Vancouver-based junior Nicola Mining (TSXV: NIM) has finished a 39-hole, reverse-circulation drill program at its past-producing 100.8 sq. km New Craigmont copper property in south-central B.C.’s Nicola Valley, testing waste material at the project’s 3060-Portal.

Highlights from the program include 0.91% copper and 6.44% iron — or 1.08% copper equivalent — over 4 metres from surface, and 0.28% copper and 7.1% iron — or 0.47% copper equivalent — over 8 metres from surface. The company returned an average grade of 0.4% copper equivalent across all 39 drill holes. The grades do not include the impact of magnetite recovery. Preliminary metallurgical testing by Nicola has shown that magnetite at the project could increase copper equivalent grades up to 34%.

In total, the project hosts 80 million to 90 million tonnes of waste material piled in terraces. Nicola aims to define a resource from those waste piles this year. It says that the value of the historic terraces are significant, considering that costs of mining have already been paid.

“Over 60% of the cost of mining is mining,” Nicola Mining president and CEO Peter Espig says in an interview with The Northern Miner. “So if it’s in piles, you’ve mitigated your costs by 60%.

“The economic value of the terraces cannot be underrated.”

Located 14 km from the city of Merritt, B.C., the historic Craigmont copper mine was once the highest-grade major copper mine in North America, according to Espig. It operated from 1961 to 1982, producing close to 1 billion lb. copper grading 1.3% copper from its open pit, and more than 2.5% copper from its underground operation. It closed in 1982, when copper prices fell to US60¢ per lb. copper. At the time, the operator paid US61.5¢ per lb. copper to mine.

Management bought out the property, and by 1992 had begun producing magnetite from the historic tailings, although the claims remained split between as many as nine groups at any given time.

A former Goldman Sachs executive, Espig came out of retirement to help save Huldra Silver, which owned B.C.’s Treasure Island silver mine and had become distressed. Huldra owned 50% of the Craigmont claims. The other claims were at the time divided between six owners.

“You cannot run a company with seven decision makers,” Espig says.

Huldra became Nicola Mining.

The site produced magnetite until 2014, when Nicola asked the operator to stop. A year later, in November 2015, Nicola acquired 100% of the Craigmont claims.

“I hear this story a lot in mining: ‘We’ve got the best gold project in the world, we’ve got a million ounces, it’s grading like 10 grams and were raising $2 million. We got it from Group B, and Group B spent $10 million drilling, and we have all their results and they made a couple mistakes, and they got it from Group C, and Group C had it for 10 years, and so on. I hear that story a lot. And this is very different,” Espig says.

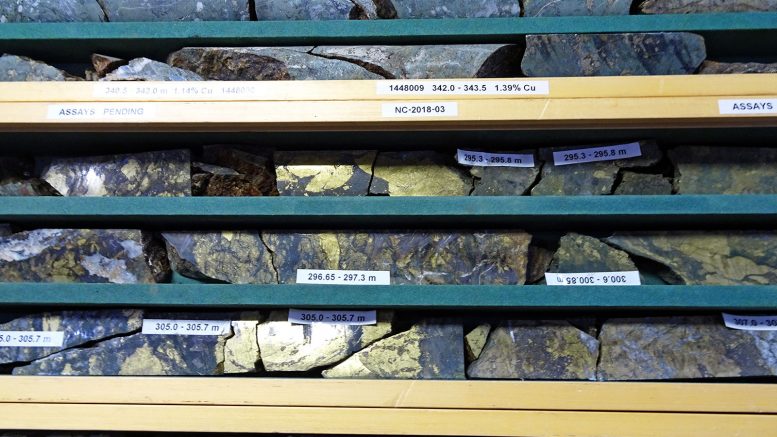

A core shack at Nicola’s New Craigmont copper property in British Columbia. Credit: Nicola Mining.

The project has a historic estimate of 50 million tonnes at 0.4% copper in a halo surrounding the underground orebody west of the historic pit. An exploratory hole the company drilled in 2018 targeting the northern extension of the halo confirmed the presence of a previously unexplored mineralized zone that falls within the company’s active mine permit. The hole — 18-2 — cut 1.05% copper over 74 metres from 228 metres downhole, including 2.22% copper over 31 metres from 267 metres downhole.

It was part of an eight-hole, 2,755-metre drill program Nicola conducted at the project’s Craigmont Central zone in 2018. Other intercepts from the program include 0.24% copper over 89 metres from 102 metres downhole, and 0.55% copper over 6 metres from 145 metres downhole.

“There were three questions we needed to understand when we acquired this property,” Espig says. “First: is there another skarn around there? Second: is this skarn driven by a porphyry system? And third: how much did they leave behind?

“We now know unequivocally that the skarn we have is a porphyry driven skarn, so we will drill some holes targeting the porphyry system this year.”

Nicola says it will likely resume drilling in May or June 2019. It expects to spend in excess of $1 million, and is engaged in discussions with potential strategic partners.

The company has targets for a separate skarn that it will look to drill as well. It aims to drill the halo, confirm the historic resource and hopefully expand it to 100 million tonnes.

To help fund more exploration at New Craigmont, Nicola is using its fully permitted Merritt mill and tailings storage facility, located 10 km northwest of the city of Merritt. The mill can produce free gold concentrate, gold flotation concentrate and silver concentrate.

It is the only facility permitted to process gold and silver from throughout British Columbia.

“When we got the permit to process — we didn’t apply for it, so I was confused,” Espig says. “The government said we need your site to be a facilitator for small projects in British Columbia.”

The mill was built in 2012 for $30 million: $8 million to zone the land for industrial use, $21.6 million for the mill and infrastructure, and $1.8 million for the construction of a tailings facility.

In 2016, the company spent $2 million on mill upgrades. The mill can now process between 200 and 300 tonnes per day.

The Merritt Mill property hosts an active gravel pit permitted for up to 60,000 tonnes per year and a $1.8-per-tonne tolling agreement with a local cement company.

Nicola has profit-share agreements with six gold projects in British Columbia. In 2016 and 2017, the company accepted material from Smithers and even from Vancouver Island for processing at its mill. The miner pays for the mining costs and to ship its material to the mill. Nicola pays for milling, and the cost to sell the concentrate. It reimburses itself and the miner, and splits the profit in half.

Nicola shares are trading at 10¢, in a 52-week range of 8¢ to 19¢. The company has a $24-million market capitalization.

It still owns the past-producing Treasure Mountain silver mine, and is looking at another acquisition.

“Without a doubt, New Craigmont will be a mine again some day,” Espig says.

“There aren’t many projects like us in the world. Yes, we are exploration, but we’re a fully permitted exploration site that could go back into mining very quickly.”

Be the first to comment on "Nicola drills at past-producing New Craigmont in BC"