By trish Saywell

For a junior exploration company with shares trading at just 9.5¢, Calibre Mining (TSXV: CXB; US-OTC: CXBMF) is making pretty decent headway at its projects in Nicaragua.

The junior released drill results from two projects, the first from its wholly owned Montes de Oro project in the country’s Siuna district, and the second from its Eastern Borosi project, which is being financed under a 2014 option agreement with Iamgold (TSX: IMG; NYSE: IAG).

At Montes de Oro — a gold-copper-silver-zinc discovery — assay results from four drill holes of its planned 11-hole, 2,500-metre drill program include 12.3 metres grading 2.42 grams gold per tonne in hole 15-7, 2.6 metres grading 5.71 grams gold in 15-3 and 1.7 metres grading 8.20 grams gold in drill hole 15-2.

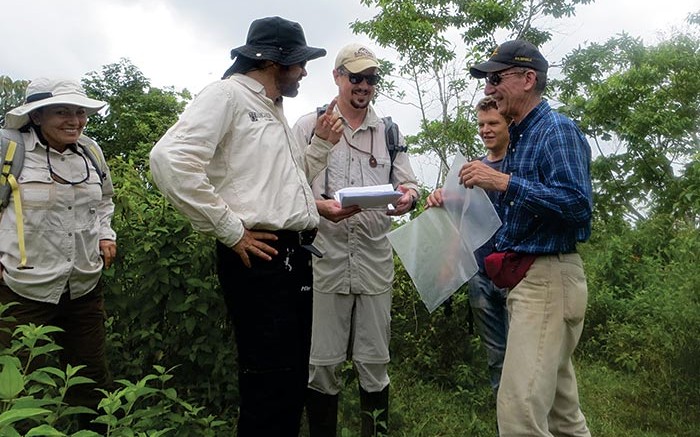

“We are seeing excellent gold grades associated with the sulphide mineralization,” Greg Smith, the company’s president and CEO, wrote in an email to The Northern Miner from the field.

Montes de Oro is 10 km north of the La Luz mine, which produced 17.1 million tonnes of ore grading 4.14 grams gold per tonne for 2.3 million oz. gold of historic production. About 1 km south of La Luz, Calibre’s Cerro Aeropuerto gold-silver deposit has an inferred resource of 6 million tonnes averaging 3.64 grams gold per tonne and 16.16 grams silver per tonne for 707,750 contained oz. gold and 3.1 million contained oz. silver.

The company believes that the higher gold grades at Montes de Oro are closely related to an increase in overall sulphides and vein density, and that these zones are reflected in the induced polarization geophysical anomaly measuring 300 by 500 metres, which it outlined in the first quarter.

Meanwhile, in its 2015 exploration program with partner Iamgold at the Eastern Borosi gold-silver project in northeastern Nicaragua, drilling at the Blag vein system has extended and defined mineralization on three targets: Main Blag, the East Dome and the Santos trend, all of which remain open at depth and along strike. East Dome is 500 metres east of Main Blag, while the Santos trend is 1,000 metres west of Main Blag.

Drilling at Main Blag returned 5.4 metres grading 2.99 grams gold and 31.6 grams silver, while drilling on the East Dome intersected 19.2 metres grading 1.11 grams gold and 223.4 grams silver, as well as 9.4 metres grading 488.6 grams silver and 0.69 gram gold. Highlights from the Santos trend include 4.7 metres of 7.84 grams gold and 6 grams silver, and 5.7 metres grading 2.18 grams gold and 3 grams silver.

“Drilling by Calibre and our partner Iamgold has intersected high-grade gold and silver mineralization in several zones,” Smith says. “Recent results have included stepout drill holes, which are following up on our success in 2014, and first-pass drilling of new targets with particularly good results from the Main Blag and East Dome targets.”

The Eastern Borosi project hosts gold-silver resources in two deposits and a series of well-defined, low-sulphidation epithermal gold-silver targets. Previous work there, including detailed soil sampling and trenching, has identified 25 more targets in the Blag area alone.

Iamgold can earn a 51% interest in the 176 sq. km project within the Borosi concessions by spending US$5 million in exploration and making US$450,000 in payments to Calibre by May 2017. Iamgold could earn a 70% interest in the project if it invests US$10.9 million. (The mid-tier producer has five operating gold mines on three continents.)

Calibre also has a joint-venture exploration program in Nicaragua with B2Gold (TSX: BTO; NYSE-MKT: BTG), the largest gold producer in the country. The JV covers 322 sq. km of concessions that include the Primavera gold-copper porphyry discovery and the Minnesota gold zone.

B2Gold has already earned a 51% interest in the concessions by spending $8 million. The two companies have also entered into an agreement that grants B2Gold an option to acquire a further 19% interest by spending another $6 million on the project over three years. (B2Gold has two gold mines in Nicaragua and one in the Philippines, plus a portfolio of development and exploration assets.)

Calibre has also optioned the 33.6 sq. km Rosita gold-copper-silver project to Alder Resources (TSXV: ALR), a Toronto-based junior exploration company. Alder has an option to acquire 65% of the Rosita D concession in northeastern Nicaragua, 275 km northeast of the capital Managua. A historic open-pit mine on the property called Santa Rita produced 305 million lb. copper, 177,000 oz. gold and 2.6 million oz. silver.

In 2012, Calibre calculated an inferred resource for Santa Rita of 7.95 million tonnes grading 0.6% copper, 0.46 gram gold per tonne and 9.2 grams silver per tonne. The company has also identified a high-grade copper-gold-silver zone at the Bambana target on the property, with a 12.1-metre intercept averaging 5.2% copper, 4.40 grams gold and 144 grams silver.

Major shareholders in the company are B2Gold (13.5%), Pierre Lassonde (11.2%) and management (9%).

According to Calibre’s most recent corporate presentation in June, gold was Nicaragua’s number-one export in 2013, and the precious metal has helped the country’s economy grow by 4% annually in recent years. Nicaragua’s annual gold production has doubled in the past four years, Calibre states, and the country has “supportive mining laws and a favourable tax regime.” It also notes that the Economist Intelligence Unit ranks Nicaragua as one of the safest countries in Central America.

Be the first to comment on "Calibre makes progress in Nicaragua"