Lithium Ionic (TSX-V: LTH; US-OTC: LTHCF) said a definitive feasibility study for its Bandeira project in eastern Brazil shows higher returns, lower capital costs and a longer mine life than prior calculations. The stock rose.

Thanks to increased reserves and an optimized mine design, Bandeira is now projected to deliver a post-tax net present value of $1.45 billion (C$2 billion) instead of the $1.31 billion estimated by a May 2024 study, Lithium Ionic said Wednesday in a statement. The project’s internal rate of return climbs to 61% from 40% while the payback period shrinks to 2.2 years from 3.4 years.

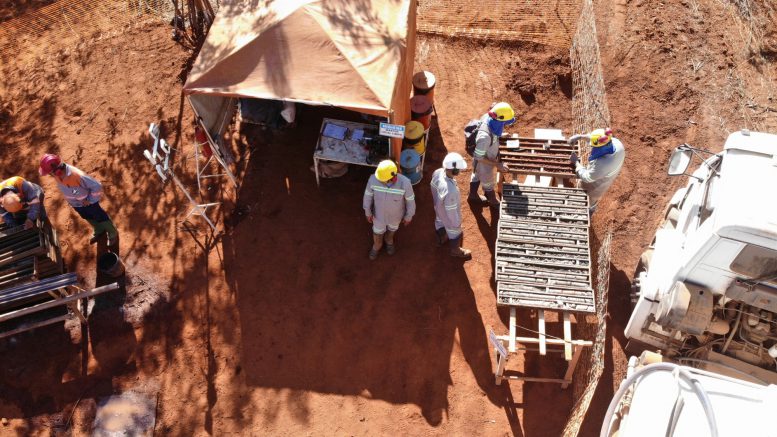

News of the improved economics comes about four months after Lithium Ionic lifted the project’s contained resources by about one-third over the 2024 study. Located in Minas Gerais state, Bandeira sits about 1,000 km north of Rio de Janeiro. Production is expected to start in the second half of next year, according to a presentation posted on the company’s website.

“What was already a robust project is now even stronger – delivering a longer mine life, lower capital requirements and significantly improved project economics,” CEO Blake Hylands said in a statement. “These results reinforce Bandeira’s position as one of the most competitive hard-rock lithium projects globally.”

Lithium Ionic shares advanced 3.8% to 82¢ Wednesday morning in Toronto, giving the company a market value of about C$130 million ($94 million). The stock has traded between 50¢ and C$1.15 in the past year.

First quartile

Capital expenditures – including contingency – are now estimated at $191 million, 28% less than the $266 million calculated earlier. Operating expenses are pegged at $378 per tonne of spodumene concentrate, which the company says would put the project in the first quartile of global lithium production costs.

Bandeira is projected to operate for 18.5 years, up from 14 years in the prior study. Annual spodumene concentrate output should average 177,000 tonnes over the mine’s life, the company says.

Measured and indicated resources now total 27.27 million tonnes grading 1.34% lithium oxide (Li₂O) for 901,059 tonnes of lithium carbonate equivalent (LCE), compared with the 696,520 contained tonnes in last year’s study, the company said May 6. Inferred resources for the project logged a slight 1.9% increase to 18.55 million tonnes at 1.34% Li₂O, or 615,432 contained tonnes of LCE.

The project claims sit across 1.6 sq. km, representing about 1% of the company’s 141.8-sq.-km land package in Brazil’s “Lithium Valley.” The area is also home to another Lithium Ionic project, Salinas, about 120 km north of Bandeira.

Be the first to comment on "Lithium Ionic boosts projected returns for Brazil project"