Sean Roosen doesn’t mince words when he says Canada needs to “stick to the family business.”

The celebrated mining executive calls for a return to what he sees as the country’s greatest strength: mining.

“We’ve always been a resource country,” Roosen told The Northern Miner at the Mining Investment Event of the North in Quebec City. “Nobody’s moving the oil sands or mines unless Canada permits development of its natural resources.”

Roosen, CEO of Osisko Development (TSXV, NYSE: ODV), has earned the right to speak plainly. Over nearly two decades, he and his associates have generated just under $14 billion (US$10 billion) in combined value from an initial $3.7 billion of invested capital. They’ve discovered about 140 million gold ounces in total.

Sean Roosen’s fingerprints are on several of Canada’s marquee mining ventures, from co-founding Osisko Mining (TSX: OSK) and developing Canadian Malartic—now the country’s second-largest gold mine under Agnico Eagle Mines (TSX, NYSE: AEM)—to advancing Windfall Lake, sold last year to Gold Fields (NYSE, JSE: GFI) for about C$2.2 billion, and creating Osisko Gold Royalties (TSX, NYSE: OR) as part of the Canadian Malartic deal in 2014.

Top-tier asset

Now at Osisko Development, Roosen is driving the Cariboo gold project in British Columbia toward production after receiving full permitting in five years, a fraction of what’s said to be the industry average of 14. While the similarly named companies share a heritage, Osisko Mining focused on greenfield discovery—including Hammond Reef, Upper Beaver, Odyssey and the Southwest complex at Malartic—whereas Osisko Development pushes advanced-stage projects through permitting, development and production.

“Cariboo is one of the few permitted development projects globally,” BMO Capital Markets mining analyst Andrew Mikitchook wrote in an April 29 note to investors. He viewed an optimized feasibility study, since released in May, as the last step before financing and construction.

Final project financing is expected this month with construction ramping up soon after, Roosen said. He needs $881 million in capex funding and is considering debt, private equity, a joint venture or a mix of them.

The Cariboo feasibility pegs an after-tax net present value (NPV) of $943 million at $2,400 per oz. gold, with NPV rising to over $2 billion at spot prices. Its all-in sustaining costs of $1,157 per oz. places it comfortably in the lower half of the global cost curve and positions the project as a potential unicorn, Roosen said. It would use a single-stage, 4,900 tonnes per day mill.

Cariboo hosts probable reserves of 17.8 million tonnes grading 3.62 grams gold per tonne for 2.07 million oz. gold metal and measured and indicated resources (excluding reserves) of 17.4 million tonnes grading 2.88 grams gold per tonne for 1.61 million ounces.

“It’s a Jurassic-age gold deposit, not like the rest of the Canadian stuff,” he explained. “All the unique ones are the best ones.”

