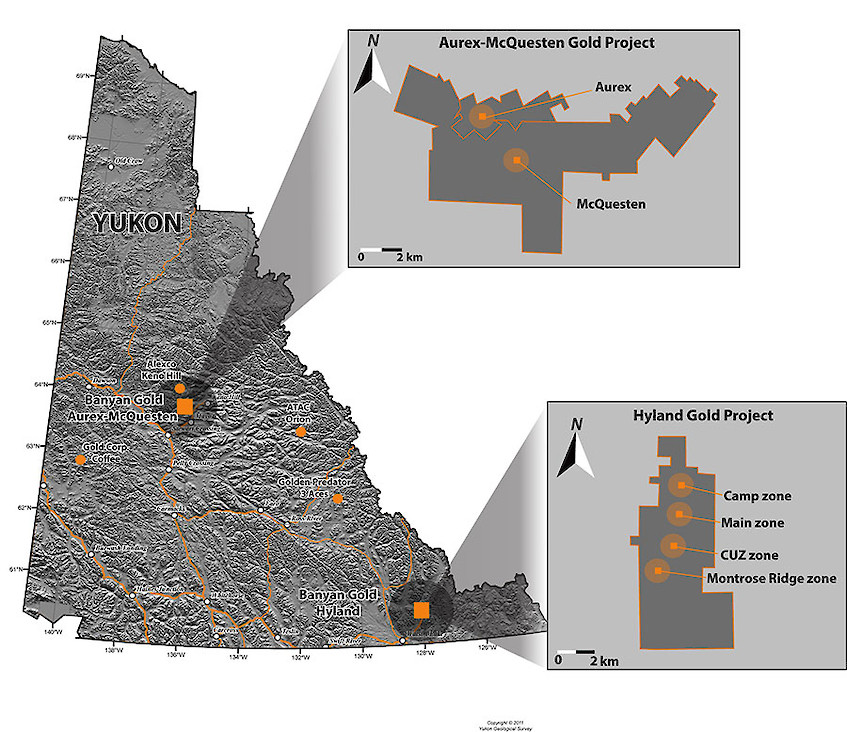

Banyan has just released its fourth round of drill results from AurMac. The 173 sq. km property lies 30 km from Victoria Gold’s (TSX: VGCX) Eagle gold mine and next to Alexco Resource’s (TSX: AXU; NYSE-AM: AXU) Keno Hill silver district. AurMac is considered highly prospective for structurally controlled, intrusion-related gold-silver mineralization.

Christie says Banyan’s summer exploration strategy entails the systematic testing of the Powerline deposit on 100-metre centred step-out drilling and the goal is to validate the geological model and expand known near-surface gold mineralization limits.

Among the most recent set of five assays from the Powerline zone are 0.85 gram gold per tonne tonne over 12.2 metres from surface in hole AX-21-87; 0.47 gram gold per tonne over 26.4 metres from 25.9 metres in hole AX-21-91; and 0.7 gram gold per tonne over 50.3 metres from 85.1 metres in AX-21-91.

Banyan Gold crew social distancing in camp. Credit: Banyan Gold.

“Once we start to get back some of the results from Powerline and the Aurex Hill target, then we’ll plan for the next 6,000 to 10,000 meters of drilling. We will have enough money to drill through to September,” says Christie.

“Our goal was to get to that two-million oz. threshold resource for our next update, which we’re planning for Q1 of 2022. But we think we’re well on track to do that,” she says in an interview.

Banyan released the first resource estimate on AurMac in May 2020. It has 903,945 oz. gold in 52.58 million tonnes grading 0.535 grams gold per tonne spread across Airstrip and a fraction of the Powerline deposit.

Initial metallurgy was good, with tests showing 90% recovery on oxide and sulphide ores, which bodes well for a heap leach scenario.

To date, Banyan has expanded Powerline over 1.2 km to the south. “We’re now really growing this very quickly,” she says. “We’re planning roughly a six-fold increase in the mineralized footprint from what we started with. Holes like 81 meters at one gram are pretty exciting for adding ounces.”

Christie is very excited about the Aurex Hill target. “In drilling it, we expected a 20% to 30% hit rate. Well, every single hole we drilled intersected mineralization. So now we can say, between Powerline and Aurex Hill, there are 2.5 kilometres of mineralization for us to follow up on and drill.

“And what makes us so excited about Aurex Hill [is] we think this small part of our property has the potential to host three to five million ounces,” says Christie.

AurMac sits in the same system that created all of the gold at Victoria Gold‘s (TSX: VGCX) nearby Eagle mine – the Yukon’s biggest gold mine, which announced commercial production on July 1, 2020.

The Powerline and Aurex Hill targets currently being drilled are testaments to how underexplored the Yukon still is, Christie says.

“They are right beside the highway, like under a highway. And it’s been sitting here for all these years, and nobody saw it. It shows you just how much there is yet to explore in the Yukon.”

All AurMac deposits remain open. Banyan has already expanded Powerline to the west and strongly expanded mineralization to the east towards Aurex Hill. The Airstrip deposit is thought to continue off to the west stronger, while other recent holes indicate a likely extension east.

Banyan’s exploration targets visualized. Credit: Banyan Gold

Banyan’s AurMac is flanked by its two largest shareholders, Victoria Gold and Alexco Resource, from which it is earning a 100% interest in large sections of its claim base.

Christie sees the recent restart of mining at Alexco’s Keno Hill silver operation and the start of the large-scale Eagle mine, including Banyan’s continued exploration success, as underpinning the makings of Canada’s next mining district. “Even John [McConnell, Christie’s husband and Victoria Gold’s president and CEO] says that he thinks that Eagle mine will produce to 20 to 30 years.

Victoria Gold’s Eagle mine in the Yukon. Credit: Victoria Gold.

“Victoria and Alexco are going to start cash flowing, drawing other people in, because you can navigate the permitting process, and the local First Nations are very knowledgeable on mining,” says Christie. “The region is so amazingly endowed with gold and silver — most hasn’t been discovered yet.”

Christie says Banyan is already drawing upon synergies in its permitting process and the work already accomplished by Alexco and Victoria Gold. “We’re able to use a lot of the data that they collected for their permitting process, saving us a lot of money and time.”

While it’s still early days, there already exists potential production synergies between AurMac and its neighbours.

Should a company like Victoria Gold want to acquire the project or Banyan, there are a couple of options. Victoria Gold could put in a pipeline to transport ore or build a heap leach at AurMac and pipe the loaded carbon to the existing production facilities to reduce trucking.

Alexco also has a mill near the project that could be amenable to processing the higher-grade material.

“The most value for my shareholders is to make this a standalone mine. By doing that, we can hopefully attract a mid-tier investment partner or an eventual sale, which captures enhanced value for shareholders,” says Christie.

“When you look at what happened in Red Lake [Ontario], it started small. And then you saw more mines pop up, and more mineralization was found in the headframe of those initial discoveries, and like that, this district is going to see the same story,” she says. “We’re going to find more and more in this area. The mineral endowment is there, and you can build a mine.”

Be the first to comment on "Banyan Gold sees district potential as AurMac drilling heats up, says CEO Tara Christie"