El Callao, Venezuela — It’s a story that would make a Goldcorp shareholder nod and smile in recognition: workers at a tired, high-cost underground gold mine in a historic gold camp drill into a new zone and discover massive, bonanza-grade reserves that revitalize both the mine and the company that owns it.

In this case, however, it’s the Colombia mine in southeastern Venezuela’s venerable El Callao gold district, and the miner is

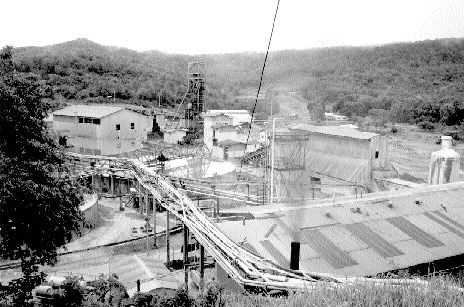

The mine is serviced by a single 479-metre-deep shaft, sunk in the late 1970s, which now provides access to seven production levels, the lowermost of which is under development.

In the upper levels, miners are exploiting two moderately dipping gold-bearing quartz veins, named Colombia and America, which grade about 15 grams gold per tonne and are about 2 metres wide but can widen to as much as 5 metres.

About a year ago, Minerven discovered a high-grade zone, known as El Bolson (“the handbag”), below the mine’s 5 level, where the Colombia and America veins intersect.

El Bolson is about 100 metres long and 20 metres wide, and the orebody remains open at depth below the mine’s 7 level. Resources within El Bolson stand at 900,000 tonnes grading 35 grams gold per tonne, enough to add 10 years to the mine’s life.

Currently, the mine’s deepest production level is about 400 metres, and workers there are mining material grading 44 grams gold per tonne (1.3 oz. gold per ton). The widening of the orebody at depth means that the narrow-vein mining methods being used in the upper portions of the mine have to be complemented by post-pillar stope methods in the deeper and wider high-grade zone.

The mine is now producing 230 kg gold per month, or 88,611 oz. per year, and the total mining cost is US$230 per oz., almost half the typical US$440-per-oz. cost recorded at the mine in the late 1990s.

Ore is milled at surface in a 700-tonne-per-day mill and also at Minerven’s nearby 450-tonne-per-day El Peru mill. Gold mineralization is closely associated with pyrite, so fine grinding is required to liberate the gold. These mills also accept feed from local artisanal gold miners and from a small, open-pit mine that Minerven operates on the Colombia property. The recovery rate from the Colombia mine is only 85%, though Minerven hopes to boost it to above 90% with certain mill modifications.

Last year, Montreal-based

Rafael Unzueta Hernando, Minerven’s assistant to the president, said “decisions take time at Minerven” because it is government-run, and so the decision on whether or not to go ahead with SNC’s recommendations will likely be delayed until next year.

Unzueta conceded that Minerven has tended to be more concerned with the social benefits of maintaining a large payroll than with aggressively striving for more efficient operations. With 900 workers, Minerven is the largest employer in the area, which has a population of 5,000 just within the town of El Callao, 3 km northwest of the mine.

Unzueta spoke enthusiastically about Minerven’s three agreements with private-sector companies in the El Callao district:

— The first is with Idaho-based

In March 2002, after a 2-year bidding process, Hecla beat out South Africa’s

The concession includes the historic Chile, Laguna, Santa Rita and Panama mines, which produced 1.5 million oz. gold between 1921 and 1946.

Hecla paid Minerven US$2.75 million in three stages for rights to the concession, and must also pay a 2-3% sliding-scale royalty on any future production.

Hecla initially focused on the Chile mine, which produced more than 550,000 oz. gold and still contains resources of about 245,000 oz. grading 21.7 grams gold, according to results from drilling carried out by Minerven a couple of years ago.

Hecla says its exploration of Block B has been “extremely encouraging,” and it intends to release a new reserve estimate shortly. With a final feasibility study in hand by the fall, the company could begin developing an underground ramp before year-end.

Meanwhile, south of El Callao in the Eldorado gold district, undergound gold mining is ongoing at Hecla’s flagship Venezuelan asset, the wholly owned La Camorra. The mine produced 67,000 oz. gold in the first half of 2003 and might have its shaft deepened in the coming years.

(Near La Camorra, Hecla is also active at its Canaima gold property, where a final feasibility study should be completed soon.)

Hecla Chairman and CEO Arthur Brown said “Block B is a very high-quality property . . . [and] an excellent complement to the La Camorra gold mine and the other exploration targets we have developed in Venezuela. These deposits are a perfect fit with Hecla’s expertise in hardrock, narrow-vein mining.”

