Eight bidders have been shortlisted for Mongolia’s massive Tavan Tolgoi coking coal project just weeks after Mongolians watched their government on national television sign a long-awaited investment agreement on the Oyu Tolgoi copper-gold project with Rio Tinto (RTP-N, RIO-L) and Ivanhoe Mines (IVN-T, IVN-N).

BHP Billiton (BHP-N, BLT-L), Vale (VALE-N), U. S. coal giant Peabody Energy (BTU-N), India’s Jindal Group and China’s Shenhua Group are all on the list, as well as South Korea’s COPEC consortium, a group of Japanese companies and a Russian consortium including Gazprom and Renova, according to Reuters news agency.

News of progress on Tavan Tolgoi underscores that the Mongolian government is starting to get serious about developing its fledgling mining industry and moving ahead with important projects that will expand and diversify the country’s largely agrarian-based economy.

“Since the formation of a coalition government in late 2007, there is clear evidence of political unanimity towards securing the rapid monetization of Mongolia’s unique endowment of mineral resources,” John Finigan, chief executive of the Golomt Bank of Mongolia, the country’s largest private and commercial bank, wrote in an email response to The Northern Miner’s questions.

Finigan notes that Mongolia is moving “progressively but prudently” towards developing the sector but is mindful of avoiding the “resource curse” that has afflicted so many developing nations with lucrative extractive industries.

“It is already addressing both fiscal stringency legislation, as well as the establishment of a sovereign wealth fund to secure intra-generational transfer of the revenue stream,” he explains. “It is noteworthy that in adopting such mercantilist policies, the government is graduating from its longstanding reliance upon the donor community and multilateral agencies.”

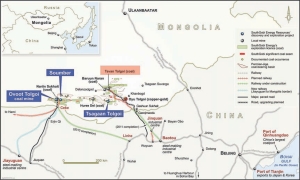

Tavan Tolgoi, one of the world’s largest undeveloped coal fields, lies 250 km from the Chinese border and 540 km from Mongolia’s capital, Ulaanbaatar. The deposit holds estimated reserves of 6.5 billion tonnes of metallurgical and thermal- grade coal. Mongolia has hired JPMorgan and Deutsche Bank to sell up to a 49% stake in the project.

“There are feasibilities to be clarified (and) options such as to divide the deposits into two to three blocks,” Temuulen Ganzorig, deputy director of state-owned Erdenes MGL, told journalists on the sidelines of a conference in Beijing, Reuters reported. (Erdenes is expected to hold at least 51% of the equity in the Tavan Tolgoi project.)

In contrast to the highly complex block-cave mining techniques that will be used at the Oyu Tolgoi mine, Tavan Tolgoi will be an open-pit mine that won’t be technologically complex, Finigan points out. As a result, splitting it up into two or three different blocks could make sense.

“A sound case can be made on each of technical, economic and geostrategic grounds for its subdivision into a number of operating licences so as to optimize the revenue and non-revenue benefits,” he says.

But selecting partners will be the tricky part.

“Identifying interested bidders is just the first step for the government,” comments a Mongolian executive working for a gold exploration company. “Selecting two or three of them will be a major headache because of geopolitics and the dilemma of each bidder sweet talking (the government). In my opinion, the frontrunners would be Peabody, Shenhua, BHP Billiton and the Russian consortium.”

The UB Post, Mongolia’s Englishlanguage daily newspaper, argues that the Russian consortium is the leading contender. In a Sept. 18 article, the newspaper maintained that Russia’s state-owned railway company, RZD, would probably get the partnership in return for its planned investment in Mongolia’s national rail system. The mining licence would then be transferred to a Russian company with the capacity to develop the deposit.

In May, RZD reportedly signed a joint venture (called Infrastructure Development) with Mongolian Railways and Erdenes, to invest a total of about US$1.8 million in upgrading the country’s rail network and lay new rail lines to mineral deposits in the country. RZD holds 50% of the joint venture.

Others aren’t as convinced the Russian consortium can bring home the deal.

“The Russians are being the most overtly aggressive — but that doesn’t necessarily clinch it,” mused one mining executive familiar with the country. “The Russians want to build an east-west railway, but China is building a new railway up to the border and Mongolia has the Germans working on the design of a north-south link in Mongolia that would serve Tavan Tolgoi and Oyu Tolgoi and hook up with the new Chinese line at the border. Who knows? There are lots of plays to watch.”

Keeping the Chinese happy certainly would make good geopolitical sense — but Mongolia has always had a fragile relationship with Beijing and would not necessarily want to give the Chinese too much power over its economy. “There is much rivalry going on and I hear the Chinese government has now given Mongolia favoured investment-destination status,” notes a foreign mining executive with exploration projects in the country. “The government wants to balance the equity stakes and not give Shenhua control.”

What is clear, however, is that with movement on Oyu Tolgoi and now Tavan Tolgoi, investment confidence in Mongolia is starting to pick up again. Since the beginning of September, Brian Thornton, chairman of Australian explorer Xanadu Mines says he has started three field programs, including drilling on copper and gold — after spending only what was required to maintain the company’s licences in good standing during the 2008 and 2009 exploration periods. “This is a direct result of renewed confidence post (Oyu Tolgoi),” he says. “Without doubt, (Oyu Tolgoi) has been the prism through which all investors around the world have viewed the Mongolian opportunity; without its approval, it was going to be impossible to build a case to invest in the country and I think investors were telling them this.”

Confidence surged again most recently on Oct. 26, with the announcement by Entree Gold (ETG-T, EGI-X) that the Mineral Resources Authority of Mongolia had approved mining licences for the company’s Shivee Tolgoi and Javhlant exploration concessions. The mining licences have a 30- year term with two renewals possible of 20 years each.

Shivee Tolgoi and Javhlant completely surround the Oyu Tolgoi mining licence. The eastern portion of the Shivee Tolgoi licence and the entire Javhlant licence are subject to a joint venture with Ivanhoe Mines.

More progress is likely to follow, predicts Golomt Bank’s Finigan. “The underlying development momentum will continue to accelerate with a consistent rollout of new projects in such vital sectors as uranium and rare earth elements now that the underlying contractual and operating framework is in place.”

Be the first to comment on "Mongolia Serious About Mining"