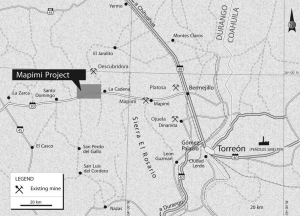

VANCOUVER — Despite being busy running four mines, Great Panther Resources (GPR-T, GPRLF-O) still found time to boost the resources at its Mapimi silver-lead-zinc property in northeastern Durango state, Mexico.

An updated resource estimate for the La Gloria and Las Palmitas zones at Mapimi effectively upgraded the old inferred resource to the indicated category while adding new inferred ounces.

In the oxide layer, Mapimi now hosts 4.27 million indicated tonnes grading 0.09 gram gold per tonne, 32 grams silver, 0.46% lead and 0.95% zinc, as well as 927,000 inferred tonnes grading 0.08 gram gold, 32 grams silver, 0.5% lead and 0.8% zinc. The sulphide zone hosts indicated resources of 2.31 million tonnes grading 0.11 gram gold, 22 grams silver, 0.3% lead and 1.5% zinc, plus inferred resources of 1.1 million tonnes grading 0.16 gram gold, 36 grams silver, 0.57% lead and 0.83% zinc.

The new estimate included results from 29 holes drilled in early 2007, most of which was directed at infill drilling. Wardrop Engineering used a cutoff grade of 50 grams silver equivalent per tonne and the following metal prices: US$530 per oz. gold, US$9.55 per oz. silver, US63 per lb. lead, and US$1 per lb. zinc.

Compared with the previous resource estimate, the increased metal prices in the new report allowed the inclusion of lower-grade material. As a result, tonnage increased by 73%, while the average silver-equivalent grade dropped. The average indicated grade is now 105 grams silver equivalent; for inferred resources, the grade sits at 97 grams silver equivalent. The old estimate, which only included inferred material, carried a grade of 139 grams silver equivalent.

The latest round of drilling also determined that the La Gloria and Las Palmitas zones are structurally complex and fault-bounded on all sides, including at depth, where a shallowly dipping fault system appears to cut off mineralization between 100 and 200 metres. La Gloria has a strike length of 360 metres, with widths up to 150 metres. Las Palmitas extends for 200 metres along strike and is up to 30 metres wide.

In both zones, widths are greater at surface and appear to pinch at depth, a shape amenable to open-pit mining. The oxidation layer extends to a depth of 60 to 80 metres. Mineralization consists of disseminated pyrite, galena and sphalerite hosted within hydrothermal breccias and stockworks, brecciated sediments, and rhyolite associated with a cluster of rhyolite domes.

Great Panther has started a scoping study to examine basic issues around permitting, metallurgy, transportation and construction costs. At the same time, the company aims to increase the project’s resource base by drilling targets outside of La Gloria and Las Palmitas.

The Mapimi project covers some 150 sq. km, most of which is still unexplored. A second-phase drilling program that kicked off in October is testing two large coincident geological, geochemical, and geophysical anomalies known as the Bull’s Eye and North zones. In the area north of La Gloria, widely spaced drilling has intersected skarn alteration and some mineralization; along with other data, this indicates that La Gloria may be part of the southern tip of the 2,000-metre-long, 800-metre-wide Bull’s Eye anomaly.

Great Panther is earning a 100% interest in Mapimi from Minera Apolo S. A. de C. V., paying a total of US$3 million and 500,000 shares over four years. Minera Apolo retains a 3% net smelter royalty (NSR); Great Panther can purchase up to 2% of that NSR by paying US$500,000 for each 0.5%.

Aside from Mapimi, Great Panther operates three mines (Valenciana, Cata and Rayas) at its Guanajuato complex in central Mexico, all situated along the main Veta Madre (Mother Lode) structure that trends northwest-southeast through the district for roughly 25 km. Silver and gold mineralization also occurs in quartz veins that parallel Veta Madre, and in stockworks on both sides of the structure.

The company began commercial operations at Guanajuato in 2006 with the mine churning out 710,903 oz. silver equivalent last year.

Great Panther also operates the Topia silver-lead-zinc mine, in Mexico’s Durango state. It produced 625,726 silver-equivalent oz. in 2007.

Great Panther lost 5 on the news to close at $1.30. The company has a 52-week trading range of 85-$2.20 and has 81.1 million shares issued.

Be the first to comment on "Great Panther grows Mapimi"