Pure Gold Mining (TSXV: PGM; LSE: PUR) is placing its flagship PureGold mine in Red Lake, Ont., on care and maintenance, as the mine has yet to achieve the consistent cash flow needed to alleviate the company’s financial problems.

Currently, Pure Gold has a cash balance of around $2 million and a net working capital deficit of about $13 million, excluding amounts owing under the company’s debt obligations to Sprott Resource Lending Corp.

In its second quarter financial report, Pure Gold had booked an operating loss of $18.5 million despite a 30% reduction in costs compared to the first quarter. Net loss and comprehensive loss totalled $20.8 million. Both figures were higher than their comparative periods in 2021.

The miner had previously noted that it expected at least some additional funding in 2022 to come from the exercise of warrants issued in conjunction with its May 2022 financing. However, the warrants are currently priced to be exercised at 18¢ per share, and given current market conditions, it no longer expects to receive any proceeds from warrant exercises prior to their expiry on Nov. 25-27.

To date, none of the warrants have been exercised, and the company has so far been unable to obtain alternative outside financing in order to continue operations, complete its ongoing prefeasibility study and life-of-mine plan, and continue its ongoing strategic review process.

If additional outside financing is not obtained in the short term, Pure Gold says it will not be able to meet its debt obligations as they become due, which would result in a default.

Pure Gold has also withdrawn its production guidance for the fourth quarter of 2022, which was previously set at 9,000-12,500 oz. The company had achieved its third quarter guidance, producing just over 9,000 oz.

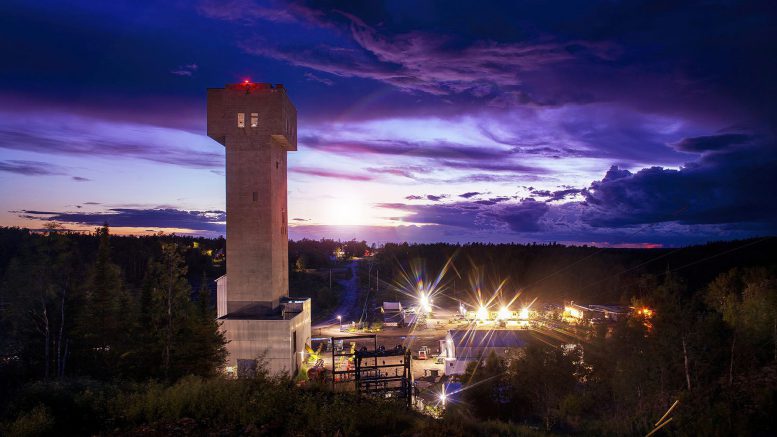

The PureGold mine, a historic producer formerly known as Madsen, first began production under Pure Gold in 2021 after the junior completed construction of an 800-tonne-per-day underground mine and processing facility.

Shares of Pure Gold Mining continued to plunge on the latest development. The stock crashed 83% to trade at 2¢ a share by 11:30 ET Monday, compared to a 52-week high of $1.08 on Nov, 12, 2021. The company’s market value now sits at $14.6 million.

Be the first to comment on "Pure Gold suspends operations at troubled Red Lake mine, stock plunges to 2¢"