Montage Gold’s (TSXV: MAU; US-OTC: MAUTF) updated resource estimate for its Koné gold project in Ivory Coast increases the tonnage, grade and potential output by adding a new deposit.

The project, estimated last year to generate a 35% internal rate of return, hosts 237 million indicated tonnes grading 0.63 gram gold per tonne for 4.8 million oz. contained metal, the Toronto-based company said on Thursday. It has 22 million inferred tonnes grading 0.5 gram gold for 320,000 oz. gold.

That compares with 225 million indicated tonnes grading 0.59 gram gold for 4.3 million oz. gold in an April 2022 prefeasibility study that had the same inferred amounts.

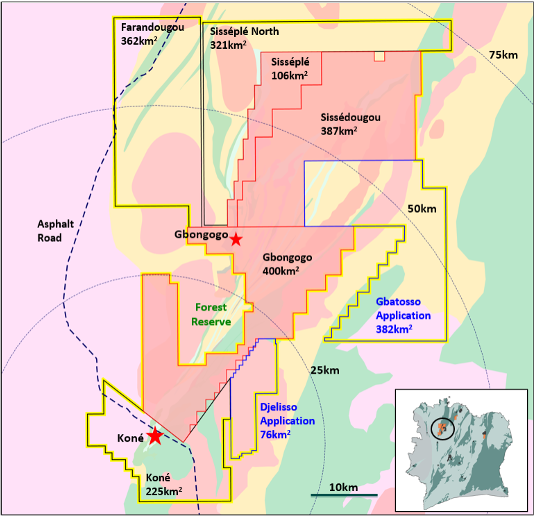

The difference is the addition of the Gbongogo Main deposit of 12 million indicated tonnes grading 1.45 grams gold for 560,000 oz., Montage said.

“We are very pleased with the successful conversion of Gbongogo Main resources from inferred to indicated and the 10% increase in grade and that has the potential to translate well into the updated feasibility study,” CEO Mike Clark said in a release. “We are confident that we can add further high-grade ounces.”

Montage says it plans to update the feasibility study with a new resource and file an environmental and social impact assessment by year’s end before a development decision in early 2024. It’s continuing to drill this year.

The open-pit project would cost US$544 million to build and have all-in sustaining costs of US$933 per payable oz., according to the 2022 study.

Koné has an after-tax net present value of US$746 million at a 5% discount rate based on a US$1,600 per oz. gold price, the study showed. The mine would produce 3.1 million oz. of gold over a 14.8-year mine life with annual output of 257,000 oz. in first nine years.

The junior has set up a corporate office in Toronto and hired HCF International Advisors to help raise money starting this year. Montage says it will engage with commercial banks in Africa and elsewhere, private debt and equity funds as well as streaming and royalty companies. It plans to announce project financing next year.

The company has hired Mike Robinson to manage Montage in Ivory Coast. Robinson is the former Mauritania manager for Red Back Mining, now part of Kinross Gold (TSX: K, NYSE: KGC), who oversaw development and expansion of its Tasiast gold project.

Be the first to comment on "Montage Gold boosts high-return Ivory Coast project with higher-grade zone "