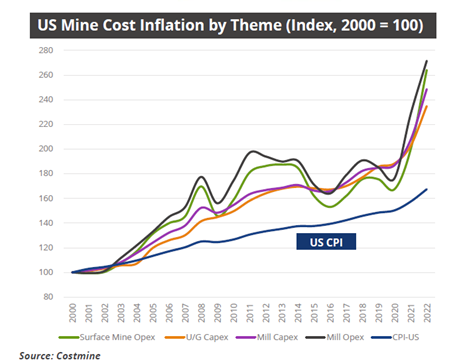

It has never been more expensive to operate or build a mine, according to new research from CostMine, although not all costs are rising equally.

In late November, Michael Sinden, vice-president of data with The Northern Miner Group, presented inflation data at the Canadian Mining Symposium in London, showing that mining operational and capital expenditures are reaching 20-year highs.

Sinden pointed out that this data is not a big surprise given the current economic climate but there is more to the story. “There’s no question mine costs are increasing and will continue to do so, but the ability to pinpoint where inflation is coming from and the ability to mitigate it is critical.”

Mill and surface operations expenditures experienced the biggest uptick due to exposure to fuel and electricity costs, raw materials, reagents, grinding media, and liners. The bulk of costs come from fuel, explosives, chemicals, and electricity, or as Sinden puts it: “Anything hydrocarbon related is inflating costs at a mine.”

All data provided by CostMine.

Mill and underground capital expenditures are a serious source of inflation as deeper mines and expensive milling equipment are driving up costs. Since 2015, costs have risen 7% on a compound annual growth rate (CAGR) basis or 60% compounded over this period.

When it comes to labour, costs aren’t the problem, at least not yet, CostMine data shows. The hourly rate for labour at U.S.-based mines is only rising at a 2.8% to 3.5% compound CAGR and salaries are growing at a 2.9 to 3.9% CAGR.

Data provided by CostMine.

Data provided by CostMine.

All this is coming at a time when metal demand is accelerating due to a mineral and metal intensive energy transition and increased scrutiny of the mining industry’s own carbon footprint.

Mitigate or eliminate carbon costs?

Renewable energy is increasingly becoming cost competitive with fossil fuels. Decarbonizing the mining industry appears to be a solution, but it is not so simple.

According to Ali Madiseh of the University of British Columbia, Canadian Research Chair in Advanced Mine Energy Systems, the mining industry is still using fossil fuels because it is “comfortable” with them.

“Fuels have been the most techno-economically feasible choice and should we not take into account the environmental costs associated with consuming them, there is a good chance that fossil fuels will stay the most ‘comfortable’ energy source in at least the near future.”

He notes that fossil fuels are still relatively cheap, abundant, and flexible enough to power remote mining sites. In addition, different mining operations have different energy demands due to the variability of operating conditions such as climate, location, level of access to energy grid, deposit type, mining technique, and mineral processes.

However, Madiseh cautions that this could change with incoming carbon tax policies around the world. Miners should consider at what point their reliance on fossil fuels becomes too expensive, or could result in the loss of their licence to operate.

“Unfortunately, there is no silver bullet to mine decarbonization,” Madiseh adds. The process is rather step-by-step. People need to devise a strategic plan and start with the low-hanging fruits which are technologically more mature and economically less costly to implement.”

Mining operations that depend on a hydro-powered electrical grid may have a relatively low carbon footprint while some remote operations may rely solely on fossil fuel-generated power, greatly increasing their carbon footprint.

The global transition towards a green economy can only be accomplished with renewable power, electric vehicles and energy storage technologies, but this places pressure on the mining industry to produce minerals and metals.

The need for mines has never been greater, but at what cost?

Politicians’ massive STUPIDITY regarding climate change CO2 Insanity is ever-growing.

“It’s just economic stupidity across the board as noted in Al Gore and John Kerry’s Aim to Hijack the World Bank for Climate Agenda”

https://mishtalk.com/economics/hoot-of-the-day-germanys-electricity-from-coal-soars-to-33-percent

What value did they register and what trend is their Opex, O&M in grinding and transport trucks from the mine? Tks