Newmont Mining (TSX: NMC; NYSE: NEM) had a good year in 2013, but it’s bracing for challenges ahead.

The company produced 1.45 million oz. gold and 38 million lb. copper in the last quarter alone, which beats a 1.3 million oz. gold forecast by BMO Capital Markets analyst David Haughton, largely thanks to the Denver-based company’s Australian operations — Boddington, Jundee and Tanami.

Cash costs have not yet been disclosed, but Haughton expects them to be US$720 per oz.

Less impressive, however, was what Newmont has said about this year: production guidance for 2014 came in at 4.6 million to 4.9 million oz. gold and 195 million to 255 million lb. copper.

For gold, those numbers doesn’t compare well to the 5.07 million oz. it produced last year. The guidance also shows that Newmont will rely more on revenue from the red metal this year, as last year it produced just 144 million lb. copper. Both of last year’s gold and copper totals improved from the year before.

While Newmont’s 2014 copper guidance was in line with Haughton’s estimate it disappointed on gold, with BMO forecasting 5.2 million oz. gold production this year. The company also failed to impress on cash costs and capex.

“Cash costs guidance of US$740 to 790 per oz. was disappointing [at US$690 per oz. gold]. Capex guidance of US$1.3 billion to US$1.4 billion was well below the US$2.2-billion forecast, with slower development of key projects now anticipated,” Haughton said in his research note.

In an industry environment where constrained balance sheets have led to reduced capex, investors may also wonder about the continuance of the company’s dividend. Newmont said it would update its dividend policy, which allows for US$300 million in cash distribution to shareholders per year, at a later date.

“A revision downwards to relieve cash-flow pressure seems likely,” Haughton wrote.

CIBC analyst Alec Kodatsky echoed such concerns.

“Given 2014 cost expectations, Newmont’s margins look skinny at current gold prices, leading investors to question the sustainability of the dividend policy and what other steps may be taken to preserve the investment-grade rating,” Kodatsky writes in his research note. “We expect more on this with the year-end results.”

CIBC rates Newmont’s stock as a “sector underperform” with a US$27 target price, down from US$30.

The anticipated drop in gold production will largely stem from weaker production from its operations in Nevada and its Ahafo gold mine in Ghana.

In Nevada production at both the Carlin and Twin Creeks mines are entering a temporary period of lower grades. Those lower grades coincide with the loss of ounces from the Midas mine, which is also in Nevada, as it has been sold to Klondex Mines (TSX: KDX) in a deal that is expected to close in the coming weeks.

Newmont doesn’t report production totals specifically from Midas since it blends ores from different sites to take advantage of regional synergies. In an email to the Northern Miner, however, Newmont’s executive of corporate communications Omar Jabara did offer some insight.

“Currently, an estimated 10 ounces of silver are recovered with every ounce of gold that comes from Midas,” Jabara wrote. “The Midas Mill processes approximately 45 tons of ore material per hour and delivers a gold recovery rate of about 92%.”

Jabara also noted that Newmont does expect production totals to come back up in 2015 largely thanks to the expected completion of the Turf vent shaft in Nevada, which is expected to add 100,000 to 150,000 oz. of gold production beginning in late 2015.

Newmont president and CEO Gary Goldberg, speaking on a conference call, offered some insight into the situation at its Ahafo gold mine in Ghana. He said the next two years would bring reduced grades and increased stripping, and that the company is re-evaluating its mine plan there.

Those reductions at Afaho, however, are expected to be offset by new gold production from its Aykem mine, which is also in Ghana.

Still the poor guidance for this year was a factor in Scotiabank analyst Tanya Jakusconek cutting her target for the company’s stock by $6 to $25.50 per share. The stock is rated as a “sector perform.”

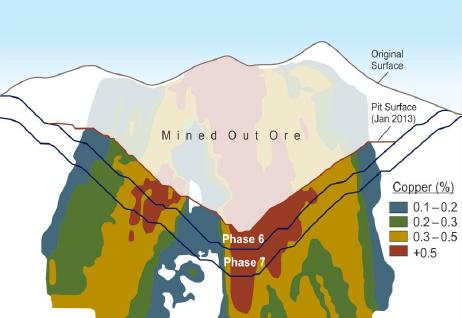

And looking beyond the weak 2014 outlook, Jakusconek pointed to uncertainty at its Batu Hijau mine in Indonesia as another cause for concern.

On that front, Goldberg said the company is in talks with the Indonesian government regarding the export ban for unprocessed minerals produced in the country. These measures are being taken to encourage downstream metal production within Indonesia.

While an outright ban on exporting copper concentrate has been postponed until 2017, Goldberg says export restrictions and escalating tax increases are posing a problem.

“We understand the government’s aspiration to derive the most value possible from natural resources, but we believe these proposed regulations will have the opposite effect,” Goldberg said.

He pointed out that more than 95% of the copper value Newmont mines in Indonesia is realized within the country.

And while the company would prefer a mutual resolution, Goldberg said it would consider other remedies, including legal action.

“We don’t have an export licence from the government,” he said. “So right now, unless we get it, we’re in a position over the next couple of months to curtail operations.”

Be the first to comment on "Newmont sees rough road this year"