With prestripping well under way following dewatering of the A-154 open pit, construction and commissioning of the Diavik diamond project in Canada’s barren north is on budget and ahead of schedule.

The mine is now expected to deliver its first diamonds to joint owners

The price tag of the Diavik mine project is a staggering $1.3 billion. The mine will employ a workforce of roughly 450.

The project is centred on a small, 20-sq.-km island on the eastern shores of Lac de Gras in the Northwest Territories, 300 km northeast of Yellowknife and 30 km southeast of the Ekati diamond mine.

The mine plan will see four kimberlite pipes deliver 107 million carats of diamonds averaging a value of US$62 per carat over a span of 20 years.

London’s Rio Tinto is the operator and owner of a 60% interest in the project through its wholly owned subsidiary, Diavik Diamond Mines (DDM). Aber, with the remaining 40%, expects the project to have a payback of 2.7 years and generate more than $150 million in annual profits for Aber alone.

The four kimberlite pipes — A-154 South, A-154 North, A-418 and A-21 — all lie offshore in the shallow waters of Lac de Gras. They are to be mined by open-pit methods in three separate pits. Mining will eventually shift underground on A-154 South and A-418 in the latter part of the project’s life. Rio Tinto estimates the four pipes together contain proven and probable reserves of 27.1 million tonnes grading 3.9 carats per tonne. They host an additional geological resource of 11 million tonnes grading 2.4 carats per tonne, or an extra 26.4 million carats. Despite their limited size, the pipes are known to be among the richest in the world.

A series of water-retaining dykes will be built from shore, surrounding the kimberlite bodies, so that mining can proceed.

The first 10 years of production will be dominated by the A-154 pit. This pit will incorporate the A-154 South and A-154 North pipes, which are only 100 metres apart. A-154 South is the largest pipe in the bunch and the highest-grade, containing more than half the reserves. An independent bankable feasibility study completed on behalf of Aber in May 2000 estimated that A-154 South contains a minable 11.7 million tonnes grading 5.2 carats per tonne, equivalent to 61.2 million carats. The A-154 South stones were valued by WWW Diamond Consultants at US$79 per carat, equivalent to US$412 per tonne of ore. A-154 North hosts a recoverable 1.3 million tonnes grading 3.5 carats per tonne, or 4.5 million carats at US$33 per carat.

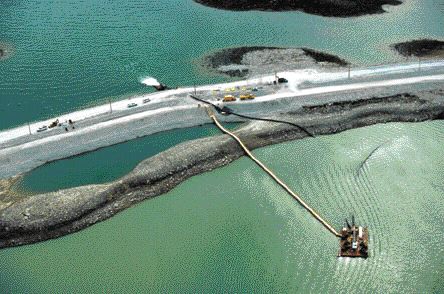

Construction of the first water-diversion dyke around the two A-154 pipes began in March 2001 and was completed this summer, some 16 months later, at an estimated cost of $400 million. A 3.9-km-long berm was built around the A-154 pipes using 6 million tonnes of crushed granite rock quarried from the island.

A 1-metre-wide, impervious plastic-cement wall in the centre of the dyke creates a waterproof barrier extending to bedrock along the dyke’s entire length. This prevents lake waters from seeping back in the de-watered A-154 pit. The dyke around pipe A-418 is scheduled to be completed seven years after commercial production begins, and the A-21 dyke should be finished in year 13.

Kimberlite A-418 hosts 8.7 million tonnes of minable reserves grading 3.4 carats per tonne, equivalent to a recoverable 29.3 million carats at US$56 per carat, whereas A-21 contains 4 million tonnes of minable reserves grading 3 carats per tonne, or 11.7 million carats, at US$28 per carat.

De-watering of the A-154 pit was conducted under controlled conditions over several months to allow gradual drainage of the pit waters. DDM notes that with every earth and rock-fill dam, some seepage will occur. Provisions have been made to ensure that this inflow will not affect the dyke’s integrity, and a system of collection channels and pumping stations has been built at the base of the dyke. The collected water is discharged to a water treatment plant before being released back into the lake. The pump stations are able to handle a discharge rate of 440 litres per second.

Canaccord Capital’s Graeme Currie recently conducted a site visit to the Diavik project and noted that the A-154 dyke was making water or leaking at the rate of 13 litres per second — well within design expectations.

Prestripping of 3.2 million cubic metres of lake sediment and overburden, ranging up to 30 metres in depth, is under way. DDM anticipates initial mining of the A-154 South kimberlite will begin in November, with increasing quantities of ore becoming available in December.

Construction of the diamond recovery plant and related camp infrastructure, such as the accommodations, power plant, maintenance and office complex, and heavy vehicle workshop, is largely completed. Commissioning of the kimberlite processing and diamond recovery plants are proceeding as planned. The front end of the processing circuit has already been tested with batches of kimberlite.

The mill circuit is designed to accept crushed kimberlite ore to a maximum 80-mm size fraction, which is then screened to minus 25 mm. Oversize material is re-crushed and screened. The minus 25-mm size fraction material is fed to a dense-media-separation (DMS) tower, where the addition of water and a ferro-silica thickening agent aid in the recovery of heavy minerals and diamonds.

The back-end of the circuit employs bulk wet X-ray sorters, infrared dryers, magnetic separators and single particle X-ray sorters, designed to capture, by airblast, each diamond larger than 1 mm. The circuit is designed so that no person comes into direct contact with the diamonds, thereby ensuring security.

The mine plan calls for a 2-year ramp-up period, after which annual kimberlite processing is expected to reach 1.5 million tonnes, with diamond production averaging 6 million carats per year. Mine site costs are estimated to be in the range of US$60 per tonne of kimberlite for the first 10 years of production and US$101 per tonne over the life of mine.

“Although the budgeted plant design is 1.5 million tonnes per annum on an operating availability of 76%, we believe there is ample opportunity to increase operating availability into the low 80% range,” states Currie. “This could translate into annual throughput levels reaching 1.6 million tonnes.”

As diamonds are recovered, they will be forwarded to the Diavik production splitting facility in Yellowknife for cleaning, division and royalty valuations. Rio Tinto and Aber each retain the right the market their respective share of diamond production. The Diavik property is subject to royalties of 2% split between

Aber has strategically aligned itself with upscale jeweller

Aber has also formed a joint-venture aggreement with Antwerp-based Overseas Diamonds to market a portion of Aber’s share of the Diavik production. The newly formed company, Aber Overseas, is owned 51% by Aber and 49% by Overseas Diamonds, a leading diamantaire and diamond manufacturer.

Aber Overseas will buy, directly from Aber, somewhere between US$50 million annually of rough diamonds and the balance of goods not sold to Tiffany (this balance is expected to be up to US$170 million annually in value). The marketing arrangement will allow Aber to share in the extra margin normally associated with a dealer of rough diamonds farther down the pipeline. Aber will supply the joint venture with sorted product on a “producer price” basis. Aber Overseas will act as a rough dealer, supplying a wide range of specialized clients with product priced and assorted with flexibility. The involvement of Overseas Diamonds in the joint venture suggests there is an opportunity to develop a polished sales business.

To service these marketing arrangements, Aber has established its own diamond-sorting facility in Toronto, where staff are now being trained.

The Rio Tinto-Aber joint venture continues to explore the Diavik property. Three new kimberlite bodies were discovered in 2002, bringing the number of known kimberlites to 63. DDM carried out an exploration program consisting of ground geophysical surveys, heavy-mineral sampling surveys, and small-diameter core drilling. Mini-bulk samples were collected from two kimberlite pipes. Sample results are still pending.

Be the first to comment on "Canada’s second diamond mine prepares for startup"