Gold exploration and development is enjoying a boom again, and Canadian juniors are leading project advancement at home and abroad.

The following are the top-10, Canadian-headquartered gold companies that are developing projects but not yet in commercial production, ranked according to market capitalization in mid-July. Gold royalty and streaming companies are not included in the list.

1. Novagold Resources

$1.9 billion market capitalization

Vancouver-based Novagold Resources (TSX: NG; NYSE-MKT: NG) is a familiar name in the gold sector, especially amongst retail investors. Novagold’s flagship project is its half interest in the large but remote Donlin Gold project in southwestern Alaska, which is a fifty-fifty joint venture with Barrick Gold (TSX: ABX; NYSE: ABX).

Donlin Gold ranks as one of the world’s largest undeveloped gold deposits, boasting measured and indicated resources of 541 million tonnes grading 2.2 grams gold per tonne for 39 million contained oz. gold, plus 92 million inferred tonnes grading 2 grams gold per tonne. (The measured and indicated resource includes 505 million tonnes of proven and probable reserves at similar grades.)

A second updated feasibility study of Donlin Gold envisions an open-pit mine that would produce 1.5 million oz. gold annually in the first five years of operation, and 1.1 million oz. gold per year over a 27-year life.

The partners plan to carry out an US$8-million drill program this year at Donlin to gain more geological and geotechnical data.

Meanwhile, the partners continue to wind their way through the permitting process. A final environmental impact statement is expected in early 2018.

NovaGold also has a fifty-fifty joint venture with Teck Resources (TSX: TECK.B; NYSE: TECK) at the Galore Creek copper project in northern British Columbia.

As of May 31, NovaGold had US$93 million in its treasury. For the year, the company expects to spend US$11 million for general and administrative costs, US$14 million to fund its share of expenses at Donlin and US$2 million at Galore Creek.

2. Seabridge Gold

$883 billion

Drilling at Seabridge Gold’s KSM gold-copper project in B.C. Credit: Seabridge Gold

Rudi Fronk-led Seabridge Gold (TSX: SEA; NYSE: SA) has 100% ownership of two core assets: the KSM project in B.C. and the Courageous Lake project in Nunuvat.

KSM has reserves of 2.2 billion tonnes at 0.55 gram gold per tonne, 0.21% copper and 2.6 grams silver per tonne for a contained 38.8 million oz. gold, 10.2 billion lb. copper and 183 million oz. silver.

Courageous Lake has reserves of 91 million tonnes of 2.2 grams gold for a contained 6.5 million oz. gold.

In June Seabridge mobilized drill rigs to KSM to begin drilling two targets: the down-plunge projection of the Lower Iron Cap zone and a target that Seabridge says could be a fifth, higher-grade deposit at KSM. Seabridge found both targets in hole 16-62, the last hole it drilled in 2016. The company plans to drill 10 holes totalling 8,750 metres in a 600-by-500-metre area.

“This is the twelfth successive season we have drilled at KSM, and, quite remarkably, it could be one of our most productive,” Fronk said in a news release. “We expect Iron Cap will become considerably larger — much like Deep Kerr over the past three years.”

Seabridge also has a drill program underway at its Iskut gold project in northwestern B.C., acquired by buying SnipGold in June 2016. The project is 30 km from KSM.

3. Osisko Mining

$769 million

Osisko Mining president and CEO John Burzynski. Credit: Osisko Mining.

The former management team behind Osisko Gold developed a reputation for furious drilling campaigns at the Canadian Malartic gold mine in Quebec before it was sold, and they are continuing this signature strategy at their Windfall gold project in Quebec’s Urban Barry region under the Osisko Mining (TSX: OSK; US-OTC: OSKFF) banner.

Osisko has a 400,000-metre drill program underway at Windfall using 24 drills, as well as four drills active at its Garrison gold project across the provincial border in Ontario, west of the Holloway & Holt mine.

Osisko is stepping up its dewatering of the old workings at Windfall, and expects to assess and rehabilitate them over the coming weeks before beginning work in September to advance the ramp at a rate of 7 to 8 metres a day.

The firm is looking at the town of Lebel-sur-Quévillon as a potential mill site to take advantage of existing infrastructure in the town and to limit development at the mine site.

Osisko plans to update the resource at Windfall this year, complete a feasibility study in the second half of 2018, obtain major permits in 2018 and begin mine construction in 2019.

As of June, Osisko had $210 million in cash and equivalents.

4. Lundin Gold

$588 million

Workers assemble for a daily morning meeting at Lundin Gold’s Fruta del Norte gold project in Ecuador. Credit: Lundin Gold.

Lundin Gold (TSX: LUG; US-OTC: FTMNF) has one of the world’s more intriguing undeveloped high-grade gold deposits: Fruta del Norte (FDN) in southeast Ecuador’s Cordillera del Condor region.

