BHP (NYSE, LSE, ASX: BHP), the world’s largest miner, is considering the reopening of four long-closed copper mines in Arizona, the centre of the copper industry in the United States.

CEO Mike Henry told the Financial Times that policy changes introduced by president Donald Trump encouraged BHP to expand its exploration efforts and review dormant assets in the state. Henry stressed the administration’s sense of urgency to secure mineral supplies and reduce reliance on China is a welcome support for the industry.

The potential restart would focus on the Globe–Miami region, where BHP also intends to reprocess tailings from the shuttered operations. One such site was the Magma mine, acquired through BHP’s 1996 purchase of Magma Copper. The mine was later shut down, with its surface area converted into the base for the Resolution joint venture with Rio Tinto (NYSE, LSE, ASX: RIO).

Resolution Copper

The state’s most significant copper project remains Resolution Copper, held by BHP and Rio Tinto. The $2-billion development has been stalled for more than two decades while awaiting court rulings and final permits. Once operational, it could produce up to 1 billion lb. of copper a year, enough to meet roughly a quarter of U.S. demand.

Rio Tinto, which holds a 55% stake in Resolution, remains confident that Trump’s administration will grant the necessary approvals to move the project forward. However, the project faces opposition from local Indigenous groups.

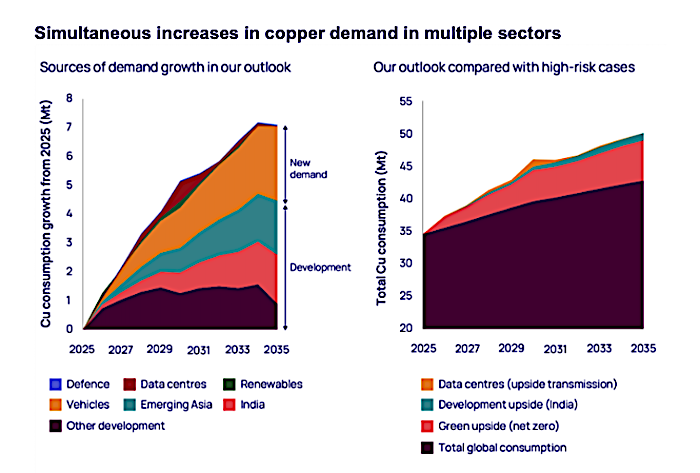

Henry’s comments come as copper demand is forecast to surge 24% by 2035, rising 8.2 million tonnes per year to 42.7 million tonnes, according to Wood Mackenzie. The consultancy’s new Horizons report warns that several powerful disruptors could amplify both demand and price volatility beyond expectations.

Among these disruptors, data centres represent the most unpredictable variable in copper demand forecasting. Beyond AI-driven demand, the broader energy transition is fundamentally reshaping copper consumption patterns. India and Southeast Asia are emerging as key growth engines, with their rapid industrialization expected to add 3.3 million tonnes a year of demand by 2035.

A fourth disruptor lies in shifting geopolitical priorities. Europe’s decision to raise defence spending to 3.5% of gross domestic product in response to Russia’s invasion of Ukraine adds a modest direct copper demand of 25,000 to 40,000 tonnes per year over the next decade. However, the broader impact will be felt through infrastructure resilience and modernization.

Together, these factors could add an extra 3 million tonnes a year, or about 40% of total copper demand growth, by 2035, Wood Mackenzie says.

Be the first to comment on "BHP eyes revival of long-closed copper mines in Arizona"