In the nine months that have passed since the first hole was completed on the Corani silver-lead project high in the Andes of southern Peru, Bear Creek Mining (BCM-V, BCEKF-O) has taken a raw, grassroots prospect and turned it into a promising bulk-tonnage target containing an overall resource of some 250 million oz. silver.

Based on the results of 83 diamond-drill holes totalling 14,689 metres and 24 surface trenches representing 2,594 metres of sampling completed in February, SRK Consulting has calculated a 44.5-million-oz. measured and indicated resource grading 49.5 grams per tonne (or 1.44 oz. per ton) silver in the Main Corani zone. Additional inferred resources in the Main Corani, Corani Este and Minas Corani zones total 205 million oz. averaging 72.8 grams (2.12 oz.), based on a silver cutoff of 20 grams.

Bear Creek president Andrew Swarthout is quick to stress that this resource is a “snapshot in time,” and does not include results from an emerging gold-silver zone 1.5 km south, where drilling, scattered along a 600-metre strike length, is intersecting 1-3 grams gold over appreciable widths.

Of the 31 holes completed to date on the gold zone, 28 of these have returned a weighted average of 1.68 grams gold and 33.7 grams silver across 22.3 metres of thickness. High-grade sections within the stockwork vein zones include 4 metres of 38.6 grams gold and 65 grams silver in hole 52.

“The numbers are arguably very conservative for the first resource calculation,” Swarthout said during a conference call. The company has already drilled another 41 holes, beyond the data used in the calculation, with more than half of these holes in the new southern gold-silver zone. Bear Creek has four drill rigs turning round the clock on the project.

“We will be going very quickly further north of 250 million ounces as we update our resource calculation in the next three to five months,” Swarthout predicted. “There is an awful lot of upside potential still for this to grow.”

The Corani project, 160 km directly southeast of the city of Cusco, covers 36 sq. km of high terrain and U-shaped valleys at elevations of 4,600-5,100 metres. It’s about a 6-hour drive along paved and unimproved roads from Cusco.

“It is high, but there are obviously no agricultural conflicts,” Swarthout said. “We have agreements in place with two communities to allow exploration.”

The villages of Quelccaya and Chacaconiza, 5 km northwest and northeast of the property, have legal title to the surface area covering the Corani project.

The area is sparsely populated, with about 500 people living within 10 km of the discovery area.

“Nonetheless, we have tried to bring them into the decision-making process and kept them educated and apprised of what this project means, and perhaps more importantly, what it doesn’t mean,” Swarthout said. “We’re working towards . . . the acquisition of the surface rights, and it has to be a win-win agreement. The community has to feel that they were treated fairly and I am confident that we are on the right track.”

Options

Bear Creek optioned the property in January 2005 from Rio Tinto (RTP-N) by agreeing to make a series of escalating payments totalling US$5.4 million over three years in return for an initial 70% interest. Upon earn-in, Rio Tinto will have a one-time right to either maintain a 30% working interest or sell it outright to Bear Creek for US$5 million.

Bear Creek’s earn-in is also subject to success payments, in addition to a claw-back provision. Should economic resources ultimately exceed 10 million oz. gold or gold equivalent, as defined by a bankable feasibility study, Rio Tinto could reacquire a 60% stake by reimbursing Bear Creek 300% of its exploration spending and carrying the junior through to production. In today’s market, this threshold is the equivalent of 600 to 700 million oz. silver, said Swarthout during a presentation at the recent Prospectors and Developers Association of Canada conference in Toronto.

“The threshold is extremely high — one that we’re not close to reaching yet, although there are some differences of opinion as to whether we could,” he said.

As it stands, the Corani project currently contains measured, indicated and inferred resources totalling 489 million oz. on a silver-equivalent basis as defined by SRK, after taking into account the added lead and zinc mineralization, based on metal prices of US$7 per oz. silver, US39 per lb. lead and US56 per lb. zinc.

