South America is endowed with geology steeped in precious, base and battery metals, and the continent has had a storied mining history. Below we showcase eight companies active in the region.

Alpha Lithium

Vancouver-based Alpha Lithium (NEO: ALLI; US-OTC: APHLF) is advancing lithium brine projects in Argentina’s portion of the Lithium Triangle, a lithium-rich region of the Andes that covers parts of Argentina, Bolivia and Chile.

Its flagship 100%-owned Tolillar project is one of the last remaining undeveloped salars — salt flats — in Argentina’s Salta province. It is also situated just 10 km from Allkem (TSX: AKE; ASX: AKE) and Livent’s (NYSE: LTHM) Fenix lithium project, which has produced about 20,000 tonnes a year of lithium carbonate chemicals for more than two decades.

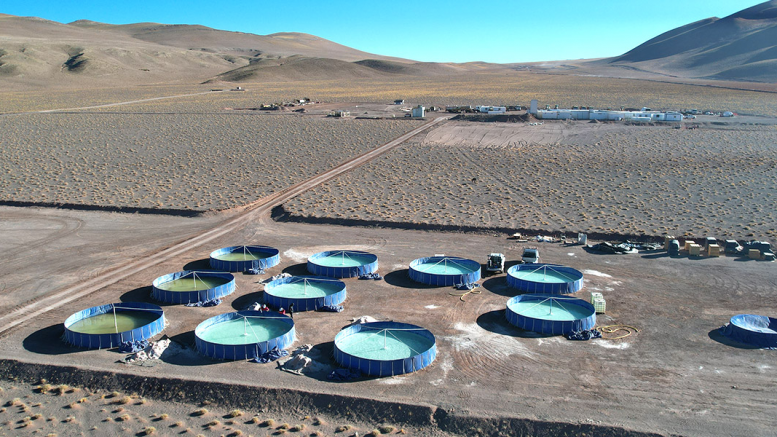

The Tolillar Salar, one of the last remaining undeveloped salars in Argentina’s Salta Province. Credit: Alpha Lithium

In September, Alpha Lithium updated a preliminary economic assessment (PEA) for a 25,000-tonne per year commercial-scale operation at Tolillar producing battery-grade lithium carbonate chemicals using traditional pond evaporation and direct lithium extraction (DLE).

The PEA outlined an initial capex of US$777 million, including a US$179 million contingency, and a 3.7-year after-tax payback period. The study estimated an after-tax net present value (8% discount rate) of US$1.7 billion and an internal rate of return of 25.6%. An average lithium carbonate price of US$23,146 per tonne was used for the analysis, and cash costs added up to US$5,980 per tonne.

Currently, Tolillar has indicated resources of 3.6 million tonnes lithium carbonate equivalent (LCE) and inferred resources of 1.4 million tonnes LCE. The resource also includes 13.2 million indicated tonnes of potassium chloride (KCI) and another 5.3 million inferred tonnes of KCI. The resource was defined over a 102-sq.-km footprint using results from short-term pumping tests and from naturally flowing wells.

Alpha’s second project, Hombre Muerto, is 10 km from Tolillar, and Vertical Electrical Sounding surveys indicate significant brine presence, the company says.

On Sept. 28, Alpha’s board recommended that shareholders accept a revised take-over bid from TechEnergy Lithium Canada, a subsidiary of Tecpetrol Investments, at a price of US$1.48 per share, a 24% premium to its closing price on Sept. 21.

The company has a market cap of about $262 million.

Atlas Lithium

Florida-based Atlas Lithium (NASDAQ: ATLX) plans to become a lithium concentrate producer and holds lithium and other battery metal rights (nickel, rare earths, titanium and graphite) in Brazil. Its flagship, 100%-owned Minas Gerais hard rock lithium project, spreads across 240 sq. km in the north of that state.

The company recently announced a new shallow pegmatite discovery (Anitta 4), following step-out drilling west of the company’s main 2.3-km-long Anitta pegmatite trend. Anitta 4 is located within the project’s Neves area, a cluster of four mineral rights in Brazil’s Lithium Valley. Drill hole DHAB-290 intersected mineralized spodumene starting at 170 metres depth with a cumulative spodumene intersect length of 43.7 metres. Drill hole DHAB-289 yielded a cumulative 18.7 metres of mineralized spodumene from 70 metres depth. Assays are pending.

