A growing wave of protectionism is sweeping across 72 nations, as governments scramble to secure access to critical minerals essential for strategic industries, new research by global risk intelligence firm Verisk Maplecroft shows.

The study reveals a surge in state intervention not seen in Western democracies since the early 20th century, driven by concerns over national security and supply chain stability.

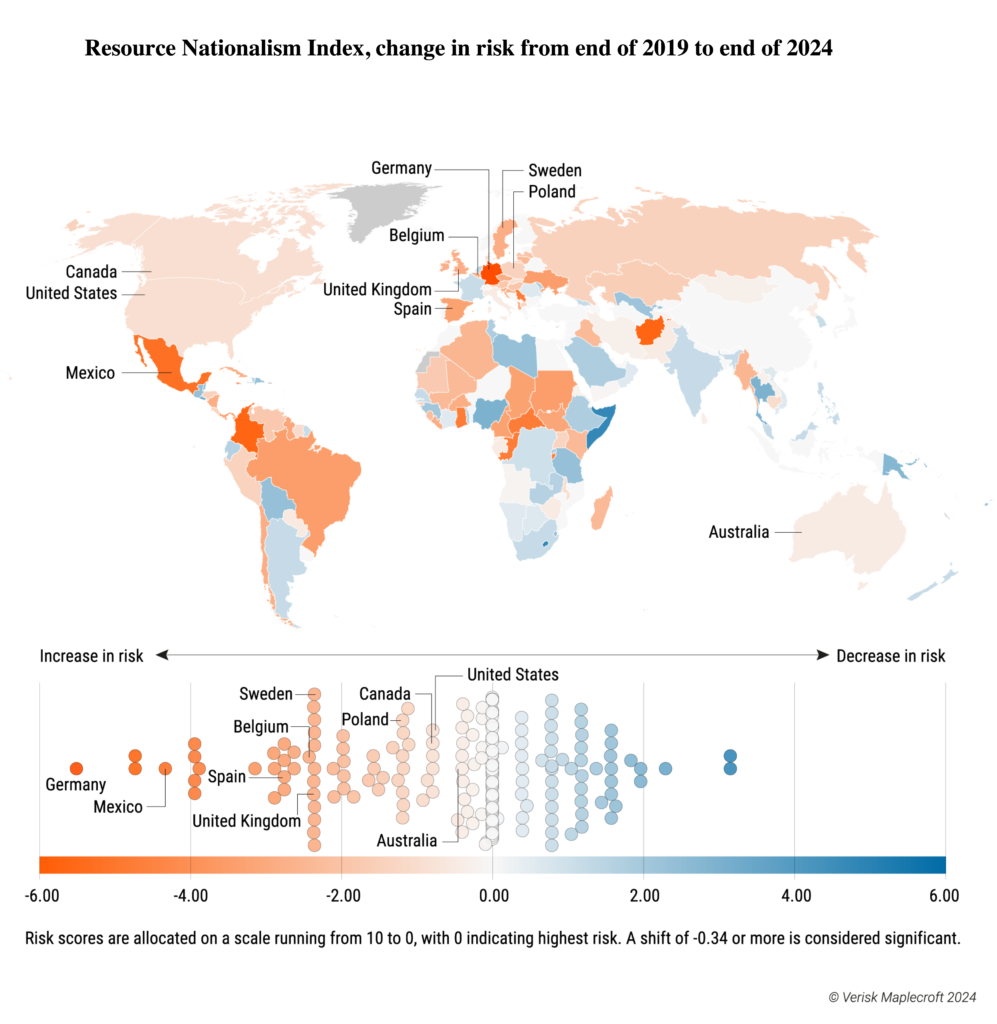

Verisk Maplecroft’s Resource Nationalism Index (RNI), which measures protectionism and interventionism in the energy and mining spaces across 198 countries, highlights a sharp increase in protectionist policies over the past five years. The trend is most pronounced in Europe and North America, where geopolitical tensions and a fractured global landscape are reshaping economic practices.

Europe has been at the forefront of this shift, with major economies like Germany, Spain, the U.K., and Poland showing significant declines in the RNI rankings. Germany, in particular, has plummeted 122 places in the index, reflecting its aggressive policies to reduce dependence on external energy and mineral sources.

Source: Verisk Maplecroft’s Resource Nationalism Index (RNI)

Berlin has implemented short-term measures, including the seizure of Russian energy assets after the Ukraine invasion, alongside long-term strategies such as subsidies for domestic manufacturing and partnerships with resource-rich nations like Canada and Australia. These efforts aim to secure access to essential minerals like lithium and cobalt while bolstering domestic processing capabilities.

The European Union is also ramping up its initiatives through frameworks like the European Raw Materials Alliance (ERMA) and the Critical Raw Materials Act, which focus on sustainable mining, recycling, and reducing reliance on non-European sources.

North America allies

In North America, policies to safeguard critical minerals have led to tightening trade and investment rules. The U.S. has enacted the CHIPS and Science Act and the Inflation Reduction Act to boost domestic production while restricting Chinese involvement in key sectors. Initiatives like the Mineral Security Partnership have strengthened collaboration with allied nations, further entrenching trade barriers with geopolitical rivals.

Canada, meanwhile, has adopted a multi-faceted approach through its Critical Minerals Strategy and the Investment Canada Act. These measures not only limit foreign investments, particularly from China, but also encourage sustainable resource development under strict environmental and labour standards.

