Although Lithium Chile (TSXV: LITH) has been a lithium-focused company since 2015, that wasn’t always the case. It went public in 2011 under the name Kairos Capital, and did so with six copper-gold prospects in Chile.

Now Lithium Chile is spinning out those properties into a company called Kairos Metals.

“Markets cratered in 2012 and there was no interest in copper or gold,” Lithium Chile president and CEO Steve Cochrane says in a telephone interview with The Northern Miner from his office in Calgary.

Cochrane took over as Lithium Chile CEO in August 2017, and suggested the company decide to be either a copper play or a lithium play. He is one of three initial board members for Kairos Metals.

“My experience on the investment side is that if you try to do both, you don’t get credit for either,” Cochrane says. “So we decided to make a stand-alone company to hold the copper-gold properties.”

Lithium Chile has US$10 million in cash. It will lend US$1.2 million to Kairos to start a drill program that Cochrane says will likely target two of Kairos’ properties: the copper-gold Salvadora property and the silver-gold Nancagua property. Lithium Chile vice-president of exploration Terence Walker last explored Nancagua in 1995.

Salvadora sits 12 km from state-owned, copper-mining company Codelco’s El Salvador mine, which has produced 1.8 billion tonnes copper. Kairos’ property appears to be on the same underlying structure. The company has found two vein systems on the property, 3 km apart, across a 4 km strike length called Feliz Retiro and La Fortuna.

Lithium Chile CEO Steve Cochrane (second from right) poses with his team and guests on a visit to the company’s property in Chile. Credit: Lithium Chile.

So far it has dropped two reconnaissance holes into Salvadora, one into each system. The Feliz Retiro hole intercepted 32 metres from 95 metres downhole grading 0.32% copper, 1.66 grams gold per tonne and 2.3 grams silver. The La Fortuna hole returned 34 metres from 36 metres downhole at 1.48% copper, 0.22 gram gold and 8.5 grams silver including 6 metres from 48 metres downhole grading 5.71% copper and 21.7 grams silver.

The system has artisanal workings, including hand-dug shafts and others descending as much as 180 metres below surface. Small-scale mining persists on the property today across two local claims within Kairos’ bigger claim.

“They’re being worked by a mom-and-pop operation,” Cochrane says. “They’re very small — one hectare, two hectares within our property.”

Salvadora is accessible via a paved highway that leads to the claim boundary. From there, what Cochrane calls a “high-grade gravel road” begins. It bisects the property and leads to what he calls “tier-two” gravel roads that sprout off into the various zones.

“There are a couple places we go off road,” he says, “but it’s really high alpine desert. No foliage, no trees, no soil or overburden. You’re driving along a hard-packed desert.”

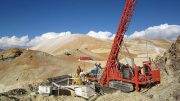

Lithium Chile senior geologist Eric Hansen on the company’s Salar de Ollague property where it has auger sample as high as 1140 mg/l lithium. Credit: Lithium Chile.

When Cochrane took over as Lithium Chile’s CEO, his goal was to raise up to US$5 million to finance 2018 and 2019 exploration programs. He ended up with US$12 million.

The company then sampled its 15 properties — including 13 salars — and picked what it considers its best six based on three criteria: grades, access and size — because, as Cochrane says, “you need a large footprint for lithium evaporation.” It settled on six properties that sampled between 1,410 and 540 mg per litre lithium, and had paved highways within 1 kilometre.

This year the company has spent US$1.2 million of its US$2-million budget on geophysical exploration. It will spend the rest on reconnaissance holes, with plans to start drilling as soon as possible and continue to the end of July. Lithium Chile is targeting four holes per property as deep as 300 metres each. All-in costs are US$200 per metre.

The company has its drill permits, but still needs consent from the local communities — a new addition to the Chilean mining code. It expects to finish paperwork for its Ollague lithium prospect imminently, and mobilize drills in early May.

Lithium Chile’s land package in Chile totals 1,485 square kilometres. Cochrane says Chile has long struggled with the perception of being a hard place to do business, and as a result other companies stayed away. Lithium in particular is seen as difficult because the government classifies it as a strategic mineral. As a result, mining companies need to deal with not only the mining ministry, but the nuclear regulatory authority, as well.

“It’s a bit of a catch-22,” Cochrane says. “Because it’s perceived as too hard, nobody applied to do it.”

However, in early March, Sebastian Pinera assumed office as Chile’s new president. Shortly after, the Chilean government granted a lithium production and export licence to Minera Salar Blanco, a joint venture between Lithium Power International (ASX: LPI) and Bearing Lithium (TSXV: BRZ).

“It sent a very strong message that Chile is open for business,” Cochrane says. “All of a sudden, we’ve become the prettiest girl at the dance. Because other companies perceive that Chile is open for business, they’re going to ask, ‘Well, who has the largest land package?’ Lithium Chile is No. 3 behind the government and SQM.”

Shares of Lithium Chile are trading at 93¢, within a 52-week range of 35¢ to $1.35. The company has a $94-million market capitalization.

“It makes us attractive, even just from a joint-venture perspective,” Cochrane says.

Be the first to comment on "Lithium Chile spins out base metals"