Near-surface drilling that has returned an intercept of 1,718.06 grams gold per tonne over a true width of 0.6 metre from 280 metres below surface — 1.5 km from Kirkland Lake Gold’s (TSX: KGI; US-OTC: KGILF) operating Macassa underground mine — should help the company supplement feed to its mill, according to CEO George Ogilvie.

“With this type of grade and anything that is near-surface, you’d expect mining costs to be significantly lower than underground,” Ogilvie says. “On average underground, we’re mining at 5,500 feet [1,676 metres], but the near-surface mineralization we’re finding is between 100 feet and 1,000 feet [30 and 305 metres], so it’s 500 feet [152 metres] on average, and if mining costs are lower, you can reduce cut-off grades and still make money.”

Other intercepts reported include 283.29 grams gold over a true width of 0.3 metre from 247.9 metres below surface, and 33.60 grams gold over a true width of 1 metre from 80 metres below surface.

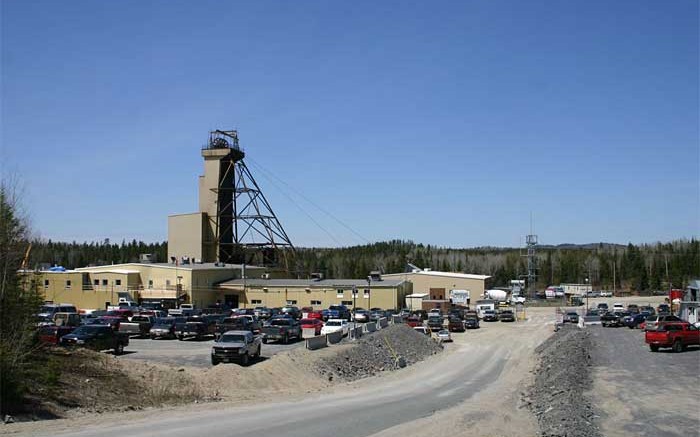

Ogilvie says that over the last three years during surface design the company has invested in infrastructure, including updating the mill to process 2,200 tonnes per day. But with a plan that calls for mining only the higher-grade ore [raising head grades, requiring less tonnes and lowering cash costs per ounce], there’s going to be excess capacity at the mill in the short- to medium-term. The underground mining operation couldn’t supply this tonnage at the grade management is looking for, Ogilvie explains, which is why it’s important to find near-surface mineralization that can supplement the mill.

Ogilvie says Kirkland Lake Gold will update its resources and reserves before May, along with the first-ever official resource estimate for its near-surface drill program on the Macassa property. He notes the company is putting together its budget for the next fiscal year starting May 1.

During the current fiscal year, which ends April 30, the company will have spent $8 million on exploration across its property, divided between surface and underground drilling. Of the surface drilling, 90% has been directed at finding near-surface mineralization near the mine on the Macassa property. “This time last year we had three surface drills running out there, and in mid-November we had two, and then I shut one of the drills down as part of our cost-reduction program,” he says.

Across the camp the company has eight drills running, one on surface and another seven underground. Of the seven drills underground, he adds, five are focused on production or delineation drilling, and two on pure exploration.

Since joining the company in November 2013, Ogilvie has implemented a hiring freeze, reduced capital and operating expenditures, and cut discretionary spending. So far, he says, the company has cut $23.5 million out of its operating costs, mainly by letting go of 144 employees and taking $15 million out of salaries and wages on an annual basis. January was the first month that the company continually produced gold at the reserve grade of 0.45 oz. gold per ton. For the month, Kirkland Lake Gold produced 13,483 oz. gold.

Earlier this month the company forecast that it would produce between 120,000 and 125,000 oz. gold during the fiscal year — which represents a 30–36% increase over the previous fiscal year that ended April 30, 2013.

Ogilvie — a mining engineer with decades of experience working in the deep gold mines of South Africa and also in Canada — is excited about the company’s prospects. “This is a prolific mining camp — probably one of the premier gold mining camps in the world,” he says. “Mining has taken place here for over 80 years, and over that period in excess of 20 million oz. gold has been produced.”

News of the latest drill results nudged Kirkland Lake Gold’s shares up 1% to $4. Over the last year shares have traded within a range of $2.21 to $6.68. The company has 70 million shares outstanding.

Analysts at U.K.-based Investec Securities describe the latest drill results as “encouraging,” and note that they show the company “could have a future in near-surface mining.”

Be the first to comment on "Kirkland Lake Gold drills shallow high grade"