The unofficial theme of this year’s annual gathering of the world’s biggest gold miners at the Denver Gold Forum in Colorado Springs, Colo., in late September could very well have been “steady as she goes,” as miners continue to consolidate their hard-won gains in debt reduction and operational efficiencies over the last several years.

The market is showing its approval, with gold-mining equities for the first time in many years modestly outperforming gold, with the NYSE Arca Gold Miners Index up 18%, versus a 15% gain in gold over the first eight months of 2017.

Like last year, the focus of most of the gold executive’s speeches was on optimizing assets and maximizing free cash flow. The current crop of execs show little appetite to return to the grandiose mergers and acquisitions and multibillion-dollar megaprojects of years past that brought such economic ruin to the industry.

Barrick Gold keeps its title as the world’s largest gold miner by production. After years of asset sales, cuts and consolidation, Barrick has settled on optimizing what it calls its four “core” mining complexes: Barrick Nevada; Pueblo Viejo in the Dominican Republic; Lagunas Norte in Peru; and Veladero in the Argentine-Chilean border area. Barrick expects 70% of its 2017 production will come from these four core assets at all-in sustaining costs of US$650 to US$700 per oz., fulfilling the company’s goal of being the lowest-cost senior gold producer.

Barrick has 86 million oz. gold in reserves — the largest in its peer group — with 45% being held in the four core assets. Companywide, Barrick expects to produce 5.3 to 5.6 million oz. gold in 2017 at all-in sustaining costs of US$720 to US$770 per oz. gold.

Regarding this June’s sale of 50% of Veladero to China’s Shandong Gold Group for US$960 million, Barrick president Kelvin Dushnisky said that the “integration with Shandong is going exceptionally well,” and the two are forming a working group to look at restarting development of the nearby Pascua-Lama gold project, which was mothballed due to major cost overruns. The partners are evaluating using underground block caving, starting on the Lama side in Argentina and progressing underground to Pascua in Chile.

Dushnisky also highlighted Barrick’s relentless debt-reduction efforts, which have seen total debt fall from US$13.1 billion at the end of 2014 towards a target of US$5 billion by the end of 2018.

Newmont Mining president and CEO Gary Goldberg was equally upbeat about his company’s outlook, stating that “we’ve got our house in order” and that his team has “improved our underlying business performance, and we are running safer and more efficient operations. We’ve strengthened our portfolio by investing in profitable and sustainable growth, and we’ve created value in the form of steadily improving free cash flow and dividends.”

With mines in the U.S., Suriname, Peru, West Africa and Australia, Newmont’s attributable gold production in 2017 is forecast at 5 to 5.4 million oz. gold at consolidated all-in sustaining costs of US$900 to US$950 per oz. gold.

“Our strategic focus is shifting from improving the underlying business to delivering superior operational execution,” Goldberg added.

Newmont has recently surpassed Barrick as the gold company with the largest market capitalization (US$20.25 billion versus US$19.49 billion on Oct. 12.)

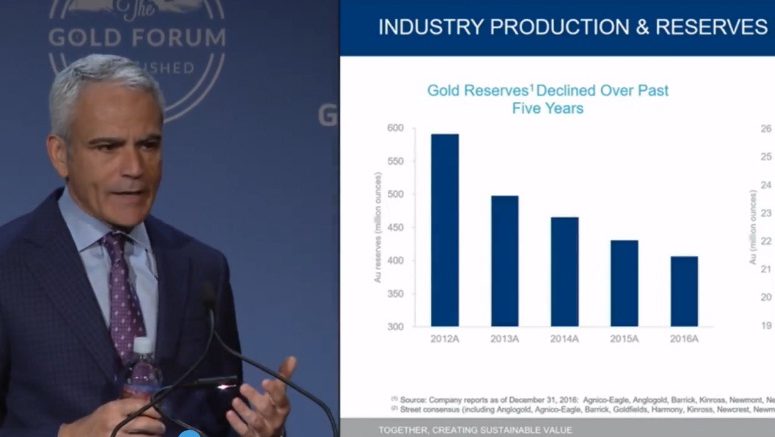

In his opening remarks, Goldcorp president and CEO David Garofalo noted that he’s seen the industry’s cycles, and that he wanted to “contrast this [meeting] with where we were five years ago at the peak of the cycle, and I remember standing up at the BMO conference and saying ‘the supercycle is a bit of a fallacy: we’re all overbuilding and introducing way too much supply into the industry across the metals complex.’ I thought it would end in tears, and it did … our egos, collectively as an industry, needed deflating.”

Now, he said, “We find ourselves at the other end of the cycle — we’ve made a 180-degree turn as an industry … we tend to augment the cycles by overbuilding at the peak and under-building at the bottom of the cycle, and that’s exactly what’s happening now. Growth is a dirty word.

“I’m a big believer in counter-cyclical investment: buying and building at the bottom of the market. That’s how I’ve made my career and how the companies I’ve helped — Inmet, Agnico, Hudbay — have made significant value propositions for their shareholders.”

Goldcorp expects to produce 2.5 million oz. in 2017, rising to 3 million oz. in 2021. Garofalo says a sustainable business model for any major gold-mining company is to produce 3 to 4 million oz. gold annually from six to eight large-scale camps.

[Note: A previous version of this article incorrectly stated that Barrick Gold had the largest market capitalization among gold mining companies.]

Be the first to comment on "Editorial: Gold majors gather in Colorado Springs"