In 2022, Ottawa ordered three Chinese investors to sell their stakes in a trio of Canadian lithium firms. This was part of a wider push to block Chinese firms from encroaching further into Canada’s critical minerals sector.

In June, Ottawa stepped in to block a potential deal that would have seen Australia’s Vital Metals (ASX: VML) sell its stockpiled rare earth material mined in the Northwest Territories to China’s Shenghe Resources. Prime Minister Justin Trudeau’s administration offered a higher sum for Vital to sell its rare earths to the Saskatchewan Research Council.

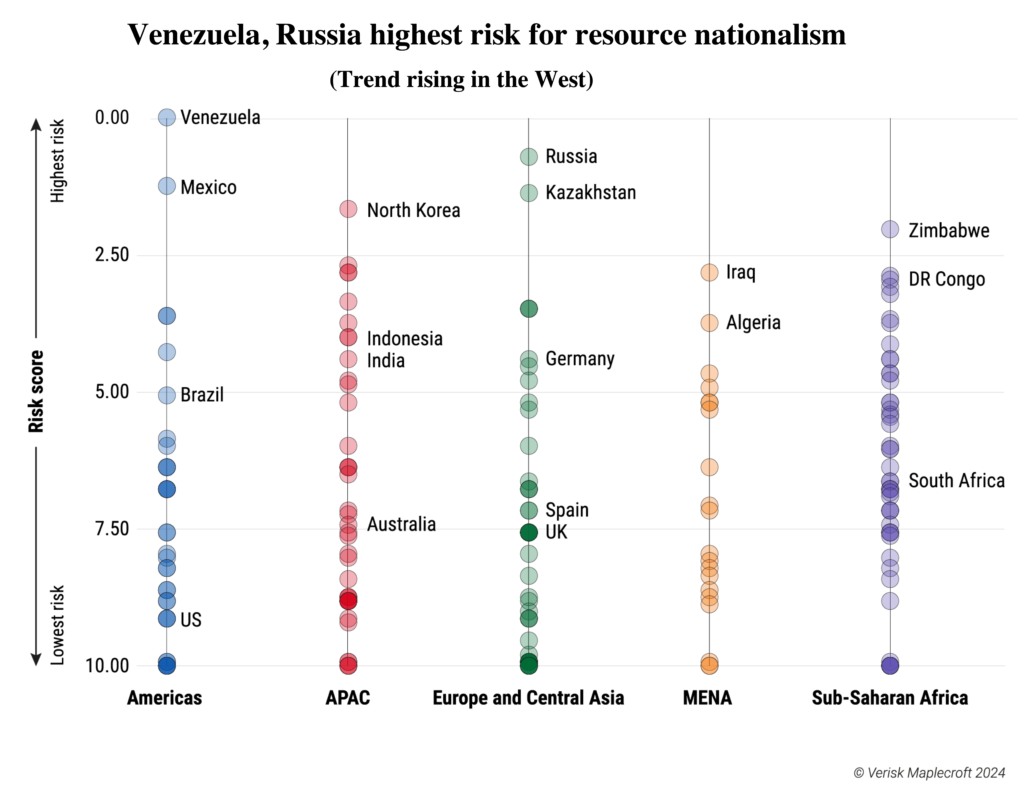

Source: Verisk Maplecroft’s Resource Nationalism Index (RNI)

Additionally, Canada has partnered with nations like Australia and the U.S. to strengthen critical mineral supply chains through agreements that prioritize resource access.

The country is also part of the Five Eyes Alliance, which includes the U.S., U.K., Australia and New Zealand, which aim to tackle the price manipulation of critical metals.

The U.S. has created several groups, such as the Committee on Foreign Investment (CFIUS), to increase scrutiny on foreign acquisitions of critical mineral assets. Early this month, the U.S. also introduced restrictions on exporting semiconductors and critical materials to China, limiting Beijing’s ability to develop advanced technologies. The Asian giant responded by banning exports to the U.S. of gallium, germanium, antimony, and other key high-tech materials with potential military applications.

Fragmented global economic

The rise in resource nationalism, described by Verisk Maplecroft as “strategic,” underscores the challenges posed by a fragmented global economic order. Jimena Blanco, the firm’s chief analyst, noted that supply chain security has become a top priority for states, opening doors for incentive programs while also narrowing opportunities to “friendly” jurisdictions.

The report warns of increased trade tensions as nations like China and the U.S. engage in tit-for-tat measures. Recent developments include China’s restrictions on gallium and germanium exports in response to U.S. semiconductor curbs, signalling further escalation.

The study also identifies the top 10 highest-risk jurisdictions, including long-standing resource nationalists like Venezuela, Russia, and Zimbabwe. These countries continue to use policies such as nationalization and resource rent hikes to exert control over their mineral wealth.

As resource nationalism becomes more sophisticated, Western economies appear poised to deploy a mix of trade barriers, investment controls, and sustainability standards to maintain strategic autonomy. For investors, the evolving policies signal a complex landscape with potential risks throughout the global supply chain.

“Western nations will likely increase localized supply chains and stricter trade policies, adding layers of complexity for global businesses,” Blanco said.

Be the first to comment on "Global scramble for critical minerals fuelling protectionism"