Drill core at Atlas Lithium Minas Gerais project in Brazil. Credit: Atlas Lithium

Atlas has identified at least 20 pegmatite outcrops so far. Drilling in some of these targets has returned up to 5.23% lithium oxide (Li2O). (Drill hole DHAB-186 in pegmatite Anitta 3, intersected 5.23% Li2O at a depth of just 9 metres, and DAB-200 returned a cumulative total of 46.7 metres of mineralized spodumene starting at 54 metres depth, including 18.3 metres at an average grade of 1.51% Li2O.The company says metallurgical testwork confirmed the ability to concentrate its lithium samples to a grade of 7.22% Li2O.

Last month, Atlas appointed former Allkem chairman Martin Rowley as its lead strategic advisor. Rowley is known for co-founding copper producer First Quantum Minerals (TSX: FM) in 1996, later joining Lithium One as chairman in 2009. Following Lithium One’s merger with Galaxy Resources, Rowley continued as chairman, growing the company until its merger with Orocobre in 2021, which created Allkem.

Atlas owns about 45% of the common shares of Apollo Resources, a private company focused on iron ore, and about 28% of Jupiter Gold (US-OTC: JUPGF), which has gold projects and is developing a quartzite mine.

Atlas has a market cap of roughly US$285 million.

Founders Metals

Founders Metals (TSXV: FDR) is a Vancouver-based company with gold projects in South America’s Guiana Shield. Its flagship is Antino in southeastern Suriname, 275 km from the capital city of Paramaribo.

Historical alluvial gold mining from pits on the 200-sq.-km property produced over 500,000 oz. gold, the company says. Exploration work has included more than 30,000 metres of historic drilling, which has been compiled into a new database, more than 35,000 auger gold-in-soil anomalies, property-wide aeromagnetic survey data; structural mapping of pits; and an airborne LiDAR topographic survey.

The project is fully permitted for surface exploration, drilling and gold mining. The company commenced its first drill program in July and has reported intersects of 12 metres grading 19.22 grams gold from 55 metres in drill hole 23FRDD003; 9 metres of 11.10 grams gold from 83 metres in drill hole 23FR009; 12.2 metres of 8.75 grams gold in drill hole 23GR011 from 76 metres; and 15.5 metres of 30.72 grams gold from 64 metres in drill hole 23FR014. The company has completed more than 3,800 metres of a planned 10,000-metre program of diamond drilling this year.

Founders describes the deposit type as a high-grade shear-hosted gold vein system and bulk-tonnage vein stockworks, and notes that the geology at Antino, characterized by folded volcanic and sedimentary assemblages, is similar to two well-known gold mines in the country, Zijin Mining’s Rosebel and Newmont Mining’s (TSX: NGT; NYSE: NEM) Merian.

The project, which lies within the Southern Greenstone Belt that extends into French Guiana, has numerous untested anomalies that have been identified from historic gold-in-soils and geophysical data, and all mineralized zones remain open along strike and at depth.

The company has the option to acquire up to a 75% interest in the project over three stages of work, cash and share commitments.

Founders has a market cap of roughly $41.8 million.

Jaguar Mining

Toronto-based Jaguar Mining (TSX: JAG; US-OTC: JAGGF) produces gold near the city of Belo Horizonte in Brazil’s Iron Quadrangle, a greenstone belt in Minas Gerais state.

The company has built and still owns four mines and three mills. Last year the underground mines at its Turmalina and Caete mine complexes produced a total of 80,968 oz. gold at all-in sustaining costs (AISC) of US$1,483 per oz. gold sold. This year its guidance is set within a range of 84,000-88,000 oz. at AISCs of between US$1,275 and US$1,375 per ounce.

In addition to Turmalina and Caete, the company owns the Paciencia mine, which has been on care and maintenance since 2012, and the Roca Grande mine, on temporary care and maintenance since April 2019.

The Turmalina mine and mill complex is about 130 km northwest of Belo Horizonte, and the Caete mine and mill complex is about 50 km to the east of Belo Horizonte. Paciencia sits about 80 km to the southwest of the city. Belo Horizonte is considered Brazil’s mining capital and has a population of 4 million.