For 2003, Hecla has doubled its exploration budget to US$10-15 million and will focus on six targets: the La Camorra, Block B, and Canaima properties in Venezuela; the San Sebastian mine in Mexico; the Greens Creek mine in Alaska; and the Hollister Development Block in Nevada.

The best percentage performer on the New York Stock Exchange in 2002, Hecla is set to produce 215,000 oz. gold and 9 million oz. silver this year at total cash costs of US$150 per oz. and US$2.16 per oz., respectively.

— Minerven’s second alliance in the El Callao district is a joint venture with China’s Shandong Gold to reactivate the Sosa Mendez underground gold mine, which has been mothballed for 44 years.

Shandong’s Venezuelan affiliate, Jinyan Co., is spending US$13 million in an effort to sink a 300-metre shaft and drain and repair Sosa Mendez’s underground galleries.

Some 350 workers are employed in building the mine, and 230 will be employed full-time, with a minimum Chinese technical staff.

From a current reserve base of 950,000 tonnes grading 13 grams gold, the mine will produce at a daily rate of 500 tonnes, generating about 50,000 oz. gold per year. Ore will be sold to and processed by Minerven’s El Callao operations.

China and Venezuela signed a co-operation agreement two years ago, and China has so far invested about US$650 million in the South American country, or about half its total investment in Latin America.

— Minerven’s third El Callao alliance was forged in 2000 with Spokane, Wash.-based junior

Choco 5 is immediately west of

Since Minerven and Gold Reserve signed their deal, work at Choco 5 has not progressed much beyond an airborne geophysical survey and some initial geochemical and geological work in areas already exposed by artisanal workings.

“We were keeping pretty quiet, because we had designs on Choco 4 and 10 ourselves,” said Douglas Belanger, Gold Reserve’s executive vice-president. “We tried to put the deal together but just didn’t have the personal relationship that Bolivar had with the cement company [the vendor]. As soon as we saw that they got it, we started to buy shares in Bolivar Gold, because we think that’s a heck of a property, and the area is so prospective and has never been properly explored.”

In early July, Gold Reserve and Bolivar agreed to explore Choco 5 jointly, with B

olivar earning a half-stake by picking up the bill for the next 12-18 months of exploration.

Just a couple of weeks later, Bolivar and Gold Fields announced their intention to co-ordinate their exploration efforts in the El Callao district (excluding the Choco 4 and 10 concessions), with Bolivar contributing its potential stake in Choco 5 to the JV.

Belanger said Gold Reserve is pleased that Gold Fields is now exploring Choco 5: “We understand Gold Fields wants to look at this whole thing as a district and do a proper job on the whole area. We felt that that’s what it really needed — to have a major come in with proper funding. To have a company the quality of Gold Fields come in here says something about the area and something about the country — that you can do business here.”

Brisas

Gold Reserve’s priority remains its 10-million-oz. Brisas gold asset, immediately south of

Having spent US$70 million on Brisas to date, Gold Reserve has determined it has the potential to be a 50,000-tonne-per day operation producing 362,000 oz. gold and 20,900 tonnes copper annually at a net cash cost of US$153 per oz. gold, using processing technology developed by

Although Gold Reserve has studied the possibility of co-developing Brisas with Las Cristinas, Belanger said the company is prepared to develop the asset as a stand-alone operation, and that “the key is not the technical aspect but the financial aspect.”

Back in El Callao, Unzueta said that Minerven is keen to enter into additional agreements with private-sector companies in the El Callao district, since his company has many gold properties here but little capital available to develop them.

“A few companies are already talking to us, and we hope to do something this year,” he said, noting that Hecla was looking at the Choco 3 concession, and that the Chinese group was looking at the Gloria gold asset.

In the area, Minerven has 12 concessions, including Block C, which encompasses gold resources directly under the town of El Callao. Unzueta said his company has “big plans” for resuming exploration deep under the town, but that currently there is an ongoing effort to collect and sort through all the pre-existing data generated over the past 150 years.

Gold Fields could be of use in this respect, since the company is said to still possess information from its mining activities in the area during the first half of the 20th century.

There is also the potential to reprocess the Colombia mine’s tailings, which amount to 4 million tonnes grading 0.8 gram gold, or 100,000 contained ounces of gold.

The remaining foreign player in the El Callao district is Crystallex, whose activities are centred around acquiring gold ore for its underfed Revemin mill. The mill operated at only half its 1,500-tonne-per-day capacity in the first quarter, reflecting what Crystallex says is “insufficient funding of the mining contractor” at its La Victoria open-pit mine, on the Lo Increible property, adjacent to Revemin. Victoria produced 3,176 oz. gold in the first quarter, off from 4,302 oz. a year earlier.

