The surge in zinc prices in 2020 and 2021 is expected to gradually unwind following a period of peak pricing forecast for the September quarter, a new assessment by Fitch Country Risk and Industry Research shows.https://www.fitchsolutions.com/products/country-risk-and-industry-research

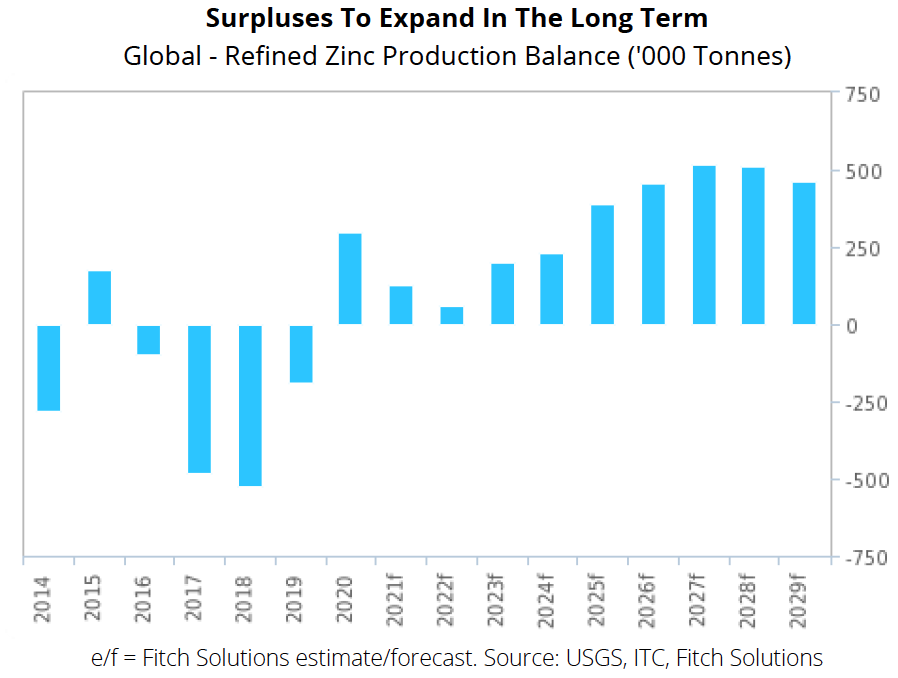

The global production surplus that emerged in 2020 should persist into the medium term, and the resulting increase of zinc inventories should gradually drag prices lower.

But before those mechanics take effect, an improving near-term demand backdrop has encouraged Fitch to bump up its average price forecasts for the coming years, guiding instead for a more gradual price slide following the near-term peak.

Fitch’s forecast for an average zinc price of $2,600 per tonne in 2021 implies an average of US$2,707 per tonne over the remainder of the year, compared with a June 14 spot price of US$3,050 per tonne and a year-to-date average of about US$2,450 per tonne. Should prices level off, they’d still be trading at historically high levels.

The forecast further calls for zinc to average US$2,360 per tonne over 2022 to 2026, compared with US$2,090 per tonne previously expected in this period.

Zinc prices will remain elevated by historical standards through the second half due to strong demand from the steel sector and reduced production in China.

Growth prospects for major economies, including the U.S. and eurozone, is seen to have improved over recent months as Covid 19 vaccination programs are rolling out and corporate profitability are improving quickly. Monetary and fiscal policy will generally remain loose, according to Fitch.

Despite the more optimistic near-term outlook, Fitch expects a steady downtrend in prices through 2030. Price weakness should be particularly pronounced starting around mid-decade, as the forecast calls for a significant widening of the global production surplus around then.

Fitch expects an average annual production surplus of 476,000 tonnes over 2026 to 2030, compared with 203,000 tonnes over 2021 to 2025.

Ultimately, zinc prices will be dragged lower as long-term production growth outstrips low demand growth.

The most significant drag on global zinc demand growth will come from China, accounting for around half of annual refined zinc consumption.

“We forecast steel production growth in China to slow from an annual average of 7.8% over 2018 to 2022, to just 1.3% over the subsequent five years,” the Fitch analysts say.

Be the first to comment on "Zinc price: Q3 price peak, long-term weakness in the cards – report"