Torex Gold Resources (TSX: TXG) shares saw a nearly 15% bounce in trading today after the Mexico-focused miner posted second quarter results that beat analysts’ expectations.

The company produced a total of 123,185 oz. gold at its El Limon Guajes mine (ELG), in Guerrero state, putting it on track to meet its full year production guidance of 430,000 to 470,000 ounces.

In spite of continued inflationary pressures, Torex reported cash costs of US$703 per oz. — within its guidance of US$695-US$735 per oz. — while all-in sustaining costs of US$911 per oz. were lower than its guidance of US$980-US$1,030 per oz.

“Despite challenging headwinds with the current inflationary environment and the persistence of COVID-19, we delivered a very solid first half of 2022, and we are well on track to deliver on production and cost guidance for the fourth year in a row,” said Torex president and CEO Jody Kuzenko in a release.

The company reported headline earnings of U$57 million or 66¢ per share (which beat a consensus estimate among analysts of 50¢ per share), compared with US$47.4 million of 55¢ per share in the same period of 2021. Torex recorded revenues of US$235 million (123,363 oz. of gold sold at an average price of US$1,864 per oz.), up from US$205.9 million last year.

Higher grades from the open pits at ELG and record production from the underground mine drove the positive performance.

“Our excellent operational performance this quarter was primarily driven by higher grades from the ELG open pits as well as record mining rates in the ELG Underground. Underground mining rates averaged 1,582 tonnes per day in Q2, well surpassing the prior record of 1,429 tonnes per day achieved in the same quarter last year,” Kuzenko said.

The company says it’s making progress towards its long-term target for underground mining at ELG of 2,000 tonnes per day, with a third portal that is expected to be completed later this year.

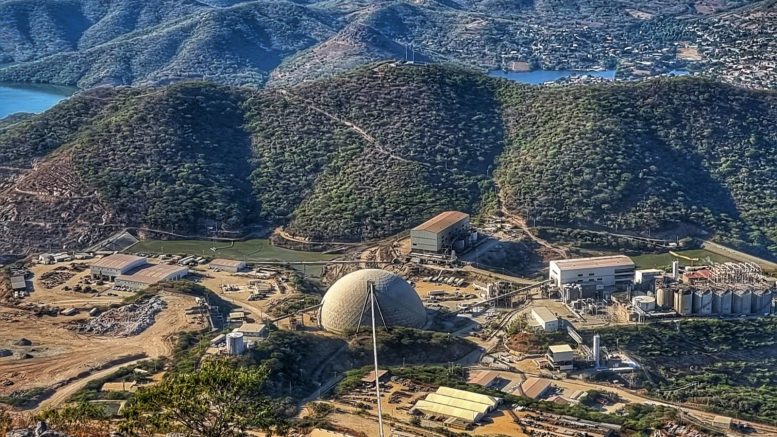

ELG is located in the Guerrero gold belt, 180 km southwest of Mexico City, and includes three open pits and an underground mine.

Media Luna

Torex approved construction of its Media Luna underground project, part of the 290-sq.-km Morelos property that also hosts ELG, at the end of March. The currently debt-free company is working towards signing a US$250-million credit facility to finance the build (about 5% complete) in the third quarter. Capital costs for the project are estimated at US$848 million, with life-of-mining sustaining capital at US$545 million. Commercial production is expected in early 2025.

Media Luna holds proven and probable reserves of 23 million tonnes grading 2.81 grams gold per tonne, 25.6 grams silver, and 0.88% copper for 2.1 million oz. gold, 18.9 million oz. silver and 444 million lb. copper.

At The Northern Miner’s Q2 Global Mining Symposium in June, Kuzenko noted that with about 30% of the value in the deposit coming from copper, Torex will become a significant producer of the red metal when Media Luna comes online. Kuzenko also noted that the copper component could play into the company’s M&A strategy as it keeps an eye on potential prospects in its region of interest – the Americas.

“As we bring Media Luna online at 45 million pounds of copper a year, about 30% of the value of that deposit sits in copper,” she said. “That opens up prospects for us for (M&A with) either a gold-copper producer, or a copper producer… where the combined value of the company and the combined operation of the company is synergistic and creates value for our shareholders.”

Torex shares were trading at $10.74 in the early afternoon in Toronto, up 14.5%. The shares have traded in a 52-week range of $8.54 and $17.43. The company has a market capitalization of $921.9 million.

Be the first to comment on "Torex Gold continues to deliver on production, cost guidance with strong Q2"