In September, Jaguar completed the acquisition of the Pitangui project and the remaining interest in the Acurui project from a subsidiary of Iamgold (TSX: IMG; NYSE: IAG). Pitangui is about 110 km from Belo Horizonte — near its Turmalina mine complex — and Acurui is contiguous to its Paciencia property and will be considered a part of the exploration and development package available to restart production at Paciencia.

In a presentation at the recent Beaver Creek Precious Metals Summit, the company said that since 2015, its mineral resource inventory inclusive of reserves has maintained a four- to five-year mine life at current production rates, and that it plans to source fresh mill feed through exploration on its land, and potential arrangements with neighbours.

The company has a market cap of about $99 million.

Lithium South Development

Lithium South Development (TSXV: LIS; US-OTC: LISMF) is focused on its flagship Hombre Muerto North lithium project on the Hombre Muerto Salar in Argentina’s Salta and Catamarca provinces, about 1,400 km northwest of Buenos Aires.

The 100%-owned project in the heart of the lithium triangle is adjacent to a US$4-billion lithium plant being built by South Korea’s POSCO, part of the Korean steelmaker’s plan to create a vertically integrated supply chain for making EV batteries.

Lithium South recently updated the project’s measured and indicated resource to 1.6 million tonnes of LCE at an average grade of 736 milligrams per litre lithium, with a low average magnesium to lithium ratio of 3.3 to one.

The resource was a combination of the in-situ contained lithium at the Alba Sabrina, Natalia Maria and Tramo claim blocks and was based on a resource expansion drill program completed this year. The 57-sq.-km property package consists of nine mining concessions, six on the salar and three off the salar.

The company is designing a pilot plant to prove low risk evaporation technology, and in mid-September it announced it will drill three wells, two at Alba Sabrina and one at Natalia Maria. Long-term pumping tests will determine optimal pumping rates, which will help estimate the overall production potential for the three combined claims.

Two of the wells, one 250 metres deep and the other 400 metres deep, will be drilled on the Alba Sabrina claim block, and the other, 250 metres deep, will be located on the Natalia Maria claim block. The results will be used in an upcoming feasibility study. Two previous production wells were installed at the Tramo claim block.

The company is working on an upcoming feasibility study. A 2019 PEA forecast a mine life of 30 years.

The Vancouver-based company has a market cap of roughly $40 million.

Luminex Resources

Luminex Resources (TSXV: LR; US-OTC: LUMIF) is advancing its Condor gold-copper project in southeastern Ecuador, about 30 km south of Lundin Gold’s (TSX: LUG; US-OTC: LUGDF) Fruta del Norte, one of the world’s highest-grade operating gold mines.

Condor has an indicated resource of 111 million tonnes grading 0.65 gram gold per tonne and 3.6 grams silver per tonne (0.75 gram gold-equivalent per tonne) for 2.3 million oz. contained gold and 12.8 million oz. silver (2.7 million gold-equivalent ounces). Inferred resources add 224 million tonnes grading 0.6 gram gold and 2.5 grams silver (0.72 gram gold-equivalent) for 4.3 million oz. gold and 18.1 million oz. silver (5.2 million gold-equivalent ounces).

Following a 2021 PEA and resource update, the company discovered high-grade gold and silver mineralization at Cuyes West, an area west of its Los Cuyes pit.

The PEA on Condor North evaluated four deposits (Los Cuyes, Soledad, Enma and Camp) that would provide a 12-year mine life with average annual payable production of 187,000 oz. gold and 758,000 oz. silver. The study estimated an after-tax net present value (5% discount rate) of US$562 million and an internal rate of return of 20.3% using a gold price of US$1,760 per ounce. All-in sustaining costs were pegged at US$839 per oz., net of byproduct credits, and initial capital costs at US$607 million.

Elsewhere in Ecuador, Luminex has two separate earn-in agreements with Anglo American (LSE: AAL) and the Japan Oil, Gas and Metals National Corp. or JOGMEC. Anglo American owns 25% of Luminex’s Pegasus project. Pegasus A is 2 km south of the historic Estero Hondo gold mine, and Pegasus B is adjacent to Salazar Resources’ (TSXV: SRL; US-OTC: SRLZF) Curipamba project.