A member of the Lundin Group of Companies, Vancouver-based Lundin Gold acquired FDN in December 2014 for US$240 million, after its previous owner Kinross Gold got stuck in a stalemate with the national government over taxation rates.

In June, Lundin drew down US$150 million from a US$400-million project financing package negotiated with Orion Mine Finance Group and Blackstone Tactical Opportunities. The package is comprised of a gold prepay credit facility for US$150 million, a US$150-million stream loan credit facility and committed participation of US$100 to US$150 million to future equity financings to fund the project.

Orion and Blackstone were also granted the right to buy 50% of Fruta del Norte gold production, up to a maximum of 2.5 million oz., at a price to be determined based on monthly delivery dates and defined quotas.

FDN has probable reserves of 15.5 million tonnes grading 9.67 grams gold per tonne and 12.7 grams silver per tonne for a contained 4.82 million oz. gold and 6.34 million oz. silver.

According to a feasibility study, a US$669-million mine built at FDN could yield 340,000 oz. gold annually over an initial 13-year mine life, at an average life-of-mine, all-in sustaining cash cost of US$623 per oz. gold.

Site facilities are now under construction at FDN, with work on portals underway in May.

5. Gold Standard Ventures

$534 million

A drill rig on the Pinion deposit at Gold Standard Ventures’ gold property in Nevada. Credit: Gold Standard Ventures.

Vancouver-based Gold Standard Ventures’ (TSXV: GSV; NYSE-MKT: GSV) flagship is its Railroad-Pinion gold project on Nevada’s Carlin trend.

Gold Standard has been consolidating ground in the area since 2009, and now has the second-largest contiguous land package (208 sq. km) on the gold-rich trend. It has made significant discoveries at North Bullion, Bald Mountain and North Dark Star.

In its most recent news, Gold Standard updated the resource estimate at Dark Star, where indicated resources stand at 15.4 million tonnes grading 0.54 gram gold per tonne for 265,100 oz. gold, and inferred resources are 17.1 million tonnes at 1.31 grams gold for 715,800 oz. gold, using a cut-off grade of 0.20 gram gold.

6. Northern Dynasty Minerals

$512 million

Northern Dynasty Minerals’ Pebble copper-gold deposit, 321 km southwest of Anchorage, Alaska. Credit: Northern Dynasty Minerals.

The travails of Northern Dynasty Minerals (TSX: NDM; NYSE-MKT: NAK) trying to advance its wholly owned Pebble gold-copper deposit in Alaska in the face of environmental opposition are legendary in the junior mining sector.

But things are picking up again for the Vancouver-based company with a change in the behaviour of the U.S. Environmental Protection Agency (EPA) under the Trump administration.

While it’s still an open question whether a mine will be built, the EPA has restored a normal permitting regime for Northern Dynasty to follow as it progresses with project development, in stark contrast to the severe limits the EPA had put on Northern Dynasty under the Obama Administration.

In the most recent development, Northern Dynasty reported in July that the EPA was withdrawing a “Proposed Determination” it issued under the Clean Water Act in 2014 that would have restricted development of the Pebble project.

The most recent resource estimate at Pebble from 2014 is staggering: 6.44 billion measured and indicated tonnes grading 0.34 gram gold per tonne, 0.41% copper, 245 grams per tonne molybdenum and 1.66 grams silver per tonne for 70 million oz. gold, 57 billion lb. copper, 3.4 billion lb. molybdenum and 344 million oz. silver, plus 4.46 billion tonnes in the inferred category at slightly lower grades, for another 37 million oz. gold, 24.5 billion lb. copper, 2.2 billion lb. molybdenum and 170 million oz. silver.

Northern Dynasty looks to start a feasibility study in 2018 and bring on a partner to help develop the asset.

7. Sabina Gold & Silver

$448 million

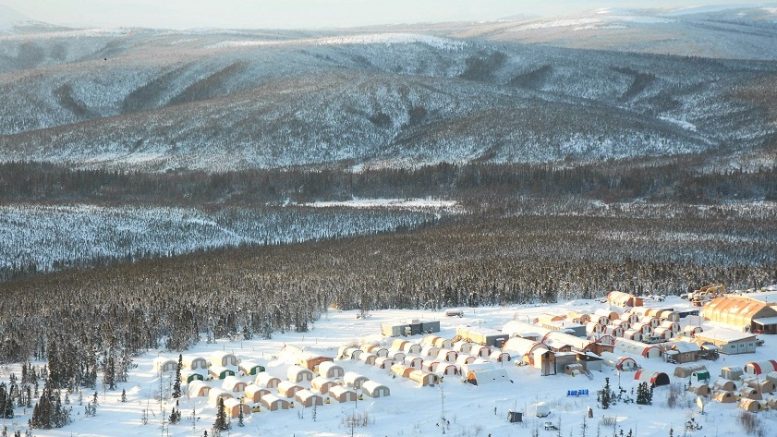

The camp at Sabina Gold & Silver’s Back River gold project in southwestern Nunavut. Credit: Sabina Gold & Silver.

