BOISE, Idaho – Access to local skilled labour is now the choke point to building new mines, Idaho’s mining leaders told the Idaho Mining Conference this week in Boise.

The University of Idaho is reviving geological engineering and the state is using its Launch career-tech program to attract students to high-paying trades. These efforts highlight the skills gap as Governor Brad Little advances reforms to quicken mining permits.

“Just two or three new mine approvals mean the state will need roughly 1,500 skilled workers it doesn’t have,” Ben Davenport, executive vice-president of the Idaho Mining Association (IMA), told The Northern Miner.

Accessing enough skilled labour has been a growing concern for mining companies as more than half of U.S. mining industry veterans are expected to retire by 2029, according to the Colorado School of Mines. Fewer students entered colleges to replace them in recent decades as the industry’s image suffered. Companies are betting on a reversal as the Trump administration champions mining, the public begins to see the industry’s importance in all consumer wares, and the industry pivots to technologies that may attract a more diverse range of job seekers.

Conference doubles

The 1,200 conference attendees, double the number of two years ago, also heard permitting was a major roadblock to projects despite efforts by the state and the Trump administration’s more intensive use of the federal FAST-41 program. Perpetua Resources’ (Nasdaq, TSX: PPTA) Stibnite copper-gold-antimony project began construction this month to be the state’s first gold mine in decades. Integra Resources’ (TSX-V: ITR; NYSE-A: ITRG) DeLamar project has advanced to an environmental review.

The governor’s Speed Council, announced in January, installed a single state project manager to herd agencies on one schedule, rather than sequential sign‑offs that add years, the IMA’s Davenport said. The model mirrors FAST‑41 and should give proponents “one throat to choke” on timelines when major projects enter the queue, he said.

But the Speed initiative has limits. Davenport pegs environmental review alone at five to eight years even before construction and he warned that litigation can add several more after permits are issued. Federal shutdowns also stall agency work, slipping review calendars regardless of market conditions. The Speed Council can align schedules, he said, but it can’t eliminate court risk.

Trades needed

On the people side, industry veterans said the bottleneck isn’t just operators. Mines need diesel mechanics, millwrights, assay technicians and geoscientists. Some said trades are still undervalued by parents steering kids toward four‑year academic degrees.

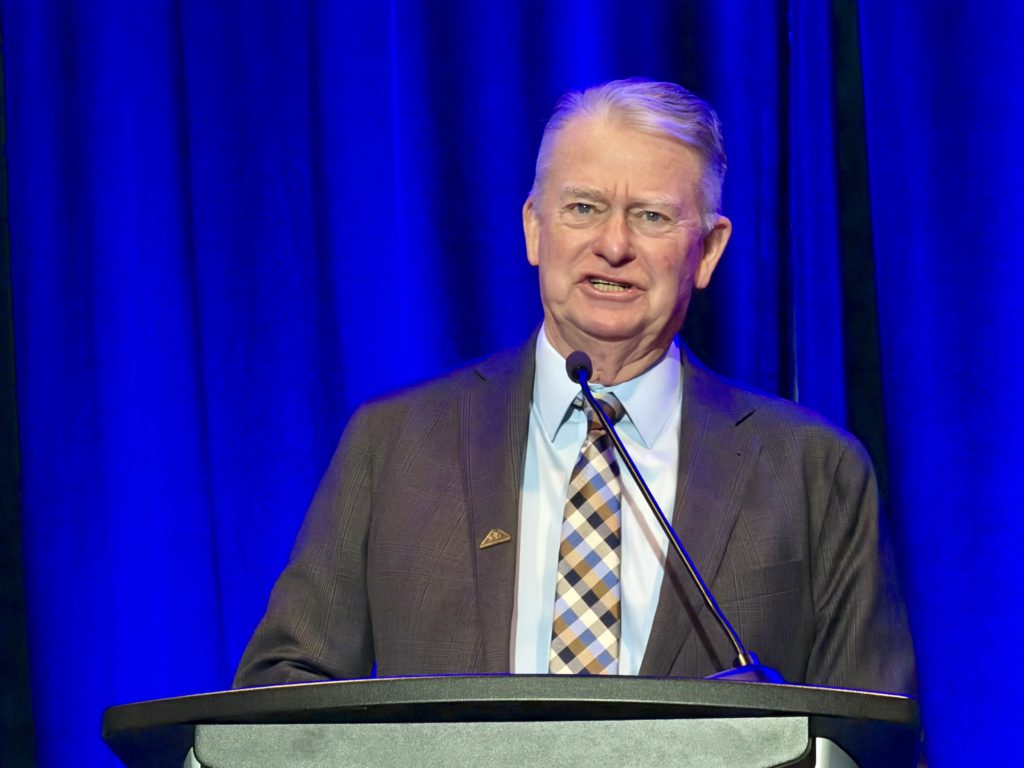

Idaho Governor Brad Little gives a welcome speech during the Idaho Mining Conference. Credit: Henry Lazenby

Integra Resources CEO George Salamis told a panel he’s already pitching high schoolers on $100,000 (C$140,000) haul‑truck jobs after graduation. Companies still expect to recruit out‑of‑state to staff new builds, he said.

The University of Idaho’s geologic engineering program which just started this fall, is a symbolic restart of mining education in the state to meet the skills demand, Idaho‑trained mining engineer Tim Arnold, told the conference.

Governor Little used his welcome address to link state workforce policy with mining’s near‑term needs.

“Launch is tailored for truck drivers, for diesel repair, for operating the mining [equipment],” he said, arguing the program is lifting Idaho’s wages while giving mines a pipeline of job‑ready talent for increasingly technical roles.

Developers should wherever possible adopt autonomous operations (like self-driving vehicles) and artificial intelligence to squeeze more output from thinner crews, Randy Huffsmith, U.S. mining practice manager at global engineering and professional services firm WSP, told another panel.

Multi-skilled workers

Talent is “the scarcest resource,” according to ASA Gold and Precious Metals (NYSE: ASA) fund manager Jamie Holman, with about $1 billion under management. His team backs companies through the “dull middle years” of the Lassonde-curve because that’s when real de‑risking happens – if the right people are in place, according to the investor.

While the state’s mining leaders are focused on skills development and speeding permitting, Governor Little is betting on Idaho’s antimony potential. Perpetua’s Stibnite project could supply about 30% of U.S. antimony once built, while creating about 950 construction jobs and 550 operating roles, Little said, a lifeline for communities where sawmills once anchored the economy. Those figures, he argued, make the project a national‑security asset as much as a mine.

For investors, the question is whether Idaho’s labour and permitting fixes arrive in time to catch this cycle. Parallel state‑federal reviews would help companies give real dates to funders who have grown wary of the “orphan period” between discovery and construction, Integra’s Salamis said.

“Time is money,” Revival Gold (TSXV: RVG, US-OTC: RVLGF) CEO Hugh Agro echoed, saying the more the state can standardize milestones, the less dilution companies suffer waiting for catalysts.

Holman offered the simplest yardstick: back the teams that can execute.

“We often are buying during the [development] period,” he said, “because we work with teams who know what it takes.”

Be the first to comment on "Idaho bets on schools, speedy approvals to renew mining"