Canadian gold and silver juniors are leading project advancement at home and abroad, as precious metals exploration and development enjoy boom times again.

The following are the top-10, Canadian-headquartered precious metals companies that are developing projects but not yet in commercial production, ranked according to market capitalization in early July. Royalty and streaming companies are not included in the list.

1. NOVAGOLD RESOURCES

$2.38B market cap

Vancouver-based Novagold Resources’ (TSX: NG; NYSE-AM: NG) flagship project is its half interest in the large but remote Donlin Gold project in southwestern Alaska, which is a fifty-fifty joint venture with Barrick Gold (TSX: ABX; NYSE: GOLD).

Donlin Gold is one of the world’s largest undeveloped gold deposits, boasting measured and indicated resources of 541 million tonnes grading 2.2 grams gold per tonne for 39 million contained oz. gold, plus 92 million inferred tonnes grading 2 grams gold per tonne. (The measured and indicated resource includes 505 million tonnes of proven and probable reserves at similar grades.)

The latest updated feasibility study of Donlin Gold envisions an open-pit mine that would produce 1.5 million oz. gold annually in the first five years of operation, and 1.1 million oz. gold per year over a 27-year life.

For 2019, Novagold says it expects to spend US$13 million to fund its share of expenses at Donlin Gold, and US$11 million for general and administrative costs.

It says its goals for 2019 include: advancing Donlin Gold toward a production decision; maintaining an effective corporate social responsibility program; promoting a strong safety culture; and safeguarding the company’s treasury, with cash and term deposits totalling US$157 million as of May 31.

A year ago, Novagold sold its half stake in the Galore Creek copper project in northern B.C. to Newmont Mining for US$275 million, with the resulting funds directed to Galore Creek. Teck Resources owns the rest of Galore Creek.

2. LUNDIN GOLD

$1.48B market cap

The process plant under construction, as seen on Jan. 31, 2019, at Lundin Gold’s Fruta del Norte gold project in Ecuador. Credit: Lundin Gold.

Since last year’s list, Lundin Gold (TSX: LUG; US-OTC: FTMNF) has risen from fourth spot to second, and seen its market capitalization rise to $1.5 billion from $588 million. Lundin Gold holds one of the world’s most intriguing, high-grade gold deposits undergoing mine construction: Fruta del Norte (FDN) in southeast Ecuador’s Cordillera del Condor region.

A member of the Lundin Group of Companies, Vancouver-based Lundin Gold acquired FDN in December 2014 for US$240 million, after its previous owner Kinross Gold got stuck in a stalemate with the national government over taxation rates.

On June 25, Lundin Gold reported that the company had begun mining its first production stope at FDN, and that process plant and tailings facility construction is on schedule, with commissioning of the process plant to begin in the third quarter.

“Fruta del Norte reached another important milestone on schedule,” said Ron Hochstein, Lundin Gold president and CEO, in the release. “At the end of May, overall construction progress was 73% complete, and 88% of the project’s capital expenditure was committed. The team continues to make great progress as we head towards our first gold pour later this year.”

FDN hosts probable reserves of 15.5 million tonnes grading 9.67 grams gold per tonne and 12.7 grams silver per tonne, for a contained 4.82 million oz. gold and 6.34 million oz. silver.

Future production is pegged at an average 310,000 oz. gold per year over a 15-year mine life.

3. MAG SILVER

$1.20B market cap

The portal at MAG Silver’s 44%-owned Juanicipio silver project under construction in Zacatcas, Mexico. Credit: MAG Silver.

Vancouver-based, George Paspalas-led Mag Silver (TSX: MAG; NYSE-AM: MAG) says it aims to be a top-tier primary silver mining company by exploring and advancing high-grade, district-scale, silver-dominant projects in the Americas.

Its focus is its 44%-owned Juanicipio silver property, developed in partnership with Mexico’s Fresnillo (56%) in the iconic Fresnillo silver trend in Mexico.

Mag Silver says it is developing the underground infrastructure on the property, with the operational expertise of Fresnillo to support a 4,000-tonne-per-day mining operation.

In a May update, Mag Silver said that along with Fresnillo, it has given mine construction approval and finalized an engineering, procurement and construction management contract to oversee mine development, with all major permits in hand.

Mag Silver notes that process-plant construction is underway, with production to start in the second half of 2020, subject to detailed engineering.