Sabina Gold & Silver (TSX: SBB; US-OTC: SGSVF) has its wholly owned Back River gold project in Nunavut, where a feasibility study released in September 2015 envisioned a mine producing 200,000 oz. gold per year for 11 years, with a 2.9-year payback. The study showed a 24.2% after-tax internal rate of return with an initial $415-million capex.

Sabina is advancing the project through an environmental assessment process, with final public hearings with the Nunavut Impact Review Board (NIRB) held on June 3.

Sabina notes that the Kitikmeot Inuit Association “confirmed in their closing statements that they believed the project should proceed.”

NIRB will issue its “Final Hearing Recommendation Report” shortly.

Sabina also owns a silver royalty on Glencore’s Hackett River project in Nunavut, comprised of 22.5% of the first 190 million oz. silver produced and 12.5% of all silver produced thereafter.

Sabina had cash and equivalents of $43 million in March.

8. Dalradian Resources

$369 million

Employees in an adit at the Curraghinalt gold deposit in Northern Ireland. Credit: Dalradian Resources.

Dalradian Resources (TSX: DNA; US-OTC: DRLDF; LON: DALR) has a memorable ticker and a high-grade gold deposit in Northern Ireland named Curraghinalt.

Based in Toronto, Dalradian is helmed by president and CEO Patrick F.N. Anderson, who first gained industry prominence as cofounder, president and CEO of Aurelian Resources, which discovered the 13.7 million oz. Fruta del Norte gold deposit in Ecuador in 2006.

Since 2010, Dalradian has increased Curraghinalt’s resource sevenfold, based on 130,000 metres of drilling into 16 veins and 1.7 km of underground development.

Reserves now stand at 5.2 million tonnes grading 8.54 grams gold per tonne for 1.44 million oz. gold, plus resources in all categories of 12.7 million tonnes at higher gold grades.

A feasibility study examined a US$192-million mine that would process 1,400 tonnes per day to produce 130,000 oz. gold annually over the first 10 years of mine life.

Dalradian had a $36-million cash position at the end of 2016.

9. First Mining Finance

$347 million

Location map of First Mining Finance’s projects in northwestern Ontario. Credit: First Mining Finance.

Vancouver-based First Mining Finance (TSX: FF) pitches itself as a “mineral bank” in the sense that it has built up a portfolio across Canada, the U.S. and Mexico of two dozen or more early-stage gold projects, plus a few copper, silver and iron properties.

Management includes chairman Keith Neumeyer, president Patrick Donnelly and CEO Chris Osterman.

Perhaps its most notable assets are its gold investments in northwestern Ontario, including Springpole, Pickle Crow, Goldlund and Cameron.

Springpole has an indicated resource of 128 million tonnes grading 1.07 grams gold per tonne, or 4.41 million contained oz. gold, plus inferred resources of 25.7 million tonnes at 0.83 gram gold for another 690,000 oz. gold.

The company expected to revise a preliminary economic assessment at Springpole this quarter.

A study in 2013 envisioned a mine operating at 20,000 tonnes per day to produce 217,000 oz. gold and 1.2 million oz. silver annually.

10. Harte Gold

$332 million

Harte Gold president and CEO Stephen Roman addresses attendees at The Northern Miner’s Canadian Mining Symposium in London, UK, in May 2017. Photo by Martina Lang.

Toronto-based, Stephen G. Roman-led Harte Gold (TSX: HRT; US-OTC: HRTFF) is an old school Ontario gold mine developer, focused on advancing its wholly owned Sugar Zone property located 80 km east of the Hemlo gold camp.

Harte has completed a 70,000-tonne bulk sample and is permitting commercial production for the Sugar Zone deposit.

In early July, Harte closed a $25-million financing, selling an aggregate of 40.3 million shares at 62¢ per share.

Harte is starting mine construction and has targeted the second quarter of 2018 for first production at a rate of 540 tonnes per day.

The company plans to update the resource estimate in the fourth quarter of 2017, and has a resource target of 3 million oz. gold, having budgeted $15 million for near-mine and regional exploration with a 75,000-metre program, using six rigs.

Where’s Pretium in this? Its seems to fit in the middle ranks by size.

Hello Nicholas, we didn’t include Pretium because they’re in commercial production. The list is of companies with no production or just a little bit from development activities, like Harte. We do have a front page story on Pretium including an interview in this week’s issue.

How about Midas Gold ??

Midas Gold’s market cap when the story was written was about $120 million — too low to crack the top 10. Today it’s about $150 million — still too low.

That is interesting , Midas Gold based on their Pre Feas , have higher Au Oz of resources and much higher forecasted production than Fruta del Norte , Gold Standard , Sabina Gold , Dalradian Resources , First Mining and Harte Gold