In 2008, for the first time ever, Saskatchewan led the country with about $9.7 billion in mineral sales. In 2009, however, preliminary indications are that the value of mineral sales declined, reflecting the impact of declining commodity prices and the global economic crisis.

Preliminary estimates are that companies spent roughly $292.9 million exploring for minerals in Saskatchewan in 2009. This is well above historic levels (see Table 1), although it is less than the record $474 million spent on exploration in 2008.

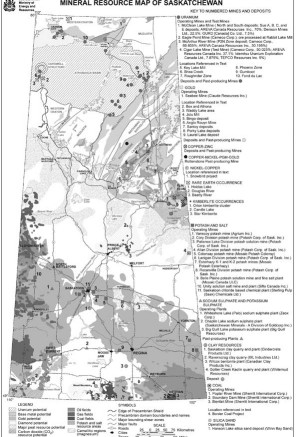

The strength of Saskatchewan’s mining industry is due to its rich and diverse mineral endowment, which reflects the geologic diversity of the province. Saskatchewan continued to be one of the largest global producers of uranium and potash. Other minerals mined included: gold, coal, sodium sulphate, kaolinite, aggregate, bentonite, and silica sand. In addition, potential for diamonds, base metals, and rare earth elements attracted exploration for those minerals.

Mineral claims remained at a high level, although they continued to decline gradually from the record levels achieved in 2007. As of Jan. 31, 2010, there were 4,394 active mineral dispositions totalling about 64,000 sq. km and 184 active potash dispositions covering an additional almost 43,000 sq. km. A recent coal discovery in the Hudson Bay area incited a staking rush for coal in east-central Saskatchewan and as of Dec. 31, 2009, there were 6,455 active coal dispositions totalling about 41,000 sq. km.

Uranium

Uranium was produced from three operations in 2009: the McArthur River mine and Key Lake mill and Eagle Point mine at Rabbit Lake, owned by Cameco; and the McClean Lake mine, owned by Areva Resources Canada, Denison Mines and OURD Canada. Total production in 2008 was 23.4 million lbs. U3O8, down from 24.6 million lbs. in 2007. The McArthur River mine produced 16.6 million lbs. of the total. In the first three quarters of 2009, Saskatchewan uranium mines produced roughly 18.4 million lbs. U3O8; forecasted production for the entire year was 25.7 million lbs U3O8.

The spot market price of uranium fluctuated between US$42 and US$52 per lb. U3O8 through 2009 ending the year with a price of US$44.50 per lb. U3O8, according to Ux Consulting Co. The January 2009 long-term price of US$70 per lb. U3O8 also fell to US$62 per lb. at year’s end. Concerns about potential supply shortages, heightened by recent production shortfalls at mining operations around the world, still bode well for the long-term demand for uranium. National and international concerns about greenhouse gas emissions from fossil fuels also enhance uranium’s medium-and long-term prospects.

In the Athabasca basin, the world’s premier exploration district for high- grade uranium deposits, it is estimated that about $124 million was spent on exploration in 2009, down from actual expenditures in 2008 of nearly $204 million. Major programs include those of producers Cameco and AREVA Resources Canada, mid-sized company Denison Mines, and junior companies UEX Corp., and Hathor Exploration. Exploration successes continue to be reported, underlining the potential of the basin. Highlights in 2009 include continued positive results from Hathor’s Roughrider zone, and AREVA-UEX’s Shea Creek property; new discoveries include the Phoenix zone at the Denison- operated Wheeler River joint venture property, Pitchstone Exploration’s Gumboot property, and CanAlaska Uranium’s extension of the Fond du Lac deposit.

Gold

The Seabee mine, owned and operated by Claude Resources, is Saskatchewan’s lone producing gold mine. In 2009, Claude produced 46,800 oz. gold, a slight increase over the 45,466 oz. produced in 2008. To date, the Seabee mine has produced about 880,000 oz. gold.

