As of February 2010, diamond drills are being mobilized and dormant projects are being revived. This is markedly different from the start of 2009, when the global economic downturn battered exploration and mining in the Northwest Territories. Despite the rough diamond market taking a hard hit, the Ekati diamond mine increased production. Both the Diavik and Snap Lake mines saw a reduction in diamond production with the implementation of six-week summer shutdowns, however, shutdowns planned for later in the year were cancelled as economic conditions improved. The good fortune of higher than anticipated grades and a burgeoning ore stockpile were countered by a poor market, forcing the Cantung mine –Canada’s only tungsten mine –to close temporarily in October. Gold exploration, aided by record-breaking commodity prices, and rare earth projects proved resilient in the first three quarters of 2009. Successful projects and an improving financial environment do not eclipse the reality of reduced spending in the N.W.T. Natural Resources Canada statistics show spending for exploration, deposit appraisals, and mine construction was at $28.7 million by October 2009, compared with $129 million a year earlier.

Mining operations

De Beers Canada’s underground Snap Lake diamond mine, officially opened July 2008, recovered a total of 2 million carats of diamonds at a grade of 1.3 carats per tonne (cpt) by November 2009. The deposit has an indicated resource of 1.4 million tonnes with a recoverable grade of 1.2 cpt. The mine is expected to produce 1.4 million carats per year over the next 20 years.

The Diavik mine, owned by Rio Tinto and Harry Winston Diamond, recovered 4 million carats in the first three quarters of 2009, compared with 6.6 million carats in the same quarter of 2008. Reserves reported in 2008 came to 20 million tonnes at 3.1 cpt, with an expected mine life to 2020. Work was focused on the transition to underground mining for the first quarter of 2010.

At the Ekati mine, BHP Billiton and partners recovered 3.1 million carats during the first three quarters of 2009, comparable to 2.8 million carats in the same period of 2008. Total production for 2008 was 3.6 million carats averaging 1.3 cpt from open-pit and underground mining. In the Core Zone lease area, proven reserves stand at 19.1 million tonnes grading 0.3 cpt (open pit) and 3.9 million tonnes grading 0.9 cpt (underground).

North American Tungsten shut down its Cantung mine on Oct. 15. Market fluctuations and a substantial ore stockpile were cited as the causes of the suspension. Cantung’s production was up 13% in the first three quarters compared to the same period in 2008. A 2009 calculation puts probable reserve at 925 kt grading 1.08% WO3. The mine has projected reserves to operate for at least another 2.5 years and exploration drilling has intersected new high-grade zones, with results including 19 metres at 2.45% WO3.

Exploration

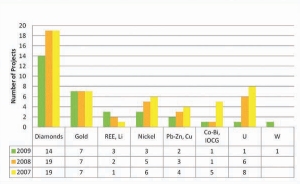

The impact of the financial slowdown is readily apparent in the exploration statistics. The total number of reported exploration projects fell to 32 in 2009 from 50 in 2007 (Table 1) and the number of projects with active drilling decreased to 12 in 2009 from 29 in 2007. The number of uranium and base metal exploration projects decreased while there was a slight increase in the number of rare earth and lithium projects. Exploration for diamonds, still the most sought-after commodity in the N.W.T., decreased by 26%, with the number of drilled projects decreasing by 79% as of November 2009. However, precious metal exploration has remained consistent over the last three years.

Diamonds

The level of diamond exploration was subdued in the Slave Province during 2009, although it is showing signs of improving early in 2010. East of Snap Lake, a feasibility study is under way at De Beers Canada and Mountain Province Diamonds’ Gahcho Ku project. The project has an updated indicated resource, including pipes 5034, Hearne and Tuzo, of 30.2 million tonnes containing 50.5 million carats at 1.67 cpt. Diavik Diamond Mines undertook exploration necessary to maintain its obligations on joint-venture claims. Archon Minerals acquired full ownership of leases covering the Ekati Buffer zone, including 10 drill-confirmed kimberlite pipes. Arctic Star Diamond collected till samples from its Credit Lake property, west of Monument, and from their Crown property, north of Ekati.

