Gold bugs have been riding a scorching rally in 2025. With a gain of over 50%, gold is one of the best-performing assets year to date, buoyed by strong buying pressure from central banks and retail investors.

Gold shot up to a record high close to $4,400 an oz. last month before succumbing to profit taking. After spending time below the $4,000 level, bullion climbed again this month on expected U.S. interest rate cuts and persistent fears about inflation.

With rising costs and the number of new discoveries declining, many question whether gold companies can sufficiently increase production to meet the rising demand.

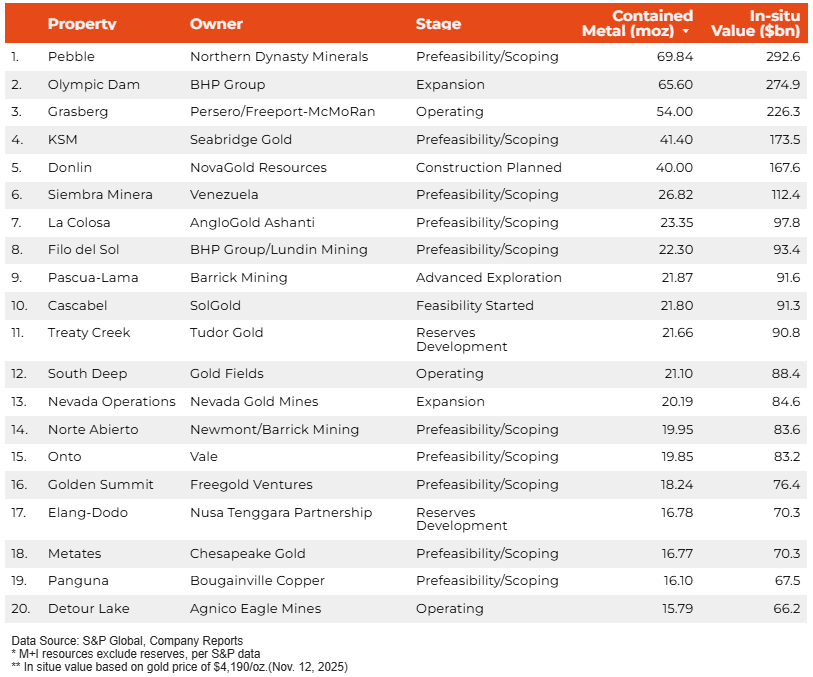

While some of the 20 largest properties ranked by measured and indicated gold resources face an uphill battle to go into production and many greenfield properties have been stalled for years, the pipeline of potential projects continues to swell as gold prices stay on the boil.

1. Pebble

Stage: Prefeasibility/Scoping

Coming in No.1 is Northern Dynasty Minerals’ Pebble project with 69.8 million oz. of contained metal. The project has been stalled for over a decade due to its location near the Bristol Bay watershed in Alaska. Its fate remains up in the air amid a legal battle over the US Environmental Protection Agency’s ability to veto the project.

2. Olympic Dam

Stage: Expansion

Olympic Dam is number two, with 65.6 million oz. of gold. BHP’s copper, gold and uranium complex in South Australia is set for a significant expansion in the coming years. BHP plans to invest A$840 million on a series of growth projects to tap into other deposit areas. It is also host to one of the top copper-producing mines in the world.

3. Grasberg

Stage: Operating

In third spot is the Grasberg gold-copper mine, situated in the Sudirman Mountain Range of Indonesia with 54 million oz. of gold. Operated by Freeport-McMoRan, the mine grabbed headlines this year for a deadly accident at its largest underground deposit that sent the copper industry into a supply panic. Part of Grasberg remains under long-term development, such as the Kucing Liar orebody, and the earlier-stage Dom deposit.

4. KSM

Stage: Prefeasibility/Early Construction

Seabridge Gold’s Kerr-Sulphurets-Mitchell (KSM) is in fourth place with 41.4 nillion oz. of contained metal. The project in British Columbia has been federally approved for a decade. KSM has been advancing early-stage construction activities since 2022 and has spent in excess of C$550 million on construction. KSM is also involved in a legal dispute between its operator Seabridge and a neighbouring explorer, Tudor Gold.

5. Donlin

Stage: Construction/Planning

Donlin, the second Alaska project to make the list, ranks number five with 40 million oz. of metal. Giant Barrick Mining previously held half of the project, but sold its stake to partner Novagold Resources (TSX: NG) and US hedge fund billionaire John Paulson earlier this year. The new owner is eyeing a new feasibility study in 2027.

6. Siembra Minera

Stage: Prefeasibility/Scoping

Siembra Minera in Venezuela ranks sixth with 26.8 million oz. of gold. The project is owned by Siembra Minera, a joint venture of Gold Reserve (55%) and the Venezuelan government (45%). Last year, Gold Reserve raised $36 million to advance the copper-gold project in Bolivar state.