Despite strong gold prices in 2009, gold exploration expenditures in the province are estimated to have dropped by more than 50% from a recent high of $8.9 million in 2008. Claude has continued to have success exploring in the Seabee mine and surrounding area. Linear Gold recently took over the Goldfields project near Uranium City from GLR Resources and released an updated feasibility study for the Box deposit and prefeasibility study for the Athona deposit, to reflect a higher current gold price. Golden Band Resources continues to make important progress toward its goal of production at its La Ronge Gold Belt project (including the Bingo deposit, deposits in the Waddy Lake area, and the Jolu mill). Golden Band has completed a positive prefeasibility study, received approval from the Saskatchewan Ministry of Environment, and settled a surface lease agreement for their La Ronge Gold Belt project area. Skeena Resources is moving ahead with a plan to mine the copper-gold tailings at the old Anglo- Rouyn mine. St. Eugene Mining has acquired a 35% interest in Claude’s Amisk Lake property with the intent of mining the Laurel Lake gold deposit.

Base metals and rare earths

There was no base metal production in Saskatchewan in 2008. The drop in commodity prices was particularly reflected in the lower levels of base metal exploration in 2009. Strongbow Exploration conducted some preliminary exploration for mafic-ultramafic-hosted nickel sulphide mineralization on its Snowbird project in the Dodge Domain, about 35 km north of Stony Rapids and MacDonald Mines Exploration continued to explore its Nielsen-Chisholm property northwest of La Ronge. HudBay Minerals announced that it plans to close the Flin Flon copper smelter by July 2010, heralding the end of an era in the Flin Flon area.

Interest in rare earth elements (REE) increased significantly in the latter half of 2009. Great Western Minerals Group (GWMG) currently has three REE properties, in the Hoidas Lake, Douglas River, and Beatty River areas, respectively. In November, the company released an updated National Instrument 43-101 report for the Hoidas Lake project, which outlined measured resources of 963,808 tonnes grading at 2.568% (weight) total rare earth oxide, and indicated resources of 1.6 million tonnes grading 2.349% TREO. GWMG also signed a letter of intent with Toyota Tsusho Corp.

to discuss possible joint exploration and development of the Douglas River property. Other REE exploration was undertaken by Butler Resource on its Archie Lake rare earth project east of Uranium City; and at the Baska- Eldorado REE-uranium project, 55 km southeast of the Key Lake uranium mill, which 99 Capital Corp. is buying from Eagle Plains Resources.

Diamonds

Diamond exploration expenditures in 2009 were forecast to be significantly lower than the actual expenditures of $73.2 million in 2008. The decreased spending is a direct result of the two largest diamond projects in the province, the Star and the Orion kimberlite projects, moving from the cost-intensive exploration phases to the less expensive feasibility and prefeasibility stages, respectively. Shore Gold completed a positive prefeasibility study on its 100%-owned Star project. The study outlined probable reserves of 171 million tonnes at a weighted average grade of 12 carats per hundred tonnes (cpht), with an average weighted price of $265 per carat. The study estimated that a mine at Star could produce roughly 20 million carats over a 12-year mine life, and would cost about $1.5 billion to build. Following the recommendations of the prefeasibility report, which was prepared by P&E Mining Consultants, Shore has advanced the project to the feasibility stage. Shore estimates that it will have the feasibility study completed, and that a production decision will be made, by the end of the first quarter of 2010.

The Orion project is owned by the Fort la Corne Joint Venture (FalC JV), which is a partnership between Shore subsidiary Kensington Resources (60%), and Newmont

Mining (40%). In September 2009, Shore, who acts as project operator, released a National Instrument 43- 101-compliant resource for Orion outlining an indicated resource of 84 million tonnes grading 13.8 cpht, and inferred resources of 98 million tonnes grading 12.8 cpht. With a surface area of about 4 sq. km, the companies believe that Orion South is one of the largest diamond-bearing kimberlites in the world. Shore believes that the resources at Orion South could significantly enhance the economics of a diamond mine in the Fort la Corne area, and the company released a prefeasibility study on the combined Star and Orion South projects in February. The study found that a combined operation could produce 35 million carats over 20 years from a probable reserve of 279 million tonnes at a weighted average grade of 12.5 cpht and a weighted average price of $226 per carat. The study put the total capital cost at $2.5 billion.

Potash

In 2008, Saskatchewan’s potash production was at near-record levels (16.1 million tonnes KCl), and a new record was set for the total value of potash sales at $8.3 billion. In 2009, the global recession, and protracted negotiations with key Asian clients, resulted in a drastic decrease in potash demand. This translated into production curtailments and temporary layoffs at most mines. It is expected that 2009 production was less than half of that in 2008. Despite this setback, most industry analysts agree that the long- term forecasts for potash demand remain very positive. This sentiment is echoed by Saskatchewan’s three potash-producing companies, which are spending an estimated, collective $11.9 billion on expansions to the province’s current potash mining operations. These expansions would nearly double Saskatchewan’s potash production capacity by 2020.

