Rockcliff Metals (TSXV: RCLF; US-OTC: SVVZD) is set to drill its Laguna gold property in Snow Lake, Man. — the first drilling the property has seen in over 70 years.

Kinross is funding the 2,500-metre program. The two companies partnered in July 2018, with Kinross Gold (TSX: K; NYSE: KGC) intending to earn a 70% interest in both Rockcliff’s Laguna and Lucky Jack gold properties by spending $5.5 million on exploration over the next six years. Both properties are located within the historic Herb Lake gold camp.

The Laguna property hosts the past-producing Rex-Laguna gold mine that reportedly produced 60,000 oz. gold grading 18.7 grams gold from a single quartz zone between 1916 and 1939. Thrust faults attributed to the Crowduck Bay fault, which spans all of Laguna, control gold mineralization on the property.

“That quartz zone is located within a 6 km long ‘Gold Mine Trend’ striking across the property,” company president and CEO Ken Lapierre says during an interview with The Northern Miner. “We’ve uncovered 11 other similar-style quartz zones within that favourable gold trend, and we’ve identified visible gold in five quartz zones, with grab sample assays up to and over 600 grams per tonne gold.”

Kinross has committed to spending $750,000 on Laguna and Lucky Jack this year, and $1.25 million on both properties over the next two years. Rockcliff says that will cover work expenses until the end of 2019.

The exploration program at both properties will include geological mapping, trenching, sampling, ground-gravity geophysics, a light detection and ranging survey and drilling.

Rockcliff Metals began exploring Snow Lake 12 years ago. It became the largest junior landholder in the Snow Lake greenstone belt earlier this year when it staked two properties, VMS #1 and VMS #2, which total more than 1,000 square kilometres. They raised Rockcliff’s overall land position in Snow Lake to 2,000 square kilometres.

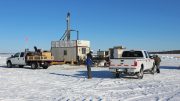

President and CEO Ken Lapierre at the storage facility at Rockcliff’s Snow Lake project in Manitoba. Credit: Rockcliff Metals.

The company’s yearly exploration expenses help maintain the claims, beginning with a $144,315 commitment this year. It plans to fly an airborne geophysical survey over the properties in early 2019 to define targets for future exploration.

Across Manitoba, Rockcliff now has eight base metal projects and five gold projects through its wholly owned subsidiary, Goldpath Resources. It also holds two separate future royalties. In total, the company owns more than 2,000 sq. km of prospective land in Manitoba.

“First and foremost, we see ourselves as an exploration company searching for buried treasure,” Lapierre says. “The drilling on the Laguna gold property will be our focus for the remainder of 2018, and that will continue into 2019, but we’re continuing to prepare two other volcanogenic massive sulphide properties for future drill programs in 2019.”

He’s referring to the Bur zinc property and the Rail copper property.

The historical Bur Zinc deposit sits on the northeast corner of Rockcliff’s Snow Lake camp. It hosts a non-National Instrument 43-101 compliant 1.35 million tonnes grading 1.8% copper, 8.7% zinc, 0.1 gram gold and 11.5 grams silver. The company plans to drill Bur in 2019.

Rockcliff has similar plans for Rail. The Rail property features at least 5 km of a prospective copper horizon containing three main geophysical targets: the North target, the Rail deposit and the South target. The North target lies 1 km north of the Rail deposit. The South target lies 800 metres south.

The project’s deposit is within the central target. It contains 822,000 indicated tonnes grading 3.04% copper, 0.7 gram gold, 0.9% zinc and 9.3 grams silver. The company has not yet drill tested the property’s north and south targets. It plans to launch a drill campaign at Rail in 2019, focused on expanding the resource. The deposit is open at depth and along strike.

Assistant project geologist Ashley Durham beside a century-old trench on the 007 vein at Rockcliff’s Laguna gold property, 20 km southeast of Snow Lake, Manitoba. Rockcliff has collected high-grade gold, silver and zinc samples from the trench. Credit: Rockcliff Metals.

The company also recently found a 10 km mineralized corridor called the McLeod gold horizon on its SLG gold property. The corridor is associated with gold and copper mineralization. The company plans to do more surface work at SLG in 2019 to advance its targets to the drill-ready stage.

Despite its expansive exploration plans, Rockcliff is in good financial shape. In May 2018 the company sold its interest in the Talbot option agreement for Snow Lake’s Talbot polymetallic deposit to Norvista Capital (TSXV: NVV; US-OTC: XTERF). Norvista will pay Rockcliff $3 million over two years and a 0.5% net smelter royalty (NSR) on Norvista’s nearby Tower copper property. If Norvista earns a 90% interest at Talbot, Rockcliff further earns a 2% NSR on the Talbot deposit.

Rockcliff now has a 2% NSR on Tower. It had been earning a 51% interest in Talbot from Hudbay Minerals (TSX: HBM; NYSE: HBM) by spending $6.12 million in exploration at the property over six years, since signing the agreement in April 2014. It was up to date on payments at the time of the sale.

The company has $3 million in cash and no debt. It recently closed a $1.84-million private placement.

Shares of Rockcliff are trading at 14¢ with a 52-week range of 7¢ to 33¢. The company has a $10-million market capitalization.

Be the first to comment on "Rockcliff to begin Kinross-funded drill program at Laguna"