VANCOUVER — It took only $1.25 million and five months of drilling for Oroco Resource (OCO-V) to define a promising resource at its Cerro Prieto project in Sonora state, Mexico, and there is every indication the resource will continue to grow.

Oroco debuted on the TSX Venture Exchange in March, raising $4.4 million in its initial public offering. By late April, the junior had a drill turning at Cerro Prieto and by October, that diamond drill had completed 6,000 metres in 25 holes. Of those, 23 hit mineralization and two were stopped short due to poor ground conditions.

Now the company has an initial resource for the property. Within the 600 metres of strike length drilled to date, Cerro Prieto hosts 25.3 million indicated tonnes grading 0.52 gram gold per tonne, 8.6 grams silver, 0.34% lead and 1.02% zinc. Inferred resources stand at 4.7 million tonnes averaging 0.17 gram gold, 19.4 grams silver, 0.37% lead and 1.2% zinc.

“Yes, it does almost seem too good to be true,” says Ken Thorsen, Oroco’s president and CEO. “I’ve been in this business for a long time so I keep looking for problems, but I haven’t been able to figure out anything wrong with this one.”

Having Thorsen on watch is certainly a strong point for Oroco. He has 40 years of experience in the business, including 21 with Teck (TCK. B-T, TCK-N). In his last two years with Teck, Thorsen managed the major’s worldwide exploration efforts as president of Teck Exploration.

In its first drill program at Cerro Prieto, Oroco focused on drilling just 600 metres of strike to a maximum depth of 400 metres. One stepout hole, collared 300 metres north of the resource, also hit the mineralized zone, returning 2.8 grams gold and 51.5 grams silver over 8.7 metres true thickness. And trenching and mapping efforts have traced the zone for 1.25 km on surface.

Cerro Prieto hosts epithermal polymetallic mineralization within a major, northwest-southeast regional shear zone traceable for more than 10 km on surface. Oroco’s properties cover some 6.5 km of that distance– the 2.2sq.-km Cerro Prieto property is southeast of, and along strike, from the 25-sq.-km Cerro Prieto North property. The shear zone cuts all geological units, from Jurassic to Lower Tertiary in age, and contains hangingwall and footwall veins, secondary veins, and breccia and stringer zones across 10 to 50 metres width. Mineralization outcrops along the length of the shear zone.

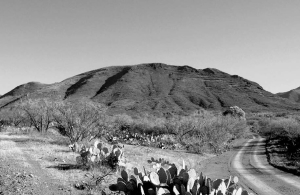

The resource defined to date sits in a sub-vertical zone dipping slightly to the east. It passes directly through a hill, even outcropping on the top of the hill. And mineralization appears to be oxide until roughly 400 metres; only the deepest drill hole hit a sulphide zone.

Oroco is now keen to expand the Cerro Prieto resource and is planning more drilling. The plan is to take 100-metre stepouts along strike to the north and south. The company will also conduct metallurgical and environmental studies, as well as more mapping and sampling.

Cerro Prieto was mined from 1906 until the Mexican Revolution in 1912. During its six years of operation, the mine produced 500 to 750 tonnes of ore each day grading about 15 grams gold and 50-60 grams silver.

A number of ownership factors prevented further mining or even significant exploration until 1998, when Morgain Minerals (now part of Castle Gold [CSG-V, CSGLF-O]) conducted a 23-hole drill program to define a historical resource covering 700 metres of strike. Despite promising results, the mining world’s turmoil and instability in the late 1990s forced Morgain to abandon the project, returning it to the individual who previously owned it.

Oroco, as a private company, signed an option on the property in late 2006. In March 2008, the company paid the rest of the US$2.5- million purchase price to own the property outright, minus a 2% net smelter royalty to the previous owner.

The property sits 135 km north of Hermosilla, on privately owned, uninhabited ranching land. The nearest community is 12 km south. Power lines and a paved road connecting to the state highway pass within 5 km of the Cerro Prieto property boundary and groundwater is available onsite year round.

Oroco’s resource estimate for Cerro Prieto failed to rouse investor attention; the company’s share price remained essentially unchanged and at presstime, still sat at around 17¢. Since March, Oroco has seen a share price range of 3-75¢. The company has 28 million shares outstanding, or 35 million fully diluted.

Be the first to comment on "Pace Pays Off With Rapid Resource For Oroco"