The world’s second-largest economy leads the energy transition and is on track to source half of its power from low-carbon energy including hydro, solar, wind, nuclear and energy storage by 2028, according to resource consultancy Wood Mackenzie.

“Never has the world witnessed the pace of growth or transformation of an energy system that China is currently achieving,” Malcom Forbes-Cable, Wood Mackenzie’s vice president upstream and carbon management consulting, wrote in a report Thursday. “By 2025, China’s installed solar and wind capacity will exceed that of both Europe and North America.”

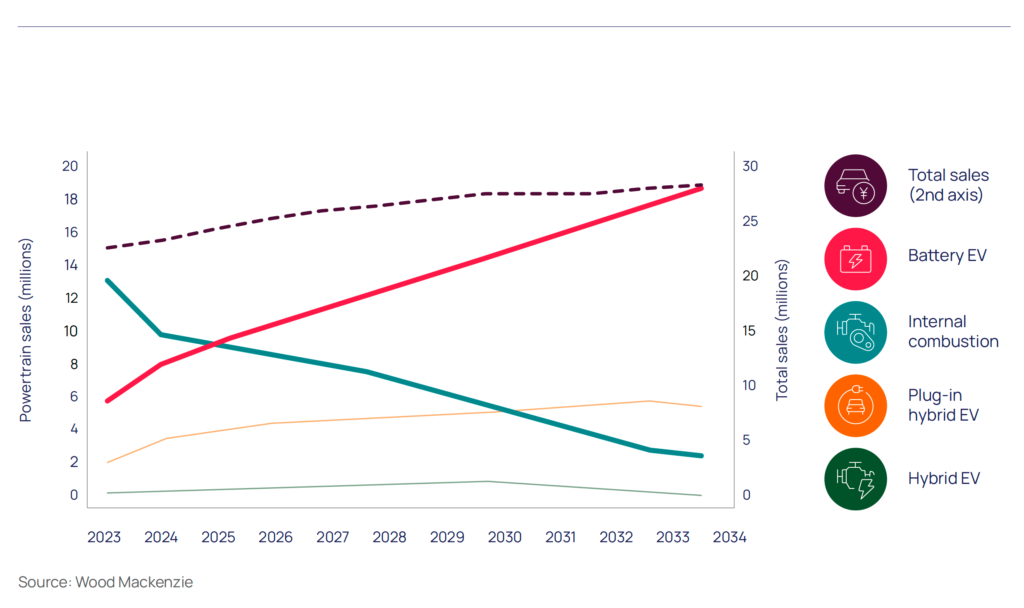

The country is crushing its global competition in the transportation sector, too. Battery electric vehicles (BEVs) will make up about two-thirds of China’s passenger car sales by 2034 and that percentage grows to 89% if hybrid electric vehicles are included.

BEVs are projected to grow by 8% annually through 2030, while sales of internal combustion engine (ICE) vehicles are expected to decline by 11% each year, according to the consulting company.

“This extraordinary growth of the Chinese EV auto industry is transforming the domestic market and flowing through to the global market,” Forbes-Cable writes.

EU duties on Chinese EVs

China’s growing market share of Europe’s EV market has been a flashpoint in trade relations between Brussels and Beijing. In October, the European Commission, which oversees European Union trade policy, increased tariffs on Chinese-built EVs to as much as 45.3%. The tariffs range from 7.8% for a Tesla built in China to 35.3% for EVs built by state-owned SAIC Motor.

The taxes are on top of the EU’s standard 10% car duty and followed an anti-subsidy probe last year, which found Chinese subsidies for domestic carmakers included cheap land for factories, lower prices for lithium and batteries produced by state-owned enterprises and tax and financing breaks from state banks. The subsidies have helped Chinese EV makers undercut their European rivals.

The market share of Chinese-brand electric vehicles in the European Union hit 27.2% in the second quarter of this year, up from 25.4% in the fourth quarter of 2023 and 25.4% in the fourth quarter of 2022, according to import data on the European Commission’s website.

China passenger vehicle sales. Credit: Wood Mackenzie

Westerners struggle

Intensifying competition from Chinese carmakers is dampening sales for Western rival Tesla. In November Tesla’s sales in China dipped 4.3% year-on-year to 78,856. By contrast, BYD, a privately held Chinese carmaker, sold 504,003 cars that month.

Other foreign car manufacturers in China are feeling the pinch. In a securities filing on Dec 4, Detroit-automaker General Motors said “market challenges and competitive conditions” in China would result in a US$2.6 to US$2.9 billion write down of the value of its stake in partnerships with China’s SAIC Motor.

Chinese prefer local brands

China’s ability to make cheaper yet technologically advanced EVs is also driving more domestic consumers to homegrown brands like by BYD and Geely, experts say.

“China’s success in EV car manufacturing has been characterized by a cost-to-quality ratio that the competition struggles to match,” said Wood Mackenzie’s Forbes-Cable.

In a recent Wall Street Journal podcast, Amrith Ramkumar, who covers the auto and tech sectors for the newspaper, noted that what the impact will be from competition from Chinese EV makers is the “million, billion, trillion, dollar question.”

“A lot of the Chinese EVS, investors and executives say, are superior in many ways, and they cost a fraction of what EVs cost in the U.S. and Europe,” he noted. “You can factor in tariffs, but even with the tariffs, the Chinese cars still might be roughly cost-competitive, which is mind-boggling.

Companies like BYD, CATL, they’re the global leaders in the space. And what many people are worried about is that if the U.S. takes a back seat in the EV industry and doesn’t prioritize this area in the next four years, China’s lead will get even bigger.”

Clean power leader, too

According to Wood Mackenzie’s analysis, low-carbon sources of power will deliver half of China’s power generation by 2029 and solar and wind will surpass coal-fired power by 2037.

“This rapid change is being driven by a long-term strategy of energy security and decarbonization, which is supporting the rapid expansion of the power market,” Forbes-Cable said. “In the last five years, annual power demand growth has been 6% and, to 2030, the outlook is for 5%. This growth is being driven by strong government policy, support for industry, electrification, high-tech manufacturing, data centres and strong residential and commercial demand.”

China total power generation mix, 2015-40. Credit: Wood Mackenzie

‘Fourth Industrial Revolution’

China realizes that increasing its power generation is key to building the infrastructure required for the new economy and demands for more data centres that are necessary to support everything from artificial intelligence to cloud computing and big data, Forbes-Cabled added. Other demands will come from cleantech, semiconductors, batteries, renewable energy equipment and electrification.

Rivals must step up

“Increasing power output is fundamental to the success of the new economy,” he continued. “The challenge of meeting the power demands of high-tech growth is not unique to the U.S., but crucial if the country wants to maintain its leadership in the field of digital technology amid growing competition from China, which has demonstrated unparallelled capacity for rapid market expansion and economic growth.”

Be the first to comment on "China leads world in energy transition, Wood Mackenzie says"