Estimated pre-operative initial capital cost is pegged at US$395 million on a 100% basis, with US$50.6 million already spent.

Mag Silver had cash and equivalents of $128.6 million at the end of the first quarter.

Underground development at Juanicipio already exceeds 19 km, and 46,000 metres of infill and step-out exploration drilling were completed late in 2018, with assays released in the first quarter.

4. SEABRIDGE GOLD

$1.11B market cap

Drilling at Seabridge Gold’s KSM gold-copper project in B.C. Credit: Seabridge Gold

Seabridge Gold (TSX: SEA; NYSE: SA) has full ownership of two core assets: the KSM project in B.C., and the Courageous Lake project in Nunavut.

KSM has reserves of 2.2 billion tonnes at 0.55 gram gold per tonne, 0.21% copper and 2.6 grams silver per tonne, for a contained 38.8 million oz. gold, 10.2 billion lb. copper and 183 million oz. silver.

Courageous Lake has reserves of 91 million tonnes of 2.2 grams gold for a contained 6.5 million oz. gold.

Its third asset, the Iskut gold project in northwestern B.C., was acquired by buying SnipGold in 2016.

Seabridge Gold says its exploration at KSM in mid-2019 has three goals: to evaluate potential for more gold-copper porphyry systems below the Sulphurets thrust fault; to follow up high-grade, epithermal gold intercepts in the area of the Sulphurets deposit; and to update the Sulphurets resource estimate, where recent drilling likely expanded the deposit.

“Our first priority at KSM has been to ensure that the project is ready for final feasibility efforts when a partner is secured,” Seabridge chairman and CEO Rudi Fronk says. “Now that this objective has been accomplished, we are intent on improving our understanding of the entire project and its district-scale potential by addressing the many opportunities that remain, using the extraordinary bank of knowledge we have accumulated over the past decade.”

5. OSISKO MINING

$906M market cap

Core samples on display at Osisko Mining’s Windfall gold project in Quebec. Credit: Osisko Mining.

Osisko Mining (TSX: OSK; US-OTC: OBNNF) is the lead gold company of the Osisko group of companies, and has spent the last few years furiously drilling its Windfall gold property in Quebec’s Urban Barry region.

As of May 2018, total resources at Windfall were 2.4 million indicated tonnes grading 7.85 grams gold per tonne for 601,000 contained oz. gold, plus 10.6 million inferred tonnes at 6.70 grams gold for 2.3 million contained oz. gold.

In July, the firm raised another $40 million by privately placing flow-through and non-flow-through shares.

“We continue to be impressed by the gold mineralization we are encountering in the infill and expansion drilling at [Windfall’s] Lynx,” Osisko president and CEO John Burzynski says. “We are very optimistic that we will be able to add significant ounces, as we progress with resource drilling and exploration of the Windfall deposit.”

As of June 2019, more than 790,000 metres of drilling had been carried out at Windfall, and 22 drills we were on-site. A Windfall resource update is expected later this year, with a feasibility study underway in 2020.

6. SILVERCREST METALS

$431M market cap

Drillers at SilverCrest Metals’ Las Chispas gold-silver property in Sonora, Mexico. Credit: SilverCrest Metals.

Vancouver-based SilverCrest Metals (TSXV: SIL; NYSE-AM: SILV) has a world-class discovery at its Las Chispas silver-gold property in Sonora, Mexico.

As of February 2019, Las Chispas hosts an indicated resource of 1 million tonnes grading 710.6 grams silver and 6.98 grams gold per tonne, for a contained 22.9 million oz. silver and 388,300 oz. gold.

Another 3.6 million tonnes sit in the inferred category at 332.5 grams silver and 3.6 grams gold, for a contained 38.9 million oz. silver and 224,900 oz. gold. This puts Las Chispas among the top-five, highest-grade silver-gold deposits in the world.

SilverCrest was formed largely by the management team that discovered and developed the Santa Elena silver-gold mine, and sold it to First Majestic Silver in 2015.