Aside from the three current producers, there are now over a dozen different companies involved in potash exploration in Saskatchewan. Prior to this recent activity, only 2,063 sq. km of land were held for potash, but as of December 31, 2009, over 43,000 sq. km of land are now under disposition for potash exploration and development. From 2007 to 2009, seismic programs totalling more than 20,000 line-km had been applied for over potash dispositions, and more than 50 potash test well licences had been granted to various potash exploration companies. Potash exploration comprised the majority of the estimated $150.6 million spent exploring for industrial minerals in Saskatchewan in 2009. Greenfield potash projects range from the preliminary exploration stage to the feasibility stage. Some of the more advanced projects include: BHP Billiton’s Jansen project, Athabasca Potash’s Burr project, and Potash One’s Legacy project. BHP recently announced it will spend $240 million on Jansen and $341 million to purchase the Burr project, and the remainder of Athabasca’s potash assets.

Coal

Coal production in Saskatchewan is currently restricted to the extensive lignite deposits of the Tertiary Ravenscrag Formation in the south of the province. Sherritt International operates three mines and reported that in 2008, the Poplar River (2.6 million tonnes), Boundary Dam (6 million tonnes), and Bienfait (900,000 tonnes) mines together produced 9.5 million tonnes of coal. SaskPower uses most of this coal at its thermal power generating stations.

Coal exploration activity in east- central Saskatchewan, sparked by Goldsource Mines’ 2008 discovery of anomalously thick coal deposits in the area, continues to be very active. Several companies have conducted airborne geophysical surveys and are undertaking exploratory drilling programs. Goldsource’s Border project is the most advanced coal exploration program in east-central Saskatchewan. Goldsource has now drilled 119 holes on its Border property and has delineated 15 coal deposits with composite thicknesses, including partings, as great as 100 metres. A recently completed resource estimate showed the property has 63.5 million indicated tonnes and 89.6 million inferred tonnes. Preliminary results indicate the coal is ranked as Sub-bituminous A to C, according to ASTM standards. The coal’s as received ash, sulphur, and moisture contents range by weight from: 11.7% to 22.1%, 1.5% to 3.2%, and 17.7% to 33.4%, respectively.

Coal exploration activity has also been rejuvenated in other parts of the Saskatchewan as companies look to implement new technologies to exploit the province’s vast lignite resources. NuCoal Energy is investigating the feasibility of building a coal-to-liquids plant on its South 50 project area in southern Saskatchewan. The plant would use coal gasification technology to convert raw lignite into liquid fuels.

Kaolin

Whitemud Resources reopened its meta-kaolin plant in spring 2009 after upgrades were made during the scheduled winter shutdown to improve productivity and reliability of the facility. The company continues to make inroads into a cement industry that was hit particularly hard by the recession. Whitemud’s meta-kaolin is gaining more attention and is being used in large- scale institutional projects such as the University of Calgary’s Taylor Family Digital Library and Energy Environmental Experiential Learning building.

———

Table 1: Mineral exploration expenditures in Saskatchewan

(in millions of dollars)

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009*e $17.7M $14M $15.4M $13.3M $31.2M $74.6M $123.7M $199.2M $204.4M $124.2M

Diamonds $4.1M $4.8M $6.1M $12M $22.4M $55.4M $98.8M $76.6M $73.2M $13.8M Gold

Uranium

$0.7M $1M $2.5M $2.9M Base metals $4.5M $1.4M $1.9M $2.2M $0.9M PGEs

Other ** Total

$5.7M $15.3M $13.8M $15.3M $8.9M $2.6M$1M $0.1M $0.6M $0.5M — — — — — — $0.1M $0.8M $1.3M $0.5M $0.5M $28.1M $22.1M $27.8M $31.4M $60.7M $150M $243.6M $325.3M $474M $292.9M$2.9M $1.8M

$3.9M $11.5M $6.8M $1.7M $3.4M $22.7M $180.7M $150.6M

Be the first to comment on "Diversity Sees Saskatchewan Through The Doldrums"