Pilot, Nevada Sunrise jump on strong drill results

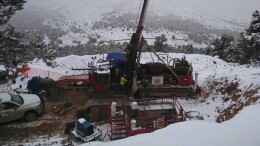

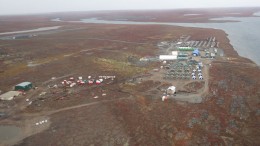

Shares in Pilot Gold (TSX: PLG; US-OTC: PLGTF) and Nevada Sunrise Gold (TSXV: NEV; US-OTC: NVSGF) got a welcome boost after solid drill results on their jointly held Kinsley Mountain gold project in Elko County, Nevada.