Resource Capital Funds, a Denver-based private equity company focused on mining, is buying the rest of NorZinc (TSX: NZC) to boost its Prairie Creek zinc project in the Northwest Territories.

RCF will pay about $12.7 million for the 51.7% of NorZinc shares it doesn’t already own, and supply an additional US$11 million in credit for the project, the companies said in a statement this week. NorZinc will stop trading on the TSX.

“RCF is acquiring NorZinc to unlock potential synergies and opportunities presented by NorZinc’s Prairie Creek Project,” the companies said. “If the arrangement is completed, NorZinc will become a wholly-owned subsidiary of RCF.”

No completion date was given for the buyout. NorZinc and RCF couldn’t be reached immediately for comment on the deal.

The buyout comes after RCF provided NorZinc with $7.7 million of bridge financing in May and its working capital sank to a $2.2 million deficit by the end of June, according to NorZinc’s second-quarter filing. The company’s share price has declined from 7¢ a year ago to 3¢ yesterday.

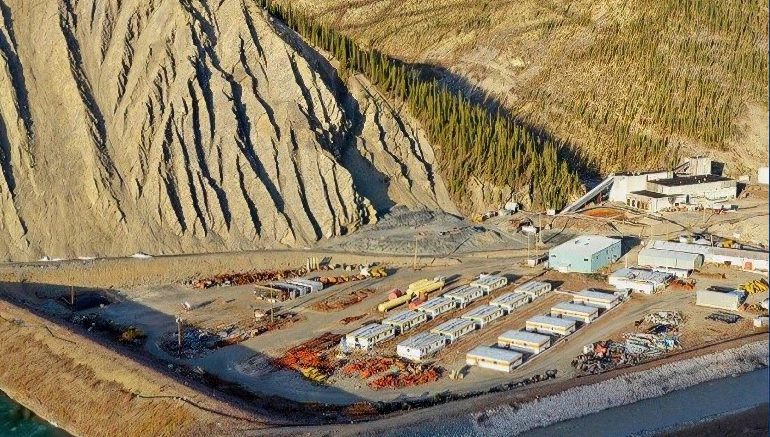

Some of the new funding will help build a winter road to the project about 200 km north of the British Columbia border in the Nahanni National Park Reserve in the territory’s west. The project is on the traditional lands of the Nahæâ Dehé Dene Band. Plans and permits for the road are to be completed by Oct. 31, the companies said.

Prairie Creek is forecast to have an after-tax net present value of US$299 million based on an 8% discount rate and a 20-year mine life, according to a preliminary economic assessment (PEA) from one year ago.

The initial pre-production capital cost is estimated at US$368 million and operating costs are forecast at US$167.50 per tonne of milled ore, the company said.

The project has measured and indicated resources of 9.8 million tonnes at an average grade of 139 grams per tonne silver, 9.7% zinc, for a zinc equivalent grade of 22.7% and 8.8% lead, according to NorZinc. There are 6.4 million tonnes of total inferred resources at 24.1% zinc equivalent, it said.

Prairie Creek is to produce about 118,400 tonnes of zinc equivalent per year including 2.6 million oz. of silver from 2,400 tonnes per day of ore over the two-decade mine life, the company said.

The PEA was based on prices per pound of US$1.20 for zinc and US$1.05 for lead, as well as US$24 per oz. silver.

The commodities closed Oct. 5 on the London Metals Exchange at US$2,989 per tonne zinc (or US$1.35 per lb.), US$1,876.25 per tonne lead (or US85¢ per lb.) and US$20.73 per oz. silver.

Be the first to comment on "Prairie Creek zinc project to get push from equity firm buyout of NorZinc"