Due south of the Ekati leases, New Nadina Explorations and partners completed a 762 line-km ground magnetometer survey. This was followed up by five diamond-drill holes (461 metres) and 13 reverse-circulation (RC) holes on the Northern zone of its Monument property. A 7.4-kg core sample from the Trio pipe (connected to the DD2002 dyke) returned eight microdiamonds. A 1,018-kg sample from RC hole 09-04 returned 848 microdiamonds, two of which were greater than 1.18 mm. Microdiamond analysis of a 199-kg composite sample from the drilled DD42a pipe resulted in 149 microdiamonds with one greater than 1.18mm. South of Diavik, Almaden Minerals and Williams Creek Exploration drill- tested seven geophysical targets coincident with indicator mineral trains on their ATW property. Southeast of Yellowknife, Snowfield Development and Dave Smith drilled magnetic anomalies with seven holes on the Wire claim, but no kimberlite was intersected.

Outside of the Slave Craton, diamond exploration also continued. Ten of eighteen drill holes intersected kimberlite, including five newly identified pipes on Olivut Resources’ HOAM property. North of Great Bear Lake, Sanatana Diamonds and Kennecott Canada Exploration completed 196 heavy mineral samples and 1,600 line- km of ground magnetic surveys on 16 targets at the Greenhorn, Colville Lake, and Simpson prospects at the Mackenzie JV property. While a new indicator mineral train near the MK-58 target has been identified in the Colville area, three RC holes failed to intersect kimberlite and basal till samples were barren on the Simpson prospect. A subset of till samples did, however, return elevated zinc, lead, and silver. Talmora Diamonds and Canadian Diamind completed an 865 line-km airborne magnetic survey and collected till samples down-ice of magnetic anomalies at their Horton River project.

Gold

North of Yellowknife, Tyhee Development drilled six geotechnical holes for a preliminary feasibility study on its Ormsby and Nicholas Lake properties. Farther south, on the Clan Lake property, Tyhee discovered seven new sulphide-hosted gold showings and extended the Main zone 450 metres to the east. Trench samples returned grades of up to 13.12 grams gold per tonne over 10 metres, including 48.8 grams gold over 2 metres. Two of three targets drill-tested by Viking Gold Exploration returned anomalous gold on its Morris Lake property. Seventeen samples returned anomalous values, with up to 3.37 grams gold from 15 sites (126 channel samples) along the projection of the nearby Ormsby zone. Seabridge Gold continued the technical evaluation of its Courageous Lake property.

Iron formation-hosted gold was the focus of three companies. Merc International Minerals drilled 27 holes to update the historic resource for the Horseshoe zone, on the Damoti Lake project. All but one of the holes intersected gold mineralization greater than 1 gram per tonne, with 20 holes cutting multiple mineralized zones. New gold intersvals reported from the west limb of the Horseshoe syncline returned up to 3.63 grams gold over 7.6 metres, including 12.02 grams gold over 1.1 metres. Results from Novus Gold and Terra Ventures’ nine-hole drilling program indicate a new zone within the Main occurrence of the Ren property. The higher-grade intersections reported include 9.65 grams gold over 2.2 metres and up to 22.4 grams gold over 0.7 metres. GGL Diamonds f

ocused on evaluating the potential of three gold occurrences on the Providence Greenstone Belt (PGB) property.

Other metals

Definition drilling at Avalon Rare Metals’ Nechalacho rare earth element (REE) project, at Thor Lake, increased indicated resource by 102% and provided information for a prefeasibility study. As of January 2010, the project hosts indicated resource of 9 million tonnes grading 1.86% total rare earth oxides (TREO), with 23.1% of the total comprised of heavy rare earths at a cutoff grade of 1.6% TREO. A total of 44 drill holes were completed (9,098 metres) intersecting the Basal zone on a 50-metre grid pattern. Assay highlights include 2.96% TREO (27.2% HREO) over 11.6 metres in hole L09- 152. After numerous hydrometallurgical tests the emphasis is now on caustic cracking to decompose refractory minerals and extract the REEs.

