Canadian explorer Midnight Sun Mining (TSX-V: MMA; US-OTC: MDNGF) just released an initial resource in the heart of the Zambian-Congo Copperbelt, an area that’s attracting Cold War-style financing competition to speed the record-price red metal to market.

The junior reported Jan. 20 that its Kazhiba deposit, a small part of its Solwezi project’s Dome Region shallow copper system, holds 2.33 million indicated tonnes grading 1.41% copper for contained copper of 72.4 million pounds.

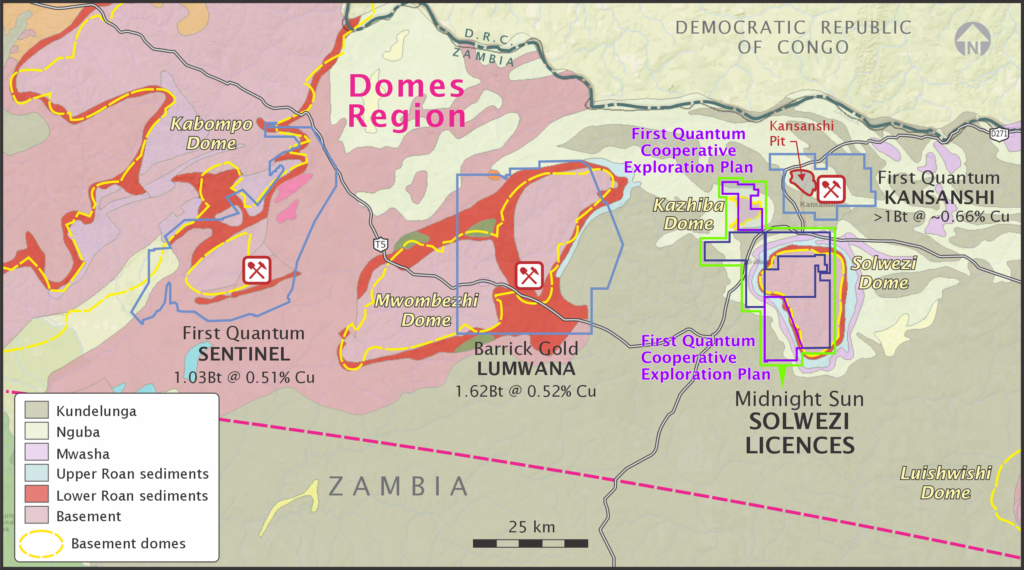

It’s a tiny package so far, but it’s in the belt ranking second-largest in global copper output and reserves, trailing only Chile. First Quantum Minerals (TSX: FM) has the Kansanshi mine next door and Sentinel further away. Barrick Mining (TSX: ABX; NYSE: B) operates Lumwana to the west, and Ivanhoe Mines (TSX: IVN; US-OTC: IVPAF) partners with China’s Zijin Mining to run the Kamoa-Kakula complex north of the border in the Democratic Republic of Congo (DRC).

With spot copper prices rising to all-time highs – more than $6 a lb. before the early February sell off — Midnight Sun President and CEO Al Fabbro says the company’s timing is right to sell Kazhiba copper to pay for drilling on the more promising 20-km long Dumbwa deposit nearby.

“We secured absolutely critical ground at the heart of what is now emerging as one of the world’s premier copper districts, ground that today would be virtually impossible for anyone but a major to acquire,” Fabbro told The Northern Miner by email. “It’s ground now at the centre of a geopolitical tug-of-war between the U.S. and China as they compete for access to this vital copper supply.”

Lobito Corridor

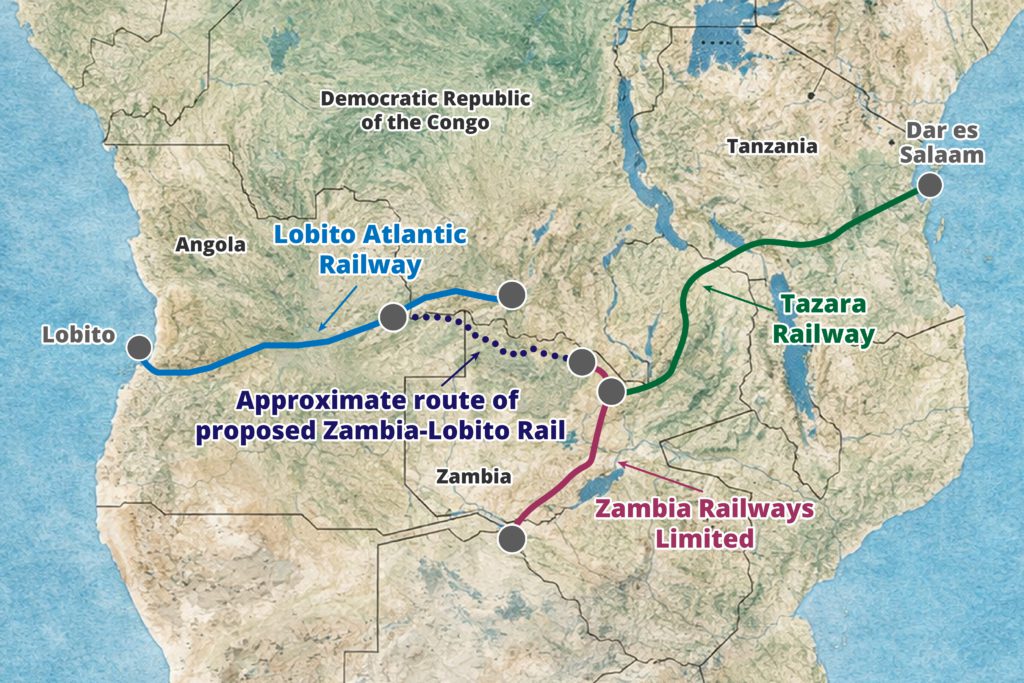

At the heart of that contest is Angola’s Lobito Corridor, a $2.1-billion Western-backed effort to upgrade a railway into a major Atlantic export route for copper and other critical minerals by extending it into Zambia and the DRC. Meantime, China is financing a separate eastward rail link to the Indian Ocean via Tanzania.

