Excelsior Mining (TSX: MIN) announced in early February that it is fast-tracking a production optimization program, based on data collected at its Gunnison in-situ recovery copper mine in Arizona.

“These upgrades were planned to take place over time once nameplate production had been achieved,” the company said, noting that mining activity began in January, but Excelsior decided to make the changes earlier “to assist with breakthrough and production optimization.”

“Breakthrough is the pH level whereby copper will stay in solution. Currently, the acid that we inject down is mobilizing the copper, but it does not remain mobilized because the pH level needs to reach breakthrough level (lower pH),” JJ Jennex, Excelsior’s vice president of corporate affairs, wrote in an email to The Northern Miner.

“When we are getting free acid out of the recovery wells, then we will know that breakthrough has occurred. All of the optimizations that we recently announced are designed to get us to breakthrough as quickly and as efficiently as possible. Once breakthrough is achieved, we will be a major step closer to first production.”

The company has pushed back its estimated first copper production from the first quarter to the second quarter of 2020.

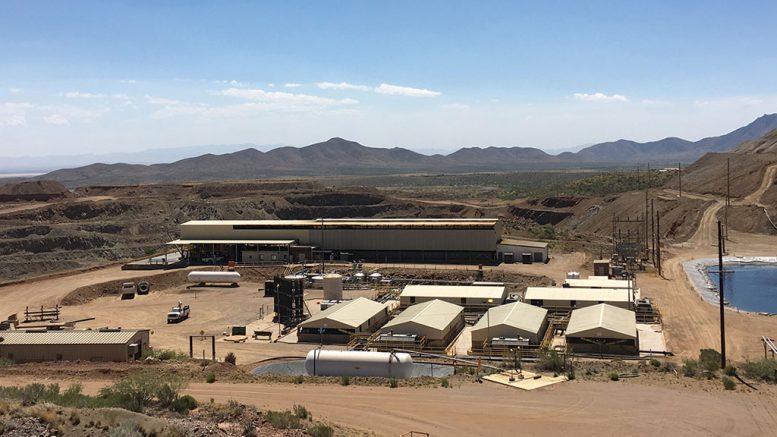

The wellfield at Excelsior Mining’s Gunnison copper mine in Arizona. Credit: Excelsior Mining.

Gunnison’s production wellfield is comprised of 57 wells, The initial configuration included 16 compliance wells and 41 production wells (16 injection wells and 25 recovery wells). Leaching solution acidified with sulfuric acid is pumped into the oxidized mineralized material via the wells and circulated in a closed-loop system through naturally fractured rock over a cubic area of 120 x 120 x 210 metres.

Hydraulic control wells around the wellfield keep the mining solution from migrating beyond the planned area.

The pregnant solution is recovered and processed into copper cathode at Excelsior’s Johnson Camp solvent extraction and electrowinning (SX-EW) plant, two km from the wellfield. The plant is designed to process solution with a feed grade of 1.63 grams copper per liter, recovering 48.4% of the total copper.

The optimization program will see the production wells become fully reversible so they can each serve as injection or recovery wells as required. Wellheads and related piping will also be reconfigured in accordance with reversibility. Additionally, the company will implement improved preventative maintenance to limit pump and wellfield downtime.

“Our initial copper recoveries are highly encouraging; and the implementation of these improvement programs keeps us focused on achieving long-term, low-cost copper production as soon as possible,” Stephen Twyerould, Excelsior’s president and CEO, explained in a prepared statement.

Excelsior issued a feasibility study in 2017, which outlined a 24-year operation producing a total 2.17 billion lb. copper and costing US$46.9 million in initial costs, plus US$741.8 million in sustaining costs. Using a base case price of US$2.75 per lb. copper the project has a US$730 million net present value (after tax, at a 7.5% discount rate) and a 35.6% after-tax internal rate of return. Life of mine all-in sustaining costs are pegged at US$1.33 per lb. copper.

As outlined in the study, mining is to unfold over three stages. Initially Gunnison will produce 25 million lb. copper per year. Stage two will commence in the fourth year of operation and triple production to 75 million lb. copper per year, requiring a new SX-EW plant near the wellfield. The third stage would see the new plant’s capacity doubled, allowing Gunnison to produce 125 million lb. copper per year.

Pregnant leach solution ponds at Excelsior Mining’s Gunnison copper mine in January 2020. Credit: Excelsior Mining.

Gunnison’s North Star deposit has 782 million tons in reserves, grading 0.29% copper, for 4.5 billion lb. of contained copper. Mineralization is hosted in Paleozoic rocks that have been intruded by the Texas Canyon quartz monzonite along the western margin of the deposit. The intrusion formed wide zones of calc-silicate and hornfels alteration, as well as extensive low-grade copper sulfide mineralization within the Paleozoic rocks.

Clarksons Plateau Securities has a “buy” rating on Excelsior’s stock with a target price of $2.00 per share, according to a Jan. 15 research report. Analysts said they expect Excelsior to hit the 25 million lb. copper production rate this year, but expect just 15 million lb. of production in 2020 “due to a slightly later-than-expected start of operations.” In 2021, the analysts also expect to see an updated feasibility study for Gunnison’s stage three expansion, and ultimately anticipate the company will skip stage two and proceed to full capacity.

Excelsior shares closed at $1.02 apiece, down 10¢, on Feb. 4, the day it announced the optimization decision. At presstime they traded for 94¢ giving the company a $226 million market cap.

Be the first to comment on "Excelsior optimizes Gunnison ahead of first copper in Q2"