TNR Gold and International Lithium evaluated the Moose 1 and Moose 2 pegmatite dykes of the Moose lithium project, near Thor Lake. Spodumene crystals up to 4 metres in length were observed in the Moose 2 pegmatite. Assay highlights include 2.07 wt% Li2O over a 6.7-metre composite sample from Moose 1 and 1.96 wt% Li2O over a 1.7-metre channel sample from Moose 2. North Arrow Minerals identified six new spodumene- bearing pegmatite localities through mapping and drilling on the Phoenix lithium project, in the Aylmer Lake area. Seven diamond-drill holes (682 metres) tested the Big Bird and Curlew pegmatites. Significant drill intersections returned up to 34.3 metres grading 1.24% Li2O from Big Bird and 14.9 metres of 1.72% Li2O from Curlew.

Metallurgical testing was completed on the Main zone of Strongbow Exploration’s Nickel King project, Thye Lake area, following a recent resource estimate. The Main zone hosts indicated resources of 11.1 million tonnes grading 0.4% nickel, 0.1% copper, and 0.018% cobalt, using a 0.2% nickel cutoff grade. A 120-kg composite drill core sample averaging 0.65% nickel produced a final concentrate grade projected as 16.5% nickel, 4.2% copper and 0.74% cobalt, with respective recoveries of 78.4%, 89.1%, and 63.5%. Mineralogical studies determined that 89.9% of the contained nickel is associated with pentlandite in norite. Strongbow evaluated priority targets along its Snowbird nickel project, covering 150 km from their Nickel King Deposit in the N.W.T. to Stony Rapids, Sask. On the company’s Opescal Lake property, straddling the N.W.T./ Saskatchewan border, several new areas of mafic/ultramafic-hosted nickel-copper sulphide mineralization were discovered.

Within the Providence Lake Greenstone Belt, Arctic Star Diamond discovered the Finn Valley copper- nickel-cobalt-platinum group elements massive sulphide occurrence 13 km west of its 2008 Providence Lake nickel discovery. Prospective komatiite and mafic amphibolite stratigraphy was evaluated with a 465 line-km magnetometer survey and HLEM surveys covering 13 grids, mapping 51 geophysical anomalies, collecting 1,261 geophysical-targeted soil samples, and re-logging 2008 drill core.

In the southern Mackenzie Mountains, Canadian Zinc’s proposed development and operation of the Prairie Creek zinc-lead-silver project is currently undergoing environmental assessment by the Mackenzie Valley Environmental Impact Review Board. Work was limited to studies related to the environmental assessment and refinement of the mine plans. Results from three large-scale locked cycle tests indicated an overall grade of blended lead sulphide/ oxide concentrate of 67% lead, with an 82% recovery of total lead, and a zinc sulphide grade of 58% zinc with a 74% recovery of total zinc, in the plant feed, and an average of 92.7% total silver in plant feed from the zinc and lead concentrates. Western Copper started an assessment of their claims in the Mackenzie Mountains. Across the valley from the Cantung mine, North American Tungsten prospected for tungsten on their Rifle Range Creek project by extracting geochemical samples through holes melted in the Rifle Range Glacier. Tamerlane Ventures continues environmental assessment of its Pine Point lead-zinc project west of Hay River.

Fortune Minerals’ NICO gold- cobalt-bismuth project, in the southern Bear Province, is in the permitting process. The only uranium exploration was an audiomagnetotelluric geophysical survey and soil sampling on Ur-Energy’s Screech Lake uranium project, in southern Thelon basin.

The last quarter of 2009 saw pronounced change in the attitude of exploration companies active in the Northwest Territories as evident by early 2010 drill program preparations. With continuing improvement in financial markets, a more dynamic and vibrant exploration season is anticipated.

Be the first to comment on "Gold, Rare Earth Projects Prove Resilient"