As well, first-quarter gold recoveries from Victoria ore plummeted to 71% from 90%, year over year, as the company began milling refractory sulphide ore in April 2002. Crystallex plans to improve the recovery rate by year-end by adding a flotation circuit and regrind mill to Revemin at a cost of US$1.2 million.

Undeterred

Undeterred by the above problems, the company plans to boost Revemin’s capacity next year to 1,800 tonnes per day in order to accept feed from La Victoria (1,550 tonnes) and new underground operations at its Tomi mine (250 tonnes), in the eastern portion of the El Callao camp.

Regarding Tomi’s underground development, Crystallex reports that the first underground ore lenses were encountered at the end of the first quarter and that ore production is under way, albeit at the rate of only 1,500 tonnes per month.

By the end of 2003, the company expects to have reached stopes 2, 3 and 4, which should allow it to ramp up to full production of 6,000 tonnes per month by early 2004.

Meanwhile, work crews are trying to improve the ventilation system by building a fan-house on top of the new ventilation raise and installing a larger fan.

In March, on the Tomi property, the company reactivated the Mackenzie pit to compensate for the drop in output from La Victoria. Plans call for the mining of roughly 100,000 tonnes of Mackenzie ore through October 2003, which would add about 9,000 oz. of gold production.

The Tomi concession produced 387 oz. gold during the first quarter, with ore sourced from the Mackenzie and Milagrito pits.

Crystallex’s total cash costs in Venezuela (comprising Victoria, Tomi and some purchased material) climbed to US$461 per oz. in the first quarter from US$280 per oz. a year earlier.

Crystallex acquired the Revemin mill and Tomi from Bolivar Goldfields in August 2000 for US$20 million and the assumption of US$13 million in debt. Bolivar had been operating the Tomi mine for three years at the rate of 55,000 oz. per year.

Las Cristinas

In early 2001, Crystallex acquired the Lo Increible property by obtaining

Crystallex’s primary focus is Las Cristinas, which, in September 2002, it agreed to develop jointly with CVG.

Crystallex has hired SNC Lavalin to complete both a feasibility study and an environmental impact study at Las Cristinas, both of which are said to be on budget and on schedule for completion by September.

In March 2003, Reno-based Mine Development Associates (MDA) revised its estimates for Las Cristinas, pegging proven and probable reserves at 224 million tonnes grading 1.33 grams of gold per tonne (9.5 million contained oz.), measured and indicated resources at 439 million tonnes grading 1.09 grams gold (15.3 million oz.), and inferred resources at 208 million tonnes grading 0.91 gram gold (6.1 million oz.).

Near Las Cristinas, Crystallex owns the dormant Albino open-pit gold mine, which operated from 1994 to 1998. The company is considering developing an underground mine at the property, which still hosts resources of 3.3 million tonnes grading 4.02 grams gold, at a cutoff grade of 0.5 gram per tonne, including a 301,000-tonne core grading 15.7 grams gold.

MDA calculates that underground mining could be carried out at Albino at an operating cost of US$53.68 per tonne, or US$129 per oz. It concludes Albino is a “small, but good-quality project . . . [with a] mineralized zone [that] is well-defined by drilling and supported by previous mining.”

Trading in Crystallex shares was halted July 9 as part of an ongoing review by the Toronto Stock Exchange of the company’s eligibility for continued listing. The review has been extended to Aug. 6, and trading remains halted.

Crystallex responded by releasing, on July 30, its restated financial statements for 2000, 2001, 2002 and the first quarter of 2003 as they related to the company’s accounting treatment of its gold forward contracts and written call options.

The restatement, audited by Deloitte & Touche, gives effect to changes in the timing and recognition of premium income and mark-to-market adjustments relating to these derivatives under Canadian and U.S. accounting principles.

The result is US$10.9 million more in losses than was first reported, including the following:

— For 2000, a net loss of US$0.4 million was restated to a net income of US$4.6 million.

— A net loss of US$36.7 million in 2001 was restated to a net loss of US$42.6 million.

— A US$39.8-million net loss in 2002 was restated to a net loss of US$56.5 million.

— For the quarter ended March 31, 2003, a net loss of US$29,000 was restated to a net income of US$6.7 million.

Crystallex says t

hat in its fiscal years 2000 and 2001, it initially recognized premium income on certain call options at the time the call options were written. Instead, the company says, it should have set up a deferred credit on its balance sheet.

The company notes that, over the full term of the transactions, the total contribution from these transactions will be the same under the new accounting as under the old treatment. Also, the financial statements for 2000, 2001 and 2002 and for the quarter ended March 31, 2003, were restated to reflect, on a mark-to-market basis, the company’s gold forward contracts.

Crystallex says these last changes will result in “significant fluctuation in profit and loss” for accounting purposes.

Be the first to comment on "El Callao district abuzz with activity"