Perhaps ironically, it was China that first rehabilitated the colonial-era Benguela railway in Angola after a decades-old civil war ended in 2002. That work was initially completed around 2017 but in recent years the U.S. has seen refurbishing the corridor as a means to chip away at China’s inroads in Africa through infrastructure building.

“The growing global demand for critical minerals and the desire to limit Western dependence on China’s critical mineral supply chains have spurred greater levels of U.S. and European engagement in Africa’s mining sectors,” notes the South African Institute of International Affairs in a January report.

“Examples of such initiatives are the Lobito Corridor and support for a 2023 Memorandum of Understanding on a Zambia–Democratic Republic of Congo battery value chain,” institute authors Yaseen Tayob and Adrian Joseph write.

$553M US loan

The backbone of the plan is a $553-million loan from the U.S. International Development Finance Corp. to the Lobito Atlantic Railway consortium to rehabilitate roughly 1,300 km of track across Angola and upgrade port facilities at Lobito.

Multilateral lenders the Abidjan, Cote d’Ivoire-based African Development Bank and the Africa Finance Corp. in Lagos, Nigeria are financing $1.6 billion to upgrade the Angolan rail system and build new links into the copperbelt. For miners in the region – First Quantum, Barrick and billionaire Robert Friedland-backed Ivanhoe – the attraction is a shorter, westward route to Atlantic markets.

China has spun the other way, reviving and modernizing the long-neglected Tanzania–Zambia Railway Authority line, which runs from the Copperbelt to the port of Dar es Salaam, under a deal valued at about $1.4 billion. That eastward corridor offers a direct outlet to Indian Ocean shipping lanes and Asian markets, and has long been the traditional route for much of the region’s copper.

The two builds are a rare case of competing, geopolitically-charged infrastructure strategies playing out over the same mineral district. Western governments are promoting Lobito as part of a broader effort to “de-risk” critical minerals supply chains, while China is upgrading a transport axis it originally helped build in the 1970s.

China’s investment

The Asian giant’s foreign direct investment in the continent’s mining and processing was about $10 billion in 2022, second to construction and nearly a quarter of its total spending in Africa, according to the SAIIA.

“Between 2019 and 2024, China increased its ownership of Africa’s mines by 21%, while companies from Australia, Canada and the U.S. saw decreases in their mine ownership during the same period,” the institute said. “Its involvement in Africa’s mining sector is thus substantial and it is a major player in many resource-rich African countries.”

Copper is China’s main focus in Africa, accounting for 35% of the country’s investment in non-energy mining across the continent. Aluminum was second with 20% then iron at 15%. The country’s main producer in Africa is its 40% share of Kamoa-Kakula. The mine produced 388,000 tonnes of copper concentrate last year on its way to 550,000 tonnes by about 2028.

In comparison, First Quantum reported 370,000 tonnes from Kansanshi/Sentinel in 2025 and is aiming for roughly 430,000–490,000 tonnes in 2028. Barrick’s Lumwana was on pace for 145,000 tonnes last year as its Super Pit expansion promises 240,000 tonnes by 2028.

Drilling Dumbwa

Midnight Sun hired Barrick’s architect behind the Lumwana resource – 1.6 billion tonnes grading 0.52% copper for 8.3 million tonnes contained metal – that’s fuelling the Super Pit. Kevin Bonel is now Midnight Sun’s chief operating officer as the company deploys six rigs to drill along Dumbwa, a 20-km anomaly that shows 0.73% copper at surface, said Adrian O’Brien, vice-president of corporate development and communications. The plan is to have the first 12 km assayed by the end of this year.

“Kevin ended up leaving his job at Barrick and joining us because he believed so wholeheartedly that Dumbwa was bigger than Lumwana,” O’Brien said by phone. “He brought that exact same methodology.”

Midnight Sun sees the small Kazhiba deposit’s value as a cash generator. Since it’s less than 10 km from First Quantum’s mill, it can pay for advancing the wider Solwezi with the goal one day of rivalling major neighbours in resources.

Haywood analysis

Kazhiba’s “grade is well above typical economic thresholds for oxide copper,” Haywood Securities mining analyst Pierre Vaillancourt said in a Jan. 20 note. It has “mineralization extending to an average maximum depth of only 30 metres within a compact footprint (300 metres x 350 metres), making it very accessible for potential extraction.”

Midnight Sun’s share price fell 8% after the resource to $1.51 apiece, valuing the company at C$$321 million (US$234 million). The market expected a copper grade of 2-3% based on guidance from the explorer, but Haywood’s Vaillancourt said the reaction was overdone.

The junior has formed a technical alliance with First Quantum which is helping with metallurgy. Longer term, the plan is to sell the project, O’Brien said.

“We’re not operators, we’re explorers,” he said. “First Quantum has got a new circuit there. It’s hungry, looking for feed. We could have an absolutely perfect situation.”

Midnight Sun started in the district more than 12 years ago when copper prices and investor interest were low, noted CEO Fabbro.

“We stayed the course, and today Midnight Sun is advancing a high-impact discovery at Dumbwa with the potential to become the next major Domes Region deposit during the strongest copper market the world has ever seen,” he said. “That’s timing.”

Be the first to comment on "Midnight Sun rises on Zambia-DRC copper district where superpowers converge "