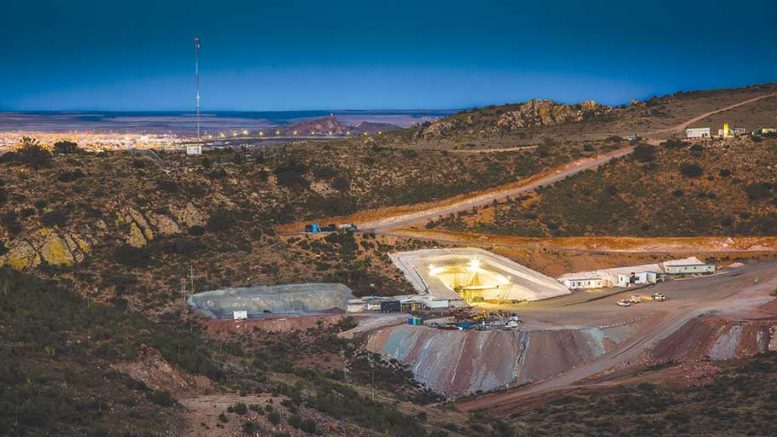

BEAVER CREEK, COLORADO — Development is well underway at MAG Silver’s (TSX: MAG; NYSE-AM: MAG) 44%-owned underground Juanicipio silver mine in the Fresnillo district of Zacatecas, Mexico, where it aims to start production by mid-2020.

The company was one of more than 150 that recently attended this year’s Precious Metals Summit in Beaver Creek, Colo., where it presented confidently on its project.

“As always we’re very proud of our forward-looking statements disclaimer,” MAG Silver chief exploration officer Peter Megaw said to kick off his presentation. “We’ve got 15 years of turning forward-looking statements into history. That doesn’t necessarily mean that past performance is an indicator of future performance, but we really like this property, and think we have some pretty good potential.”

The company is progressing both underground and surface infrastructure at Juanicipio. It has spent the past eight months pulling about a million tonnes of waste rock out of the ground that it will use as backfill in the eighth year of the mine’s life.

Current development at the project includes advancing footwall ramps, building the underground crushing chamber, and extending the conveyor ramp to the planned mill site.

It advanced underground development more than 3,600 metres in the first half of 2018, which accounts for nearly a quarter of the underground development the company has completed. Its ramp is now 16 km long.

“It looks like a Cadillac, but it’s being built for Volkswagen prices,” Megaw says. “This is costing us about US$1,700 per metre. That’s one of the things that having a partner like Fresnillo can do for you.”

MAG came together with Fresnillo (LON: FRES; US-OTC: FNLPF) to form the 44–56 joint venture company Minera Juanicipio. As operator, Fresnillo is carrying out exploration and development at the property.

Underground at Fresnillo and MAG Silver’s Juanicipio silver mine in Mexico. Credit: MAG Silver.

MAG must deliver a feasibility study for the project before Minera Juanicipio shareholders can approve it. MAG commissioned the study in 2017, and says it is still under review by both joint-venture partners.

MAG tabled a preliminary economic assessment for the project in 2017, highlighted by a US$1.14-billion, after-tax net present value at a 5% discount rate and 44.5% after-tax internal rate of return. According to the study, it would require US$360 million in pre-production capital, achieving payback less than two years after start-up. With US$5.02 all-in sustaining costs per ounce silver produced, the project would process 4,000 tonnes per day over 19 years.

The project sits in the middle of the Fresnillo silver trend. According to Megaw, 10% of all silver mined in human history comes from this trend.

Within that, the company is focused on the Valdecanas vein, which extends into Fresnillo’s neighbouring wholly owned property. Megaw says Fresnillo has been mining the same vein for the past three years and has optimized the required metallurgy.

“They’ve taken their mill from 3,000 to 6,000 to 8,700 tonnes per day,” he says. “We are building a new mill, 100% stand-alone. We’ll have the MK III version of this mill.”

Meanwhile, the company continues to explore the project’s Deep zone, trying to both extend mineralization along strike and at depth, and convert inferred resources to the indicated category. The company is also drilling the western extension of its Juanicipio vein, as it pursues other targets on the property.

The company has divided its resource into two zones: Bonanza and Deep. Bonanza averages 550 grams per tonne silver, while Deep averages 150 grams silver. Deep, however, grades 7.5% zinc and lead to Bonanza’s 4.5% zinc and lead. Both zones average 1.5 grams gold. Bonanza is narrower and slightly shorter.

Together, the two zones contain 12.83 million indicated tonnes grading 427 grams silver, 2.1 grams gold, 2.1% lead, 3.7% zinc and 0.1% copper for 176 million oz. silver, 867,000 oz. gold, 598 million lb. lead, 1.04 billion lb. zinc and 38 million lb. copper.

They also contain 12.1 million inferred tonnes grading 232 grams silver, 1.4 grams gold, 2.5% lead, 4.7% zinc and 0.3% copper for 91 million oz. silver, 562,000 oz. gold, 658 million lb. lead, 1.25 billion lb. zinc and 71 million lb. copper.

The company has not included copper into any of its economic projections because it has not yet completed metallurgical studies on the copper content.

However, Megaw says the copper is coarse grained and that the company can recover it effectively.

“MAG is in a very good market position in the sense that we made our discovery very early in our corporate existence,” he says. “So we’ve been able to keep our share count down — only 85 million shares issued and outstanding.”

Shares of MAG Silver are trading at $9.94 within a 52-week range of $9.24 to $15.97. The company has an $869-million market capitalization.

With US$151 million in the bank and no debt, Megaw says the company is fully financed for at least the next year and a half. About 85% of its shareholders are institutional.

“MAG Silver started 15 years ago looking for high-grade, high IRR, district-scale properties,” Megaw says. “The idea is to have properties that will make money under any market conditions and big enough to survive at least two market cycles. We think we’re comfortably in that position.”

Be the first to comment on "MAG Silver extends underground infrastructure at Juanicipio"