7. La Colosa

Stage: Prefeasibility/Scoping

AngloGold Ashanti’s La Colosa project in Colombia ranks seventh with 23.4 million oz. The project has faced local opposition, and has been under force majeure since the Tenth Administrative Court of Ibagué ratified a mining ban in Colombia’s Cajamarca municipality, upholding the result of a 2017 referendum.

8. Filo del Sol

Stage: Prefeasibility/Scoping

The Filo del Sol project, straddling the international border between Chile and Argentina, has 22.3 million oz. of metal. It was acquired this year by BHP and Lundin Mining. Filo del Sol is part of the Vicuña project with Lundin’s more advanced Josemaría project in Argentina. The joint venture has top-10 copper potential, according to an initial Filo del Sol resource issued in May.

9. Pascua-Lama

Stage: Advanced Exploration

Barrick’s beleaguered Pascua Lama project in Chile has 21.9. million oz. of contained gold. Environmental issues plagued the project, and Barrick has to spend $136 million shutting down Pascua-Lama after a Chilean court ordered its “total and definitive” closure.

10. Cascabel

Stage: Feasibility Started

SolGold’s Cascabel project in Ecuador is number 10 with 21.8 million oz. of contained metal. The company this year moved its tax domicile to Switzerland as it pushes the project into development. Cascabel is backed by some of the biggest names in the industry, including BHP and Newmont.

11. Treaty Creek

Stage: Reserves Development

Tudor Gold’s Treaty Creek project in British Columbia ranks 11th with 21.7 million oz. of gold. This year, Tudor applied for a permit for underground exploration at the project, located in the province’s northwest.

12. South Deep

Stage: Operating

Gold Field’s South Deep is in 12th place with 21.1 million oz. of metal. The South African mine has been in development and operation since the 1970s and has an estimated mine life that runs past 2100, which would make it potentially the last major gold mine in the country.

13. Nevada Gold Mines

Stage: Expansion

Nevada Gold Mines, a joint venture between Barrick and Newmont, and operated by Barrick, ranks 13th with 20.2 million oz. of metal. The partnership between the companies dates back to 2019, after Barrick had made a hostile takeover bid for Newmont, which at the time was the smaller of the two. Now, Newmont could potentially make a play for Barrick’s interest in the Nevada assets.

14. Onto

Stage: Prefeasibility/Scoping

Vale’s Onto copper and gold deposit in Indonesia has the same 20 millon oz. of gold as Norte Abierto, but its orebody is different and its measured and indicated resource is slightly higher. Sumbawa Timur Mining, a joint venture between Eastern Star Resources (80%), a subsidiary of Vale, and ANTAM, first announced the discovery in 2020.

15. Norte Abierto

Stage: Prefeasibility/Scoping

Norte Abierto, a 50/50 joint venture between Barrick and Newmont in Chile has 20 million oz. of contained gold. The mining complex, situated in the northern Atacama region, was created in 2017 following the merging of the separate Cerro Casale mine, owned by Barrick and the Caspiche mine owned by Newmont-Goldcorp, into a JV.

16. Golden Summit

Stage: Prefeasibility/Scoping

Freegold Ventures’ Golden Summit project in Alaska ranks 16th, with 18.2 million oz. of metal. In July, a resource update lifted the contained indicated metal by 42% – and the company’s shares to a five-year high. New assays reported this month are helping define a starter pit in the lead up to a prefeasibility study.

17. Elang-Dodo

Stage: Reserves Development

The Elang-Dodo project on Sumbawa Island, West Nusa Tenggara Province, Indonesia, has 16.8 million oz. of gold. It is owned by PT Amman Mineral Nusa Tenggara, which also operates the nearby Batu Hijau mine.

18. Metates

Stage: Prefeasibility/Scoping

Chesapeake Gold’s Metates project in Mexico’s Durango state has 16.8 million oz. of contained metal. In 2021, the company said it cracked the code at Metates to undertake the heap leach processing of sulphide material that ultimately has the potential to disrupt and enhance the project economics of sulphide ore bodies globally.

19. Panguna

Stage: Prefeasibility/Scoping

Papua New Guinea’s Panguna mine contains 16.1 million oz. of metal. Once owned by Rio Tinto and now run by Bougainville Copper, the project has a storied past. The mine closed in 1989 due to an uprising against the project and a resulting civil war that lasted about a decade and killed as many as 20,000 people. Rio disposed of its share of the project in 2016. In September, Papua New Guinea’s National Court dismissed a multi-billion-dollar class-action lawsuit against Rio Tinto.

20. Detour Lake

Stage: Operating

Rounding out our ranking is Agnico Eagle Mines’ Detour Lake project in Ontario with 15.8 million oz. of gold. Last year, Agnico Eagle updated its plans for the Detour Lake mine, including the preliminary economic assessment for underground development.

Be the first to comment on "RANKED: World’s 20 biggest gold projects"