First Quantum Minerals (TSX: FM; LSE: FQM) management says it could have a buyer for any nickel produced from a restart of the venerable Ravensthorpe nickel-cobalt mine at Bandalup Hill in Western Australia, but on a second-quarter earnings call, the company’s CEO, Philip Pascall, was vague about who that buyer might be.

Pascall cited increasing interest from a “not Congo source” that wants a “strategic source” of nickel.

“The cost to bring [Ravensthorpe] back into production is very modest because of the work we’ve done sustaining it.”

Philip Pascall

CEO, First Quantum Minerals

After being peppered with questions regarding Ravensthorpe from seemingly surprised analysts, Pascall said: “[The proposed buyer] would want to see it operating. The production level is … something over 20,000 tonnes for next year. But the actual start date at the moment is going to move up or down a month or two.”

He added that Ravensthorpe could provide the company with a “break-even contribution” down to and even below $5 per lb. nickel.

In October 2017, when Ravensthorpe was placed on care and maintenance, nickel was trading at US$5 per pound. By press time, nickel had climbed to US$7.94 per pound.

A few months earlier, in the management discussion and analysis notes published with the company’s 2019 first-quarter results, First Quantum management had hinted at a Ravensthorpe restart: “Ravensthorpe remains on care and maintenance throughout the quarter … if market conditions continue, it is expected that operations could resume in the first quarter of 2020.”

“It’s interesting because in the [first-quarter conference call] transcript they did talk about how Ravensthorpe was not economic at current prices. So that would have been April. And since then we haven’t seen a meaningful enough improvement in nickel or cobalt prices,” Jackie Przybylowski, a metals and mining analyst with BMO Capital Markets, said in an interview in mid-August. “It surprised me that the language had been strengthened on [restarting] Ravensthorpe.”

In Przybylowski’s model, it would cost First Quantum $30 million to restart Ravensthorpe, and it wouldn’t happen until 2021. At that point, Przybylowski suggested the mine could produce 25,000 tonnes nickel annually in its first year, and climb modestly from there to peak at 30,000 tonnes.

Various attempts to ask First Quantum about time lines for a Ravensthorpe restart went unanswered.

Care and maintenance costs at Ravensthorpe in the first quarter were US$4 million. The company reported that contractor and maintenance costs were higher than expected due to repairs in the processing plant.

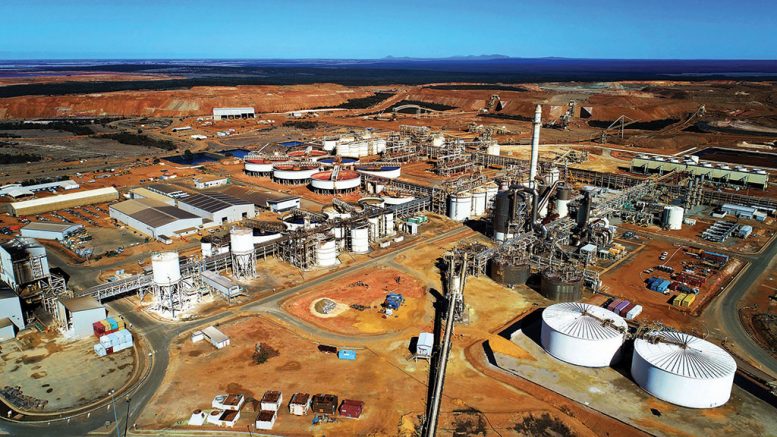

After the global economic downturn and ongoing ore processing problems, BHP Group (NYSE: BHP; LON: BLT) sold Ravensthorpe to First Quantum in December 2009. First Quantum rebuilt the processing circuit and recommissioned the plant 18 months later.

Primary crushers and a conveyor at First Quantum Minerals’ Cobre Panama copper mine under construction in Panama. Credit: First Quantum Minerals.

Ravensthorpe consists of five deposits: Halley’s, Hale–Bopp, Shoemaker–Levy, Nindilbillup and Shoemaker–Levy North. The operation has proven and probable reserves of 197 million tonnes grading 0.6% nickel and 0.03% cobalt.

Meanwhile, capital costs at First Quantum’s Cobre Panama copper-gold mine in Colon province, Panama, have soared to US$6.7 billion — up from an earlier estimate of US$6.3 billion — as production ramps up at the massive pit.

The added capital will be spent on changes to the tailings management facility, measures to accelerate commissioning, and on more mining trucks. The company says there will be no further increases in capital costs.

“Definitely a high level of confidence from my side. The risk level is dropping extremely quickly because we’re going down to a low level of construction and remaining commissioning,” said Zenon Wozniak, director of projects, during the conference call.

Six of the eight ball mills at Cobre Panama were operating by the end of June. Another mill starts in the third quarter, while the final ball mill is scheduled to operate early in the fourth quarter.

Cobre Panama reached pre-commercial production of 30,896 tonnes copper in the second quarter, and the mine is on track to produce somewhere in its prescribed guidance of between 140,000 and 175,000 tonnes copper in 2019. The first copper concentrate was shipped in June.

“[Cobre Panama] is going be a world-class mine. It’s going to be a major producer … it’s very difficult to ramp up a project of that scale,” Przybylowski said.

Przybylowski’s model suggests Cobre Panama will reach its boilerplate capacity of 100 million tonnes annually by mid-2024. BMO expects the mine to reach 82 million tonnes throughput in 2020, and 85 million tonnes a year later.

Once Cobre Panama is up and running, First Quantum says it will take three years to rebuild its balance sheet before taking on another major project.

Many believe that the next mine could be the Taca Taca copper-gold-molybdenum porphyry deposit in Argentina’s Salta province. Przybylowski remains unconvinced, given the recent instability there.

“Today [Argentina] looks like a much higher-risk place to do business,” Przybylowski said.

First Quantum owns Taca Taca through its Argentine subsidiary CASA. The company acquired the project when it bought Lumina Copper in August 2014.

The other development option for First Quantum is the Haquira copper project, situated between the provinces of Cotabambas and Grau in southern Peru. Minera Antares Peru, a wholly owned subsidiary, will spend US$17.7 million this year to drill Haquira and move it closer to the feasibility stage.

Haquira was acquired when First Quantum bought Antares Minerals in 2010.

Elsewhere, First Quantum’s wholly owned subsidiary, Kalumbila Minerals, has settled a US$7-billion duties dispute with the Zambian Revenue Authority (ZRA). The company deemed the settlement as immaterial, but did not disclose the settlement amount.

Przybylowski saidthe dispute is in the past, and does not expect that unpaid duties will escalate to this level going forward. “We have seen the Zambian Revenue Authority engaging with the company and working to resolve issues on both the duties dispute and on the VAT tax implementation, which is a positive signal,” she said.

The Zambian government also plans to replace its VAT tax with a goods and services tax, beginning in September. First Quantum expects that the tax will impact cash costs at the Zambia mines to the tune of 7¢ per lb. in 2019, and 15¢ to 18¢ in 2020. The changes are under review by the ZRA.

First Quantum generated net earnings of $78 million in the second quarter, or 11¢ per share, and ended the quarter with $802 million in cash and equivalents. The company also declared a dividend of 0.5¢ per share.

BMO Capital Markets has an “outperform” rating on First Quantum with a 12-month target price of $15, down $2 since April.

First Quantum has 689 million shares outstanding and trades in a 52-week range of $8.30 to $18.49.

—Brian Sylvester is a Toronto-based freelance writer.

Be the first to comment on "Mystery nickel buyer could restart First Quantum’s Ravensthorpe"