JOGMEC has the right to earn a 70% stake in Luminex’s Orquideas project, where mineralized outcrops have assayed up to 0.9% copper and 0.66% molybdenum and there are peripheral high-grade gold and base metal veins. The company is drilling about 2,000 metres there this year.

The Vancouver-based company has a market cap of about $34 million.

Rio 2

Rio 2 (TSXV: RIO; US-OTC: RIOFF) is focused on its Fenix gold project in Chile’s Maricunga mineral belt, about 160 km northeast of Copiapo.

The company completed a feasibility study in September that contemplated a conventional open pit mine and run-of-mine heap leach operation. The study concluded Fenix would produce an average of 91,000 oz. per year during its first 12 years of operation and 54,000 oz. gold annually during its final five years for a total life-of-mine production of 1.32 million ounces.

The study estimated an after-tax net present value (5% discount rate) of US$210 million and internal rate of return of 28.5% using a gold price of US$1,750 per ounce. Initial capital costs of US$117 million could be paid back (after-tax) in about 2.8 years after the start of production. (The initial capex estimate excluded pre-construction activities completed to date amounting to about US$29 million.)

Fenix has measured and indicated resources of 411 million tonnes grading 0.38 gram gold per tonne for 5 million oz. gold and inferred resources of 137 million tonnes grading 0.32 gram gold for 1.4 million oz. gold. The resource was constrained within a US$1,500 per oz. optimized open pit.

The company says mineralization remains open at depth and along strike, and further drilling provides an opportunity to increase resources and extend the projected mine life.

Over the last 12 months the company wound down pre-construction activities to deal with its administrative appeal to overturn the Chilean authority’s disapproval of the project’s environmental economic assessment.

Chile’s Regional Evaluation Commission, which includes 12 governmental institutions, voted for not approving the environmental impact assessment in July 2022. Rio notes that the run-of-mine heap leach operation it envisions would not require crushing or tailings storage facilities, which would minimize Fenix’s overall impact and footprint. Rio filed an appeal in August 2022.

The Vancouver-headquartered company has a market cap of roughly $53 million.

Tincorp Metals

Tincorp Metals (TSXV: TIN; S-OTC: TINFF), formerly called Whitehorse Gold, changed its name in February to signify its focus on tin projects in Bolivia. The company has signed agreements to earn 100% of the SF tin project and the Porvenir tin-zinc-silver project, both near the city of Oruru in Bolivia’s tin belt.

Its 2-sq.-km SF project is in Bolivia’s southwestern Potosi department, 72 km from Oruru and 15 km northwest of the Llallaga deposit, one of the world’s largest tin deposits. The property hosts a historic open pit, as well as small-scale underground workings. Rio Tinto (NYSE: RIO; LSE: RIO; ASX: RIO) explored the project in the 1990s, drilling seven holes and digging exploration trenches. Two of the holes intercepted significant mineralization, with drill hole ESF001 intersecting 236 metres grading 0.41% tin, 1.12% zinc and 15 grams silver per tonne from a depth of 125 metres; and drill hole ESF002 returned a 180-metre interval grading 0.29% tin, 1.06% zinc and 13 grams silver starting from 94 metres.

The Porvenir project, 65 km southeast of Oruru, is 15 km south of Huanuni, the country’s largest tin mine. Like the SF project, Porvenir contains an historic open pit as well as underground workings. Japan’s Dowa Metals & Mining drilled 88 holes (26,959 metres) between 2007 and 2011, identifying more than 19 veins assaying up to 10.2% tin, 28.1% zinc, 6.34% lead and 941 grams silver.

Tincorp kicked off its first drill program (seven holes/2,500 metres) at Porvenir in May. Its inaugural hole, DPOV001, returned 120.4 metres grading 0.60% tin, 1.11% zinc, 6 grams silver and 0.07% copper (284 grams silver-equivalent) from 259 metres downhole, including 21.6 metres averaging 2.25% tin, 3.35% zinc, 21 grams silver and 0.2% copper (1,022 grams silver-equivalent).

Outside Bolivia, the company owns 100% of the Skukum gold project, about 84 km south of Whitehorse.

Tincorp Metals, based in Vancouver, has a market cap of about $29 million.

Be the first to comment on "South America Snapshot: Eight companies hunting for critical and precious metals"