7. SABINA GOLD & SILVER

$407M market cap

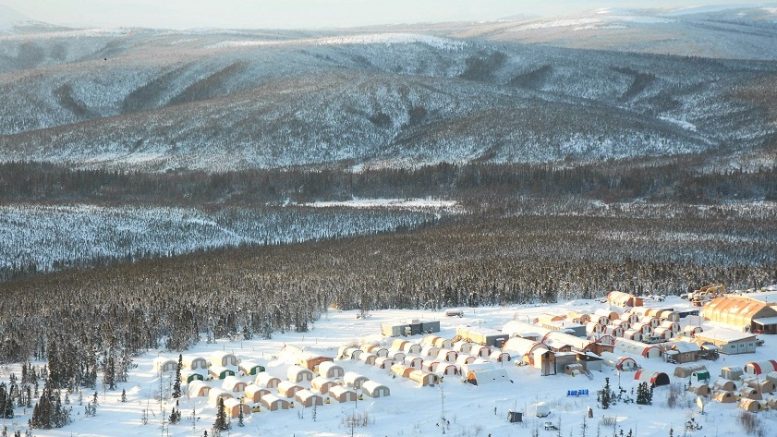

A camp on the Back River property. Credit: Sabina Gold & Silver.

Sabina Gold & Silver (TSX: SBB; US-OTC: SGSVF) has its wholly owned Back River gold project in Nunavut, where a feasibility study released in September 2015 envisioned a mine producing 200,000 oz. gold per year for 11 years, with a 2.9-year payback. The study showed a 24.2% after-tax internal rate of return, with an initial $415-million capex.

Sabina recently wrapped up a drill program of 6,400 metres in eight drill holes at three target areas at the Goose property at Back River. Drilling targets included the discovery area at Nuvuyak–Hook, high-grade optimization opportunities up-plunge from the Vault zone at the Umwelt underground, and continued scoping at the Llama Extension zone.

Sabina also owns a silver royalty on Glencore’s Hackett River project in Nunavut, comprised of 22.5% of the first 190 million oz. silver produced, and 12.5% of all silver produced thereafter.

Sabina had cash and equivalents of $43 million in March 2019.

8. NOVO RESOURCES

$356M market cap

An excavator moves earth at Novo Resources’ Beaton’s Creek gold property in Western Australia. Credit: Novo Resources.

Quinton Hennigh-led Novo Resources (TSXV: NVO; US-OTC: NSRPF) says it is involved in a “new paradigm in gold exploration and investing,” with its gold nugget-rich properties in Australia.

Novo says it aims to explore and develop gold projects in Western Australia’s Pilbara region, where it has amassed a 12,000 sq. km land package.

The company’s focus is its Karratha gold project, which comprises a number of joint-venture arrangements and wholly owned tenures.

It owns the Beatons Creek gold project near Nullagine, Western Australia, and holds a 70% interest in a number of tenements in the Marble Bar region of Western Australia.

9. GOLD STANDARD VENTURES

$348M market cap

A drill rig on the Dark Star gold deposit at Gold Standard Ventures’ Railroad project in Nevada. Credit: Gold Standard Ventures.

Vancouver-based Gold Standard Ventures’ (TSX: GSV; NYSE-AM: GSV) flagship asset is its Railroad–Pinion gold project on Nevada’s Carlin trend.

Gold Standard Ventures says its corporate mandate is to find district-scale gold deposits within the prolific Carlin trend, and other prospective trends within Nevada.

It has consolidated ground in the area since 2009, and now has the second-largest contiguous land package (208 sq. km) on the gold-rich trend. It has made discoveries at North Bullion, Bald Mountain and North Dark Star, and has substantial resources already delineated at several deposits.

In July, the junior was in the midst of raising $18.3 million in a bought-deal financing.

10. CORVUS GOLD

$241M market cap

Drills on Corvus Gold’s Mother Lode project in Nevada’s Nye County. Credit: Corvus Gold.

Jeffrey Pontius-led Corvus Gold (TSX: KOR; US-OTC: CORVF) is a new entrant to the top-10 list. Its focus is its North Bullfrog gold project in Nevada, and secondarily, its nearby Mother Lode gold project.

The North Bullfrog property encompasses 86.6 sq. km, while Mother Lode is 10 km southeast, and encompasses 36.5 square kilometres.

A preliminary economic assessment of a combined operation from both properties using heap-leaching and milling foresees 2.6 million equivalent oz. gold produced over nine years.

Pontius is a former AngloGold manager, and AngloGold Ashanti is Corvus’ biggest shareholder at 19.8%, followed by Tocqueville Asset Management (19.7%) and Van Eck Global (9.6%).

Be the first to comment on "Top-10, Canada-based precious metals developers"