Lucapa Diamond (ASX: LOM), which holds the Lulo alluvial mine in Angola and the Merlin project in Australia, has struck a rescue deal with a Dubai-based group that could pull it from administration.

Administrators KordaMentha have signed a deed of company arrangement with Jemora Group’s Gaston International, which has agreed to inject about A$15 million (US$10 million). If creditors and the court approve, the proposed deal would restructure the company and transfer its shares to Jemora’s control. A creditor meeting is scheduled for August 20.

The deal would see creditors paid in full and shareholders receive a partial payout of up to A1.8¢ per share — an improvement on Lucapa’s May 12 closing price of A1.4¢. Over the prior 12 months, Lucapa shares traded between A9.7¢ and A1.3¢.

Jemora, a metals and mining conglomerate aiming to make the United Arab Emirates a hub for resource investment, operates Gaston as its energy and precious metals arm targeting underperforming assets. It also holds the Chacarilla copper mine in Bolivia.

Industry decline

Lucapa entered administration in May due to a combination of slumping diamond prices, intensifying competition from synthetics and mounting operational setbacks.

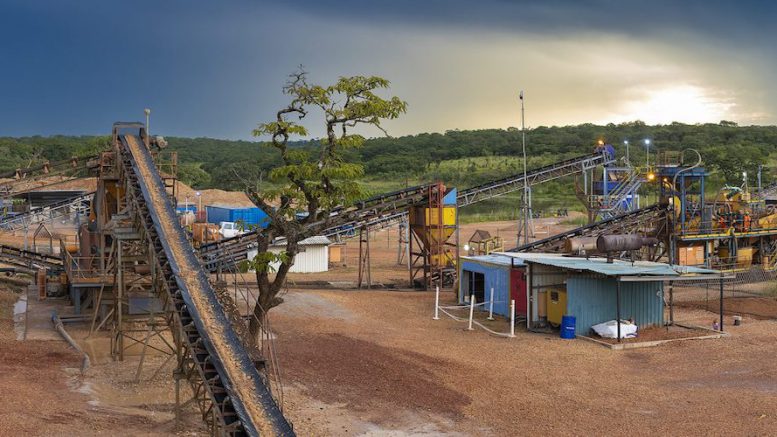

The collapse followed last year’s sale of its Mothae mine in Lesotho, leaving Lulo as its only source of income. That operation has suffered from flooding in higher-grade areas and a blockade by local leaders in February this year.

Efforts to raise equity in April failed, as did a sale of a 40% stake in Merlin. Administrators determined Lucapa became insolvent by May 21, though financial stress had been evident since 2023.

Be the first to comment on "Dubai firm offers $10M lifeline to Lucapa Diamond"