Rio Tinto (NYSE: RIO; LSE: RIO; ASX: RIO) said on Tuesday it is actively searching for lithium assets as its expects prices for the metal used in the making of batteries that power electric vehicles (EVs) to remain high for a “long period of time.”

The company had to shelve its proposed US$2.4 billion Jadar lithium mine in Serbia early this year after the government revoked the project’s licences.

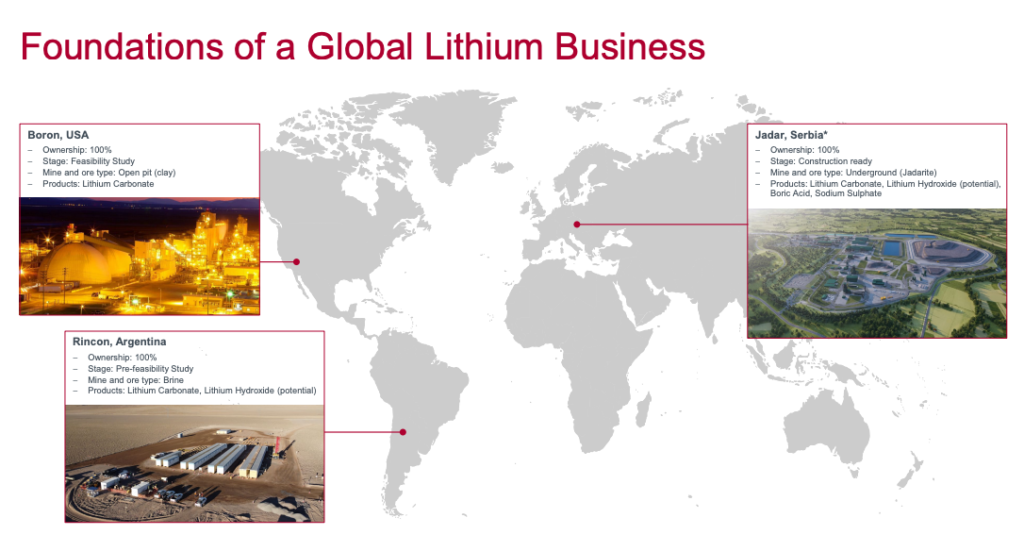

In a presentation posted on its website, Rio confirmed it has not scrapped Jadar completely as it still considers the project as part of its portfolio and said it intends to de-risk the development process.

The world’s second largest miner also said it was pursuing “organic and M&A growth opportunities” in the lithium sector.

Serbian Prime Minister Ana Brnabic was quick to throw cold water over Rio’s plans, saying she didn’t see any possibility to revive the lithium-borat project, local news site Nova reported.

Brnabic also said that having a lithium mine in the country was a “historic chance” for the nation’s development and that public debate about the matter will be necessary.

If completed, the Jadar project would be Europe’s biggest lithium mine, with a production of 58,000 tonnes of refined battery-grade lithium carbonate per year, enough to power one million electric vehicles and supply 90% of the continent’s current lithium needs.

Jadar would also propel Rio Tinto onto the world’s top 10 lithium producers podium.

The interest from the Australian miner in lithium comes amid a global push to transition to cleaner energy sources and reduce dependency on fossil fuels. This has placed electrification and battery metals at the forefront of the shift.

Over the past five years, Rio Tinto has tried expanding its footprint in the battery market. In 2018, it reportedly attempted to buy a US$5-billion stake in Chile’s Chemical and Mining Society (SQM), the world’s second largest lithium producer.

Rio Tinto estimates that committed lithium supply and capacity expansions will contribute only about 15% to demand growth over the 2020-2050 period. (From: Rio Tinto’s presentation, Dec., 2022.)

In April 2021, the miner kicked off lithium production from waste rock at a demonstration plant located at a borates mine it controls in California.

Rio took another step into the lithium market in March this year, completing the acquisition of the Rincon lithium project in Argentina for US$825 million, which has reserves of almost two million tonnes of contained lithium carbonate equivalent, sufficient for a 40-year mine life.

The miner has also approached some of the biggest investment banks asking for recommendations on both lithium companies and projects.

Those meetings, the company has said, don’t mean a major deal is imminent. Their goal is to make sure it’s aware of all the opportunities in the sector.

Rio Tinto currently has no lithium projects in Australia, which is the top producing nation of the battery metal, but said that “high-grade brines and Australia hard rock” will be called upon to meet demand.

The company estimates that committed lithium supply and capacity expansions will contribute only about 15% to demand growth over the 2020-2050 period. The remaining 85% would need to come from new projects.

Be the first to comment on "Rio Tinto hunts for lithium deals, eyes Jadar revival"