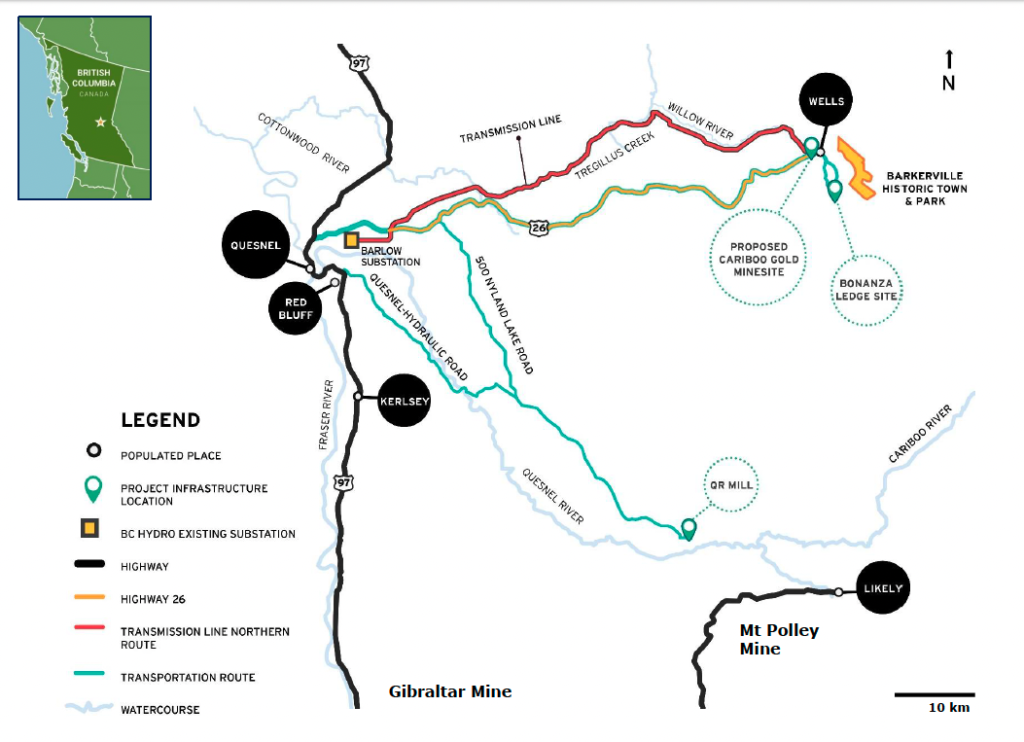

Location map of the Cariboo mine in B.C. Credit: Osisko Development (Click image to enlarge)

Unique

Cariboo stands apart from Canada’s more typical gold deposits because of its Jurassic age—about 150 to 200 million years old—compared to the 2.5-billion-year-old Archean deposits of regions like the Abitibi. This younger age reflects a different tectonic history and has given Cariboo a distinctive style of mineralization, with complex folded and faulted sedimentary rocks hosting high-grade gold veins.

That complexity offers the upside of district-scale potential and attractive grades, but it has also meant Osisko Development has had to undertake extensive drilling—hundreds of thousands of metres—to accurately model the deposit’s geometry and continuity. While this adds cost and effort, the work has helped advance Cariboo as one of Canada’s most promising new gold camps.

The deposit is thought to have significant exploration upside, Roosen pointed out. Cariboo hosts a further 18.8 million inferred tonnes grading 3.09 grams gold for 1.86 million ounces.

“We’re actually in the deposit right now,” he said, describing the extensive underground development at Cariboo, including a ramp extending 1,200 metres into the mountain.

“I haven’t been this excited since Canadian Malartic.”

Large prospects

The Cariboo project is near Quesnel, about 45 minutes from a town of 28,000 people and roughly 90 minutes by road from Prince George.

The Cariboo region is already primed with local talent. Osisko has helped people transition from the declining regional forestry and pulp industry to mining at Cariboo, Roosen said. He stressed the importance of Indigenous partnerships.

“First Nations live with these assets, so we need to build capacity in their communities to be real partners,” Roosen said.

Beyond Cariboo, Roosen is advancing the historic Tintic copper belt project in Utah. He noted Osisko Development owns all the property, consolidated in 2022 after a decade of target-finding work. It’s 65 km south of Rio Tinto’s (NYSE, LSE, ASX: RIO) Bingham Canyon, the largest human-made excavation on Earth at 1,200 metres depth, in a similar rock package.

“There are 23 past producers – five gold mines and 18 carbonate replacement deposits,” he said. ”We’ve identified a deep target that could be a Bingham-style copper-gold porphyry.”

Underground decline development at Cariboo, in B.C. Credit: Osisko Development (Click image to enlarge)

Canada’s ‘family business’

Roosen’s former “bandmates” in the original Osisko at Canadian Malartic, Bob Wares and John Burzynski, now lead Osisko Metals (TSXV: OM; OTCQX: OMZNF), redeveloping the Gaspé brownfield copper mine in Quebec. Roosen’s wealth-building story has established him as a top figure in Canadian mining, but he is not satisfied yet.

“This is what I live for,” he said, energized by the upcoming milestones for Cariboo. “Nobody thought Canadian Malartic would work either,” he recalled, noting skeptics dismissed the project now distinguished as a 36-million-oz. giant.

The CEO says Canada should focus on its resource advantages. He criticizes misguided government efforts, saying they chase tech ventures where the resultant value simply “gets moved to California or Florida” once they’re successful.

“Stick to the family business,” he argued. “Nobody’s moving the mines.”

Roosen’s clear-eyed perspective resonates in an industry often weighed down by uncertainty. As Cariboo moves closer to construction, its scale – both economic and geological – becomes evident. And with Roosen at the helm, few doubt his capability to deliver yet another zinger.

“We’re between third base and home plate,” he said confidently. “I think it’s gonna be about 10 unicorns.”

Be the first to comment on "From Canadian Malartic to Cariboo, Roosen builds a $14B mining legacy "