Lara Exploration (TSXV: LRA) is drilling its 47 sq. km Planalto copper property in Brazil’s northern Carajas district.

“We’re a prospect generator and we typically don’t drill projects ourselves,” Lara president, CEO and cofounder Miles Thompson says in a telephone interview with The Northern Miner from his office in London, England. “Our model is to joint venture everything.”

Lara optioned Planalto in 2013 from a local company, but ran into legal issues when the Brazilian department of mines cancelled Lara’s licences over what Lara says the department perceived as “deficiencies” in the application paperwork.

Those issues were not resolved until June 2016.

Planalto sits just south of Avanco Resources’ (ASX: AVB) Antas open-pit, copper-gold mine in a well-established mining district that includes Vale’s (NYSE: VALE) Sossego copper-gold mine and Salobo copper mine — the largest copper deposit ever discovered in Brazil.

True to its business model, Lara optioned the property to Avanco in May 2017.

By June, Avanco had elected not to proceed with the option after completing two electromagnetic surveys over two soil geochemistry anomalies on Planalto.

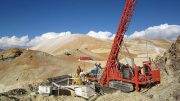

A drill rig on the homestead target at Lara Exploration’s Planalto copper project in Brazil’s northern Carajas district. Credit: Lara Exploration.

However, Thompson says that geophysical work “confirmed Lara’s view that there was something there” that “justified drilling.”

The company found several conductors, and in October 2017, proposed a scout drilling program to test a prospective zone that extends 1,000 metres in strike length and between 150 metres and 400 metres width at surface.

At the end of 2017 it launched a five-hole “proof of concept” drill program.

Results from that program began trickling out in February 2018. Lara’s first hole intercepted 222 metres from surface grading 0.38% copper, including 117 metres from 62 metres downhole grading 0.53% copper. More holes intercepted 51 metres from surface grading 0.27% copper and 101 metres from 102 metres downhole grading 0.14% copper.

The latest assays returned 211 metres from surface at 0.39% copper, including 114 metres from 51 metres downhole grading 0.55% copper.

Lara is drilling its fifth and final hole at Lara, a scissor hole designed to intercept mineralization picked up in the latest assays. After, it will continue looking for a joint-venture partner.

“From a business standpoint, drilling out a big base metals project doesn’t make economic sense for a junior,” Thompson says. “We’ll put the data together and try to find a partner to do the heavy lifting for us.”

Lara has another US$400,000 in staged payments to make on Planalto over the next three years. The property includes a 2% net smelter return royalty, part of which Lara can buy back.

The company has several core copper and gold projects across Brazil and Peru, including its Grace gold project and Liberdade copper project. At both projects, the company is working through some legal issues.

Core showing quartz veining taken from Lara’s Planalto property. Credit: Lara Exploration.

Lara recently released results on 88 shallow holes drilled by Minera Apumayo at the 48 sq. km Grace project located in the Ayacucho district of Southern Peru.

Apumayo’s option to acquire Grace expired in December 2017. According to Lara, Apumayo has expressed interest in extending the option period, but has been unwilling to make financial commitments, and still owes property fees for 2017.

Highlights from Apumayo’s drill program include 22 metres from 18 metres downhole grading 0.67 gram gold per tonne and 52 metres from 60 metres downhole grading 0.53 gram gold.

Lara’s 49% owned, 85 sq. km Liberdade project sits at the western end of the Carajas district. The project is a joint venture with Codelco, which can earn another 24% interest by defining a minimum resource of 500,000 tonnes copper equivalent.

Codelco drilled six holes into the property in 2012, returning highlights of 197 metres from 49 metres downhole grading 0.65% copper and 128 metres from 73 metres downhole at 0.69% copper.

Before Lara, the property was owned by Vale. Nine months after Vale lost its licence, in mid-2010, Lara filed a claim, and then, after the joint venture, transferred that claim to Codelco in March 2011.

Codelco finished several exploration programs and requested a three-year renewal in July 2013.

Vale is now claiming ownership of the property through a licence dating back to 1986 that it says is still valid.

As a result, the Brazilian department of mines delayed Codelco’s licence renewal and Codelco took both Vale and the department to court. Thompson says that all the motions are in and the companies are waiting for a decision.

“Any decision we get would be subject to appeal,” Thompson says. “The court route is not a quick route. But the evidence of the quality of the discovery is that two of the larger mining companies on the planet are fighting over it.”

Shares of Lara are valued at 65¢ with a 52-week range of 50¢ to $1. The company has a $22-million market capitalization. Across South America, it has nine active projects.

“That’s the neat thing about these prospect generators,” Thompson says. “Once you have a project and it’s in a joint venture, essentially what you’re doing is managing the relationship. Then your team can get on and generate the next project.”

Be the first to comment on "While seeking JV partner, Lara drills Planalto in Brazil"