The recovery of the lead and zinc is a very important component, with the potential to enhance the project’s value. Two holes dedicated to metallurgical test work were recently drilled into the heart of the Minas Corani and Corani Este zones. Samples from these holes are on their way to Salt Lake City, Utah, for further testing under the direction of Dawson Metallurgical Laboratories.

Based on polished section work and petrographic studies, the mineralization appears to be contained within argentiferous galena, galena, sphalerite and silver sulphosalts, with very little tenantite tetrahedrite.

As the deposit grows, it’s becoming increasingly apparent that Bear Creek is dealing with predominantly sulphide-hosted mineralization. Swarthout guesses that over 80% of the total resource is sulphide dominated.

“Flotation is probably going to be key in unlocking the long-term value of this property,” he said.

The test work will look at selective flotation of lead, silver and, separately, zinc concentrates. “So far, we have seen nothing that disturbs us in terms of the metallurgy,” Swarthout said.

A lower-grade envelope, which largely is not included in the resource calculation, is dominated by oxide mineralization. “There are going to be some interesting plays as far as mine scheduling and leaching,” Swarthout remarked. “It’s very possible that as you’re stripping the oxide material, you may be able to just stack it and leach it, or process it through an agitation leach circuit.”

Preliminary metallurgy on three bottle roll tests indicated recoveries for oxide material in the order of 55% to 70%, which is typical for an epithermal silver deposit.

“Those are still good results,” Swarthout said. “They show that in the oxide zones you will have reasonable recoveries with cyanide leaching.”

Bear Creek is doing more cyanide extraction tests to substantiate and nail down the oxide recoveries and cyanide consumption rates.

“Even though more and more as we drill, we suspect we’re hitting sulphide mineralization, the oxide leach performance is still a critical ingredient to the economic model,” Swarthout acknowledged.

‘Amazing’ statistics

Two trends of silver-rich mineralization — Main Corani and Corani Este, are exposed along separate ridges, roughly 500 metres apart at the north end of the project. So far, Bear Creek has drilled a collective strike length of 2.2 km and the mineralization remains wide open to the north, where some of the highest grades and thickest intercepts have been encountered, particularly on Corani Este.

The 83 holes that have been dropped into this are at a nominal drill spacing of about 100 metres.

“The statistics on this project are amazing,” Swarthout enthused. Out of 89 drill holes, 84 hit mineralization that was over 1 oz. silver and 1% lead, or in the gold belt, over 1 gram gold per tonne, he said.

The Corani Este zone lies directly across from the north end of the Main Corani zone, separated by a small drainage valley. The 26 holes completed to date into the side of the cliff and out under the younger post-mineral cover have intercepted mineralization for at least 650 metres along strike. With an inferred resource of 42.2 million tonnes grading 88.3 grams (2.58 oz.) silver, 1% lead and 0.73% zinc, based on a 20-gram (0.58 oz.) silver cutoff, Corani Este contains almost 120 million oz. silver, 421,841 tonnes lead and 306,629 tonnes zinc.

Recent drilling has extended the mineralization another 60 metres beyond the northern limits

of the resource boundary by hitting 140 metres of 103 grams (3 oz.) silver, 1% lead and 0.5% zinc. Hole 53A was drilled out to the east under the post-mineral cover and included a higher-grade section averaging 249 grams (7.3 oz.) silver, 1.8% lead and 1.1% zinc across 24 metres in the bottom half of the zone. Bear Creek has stepped out with another fence of holes a further 60 metres to the north and is visually encountering good mineralization in hole 59, which is in progress.

SRK used an average width of 130 metres for Corani Este in its resource estimate. Although Corani Este is wide open laterally to the east, it’s masked by a thickening wedge of younger post-mineral tuffs.

“We know from drilling along drill-hole fence 27 and other drill-hole fences that the mineralization is at least 200 metres wide at Corani Este and open to the east,” Swarthout said. “It’s not hard to see how this project can grow.”

Bear Creek is also encountering some bonanza-grade silver mineralization in feeder structures as it proceeds north under the post-mineral cover. The company has just finished constructing road access off to the east side, with three proposed drill sites.

“If those holes show mineralization extends to the east under that cover, then that model could change very quickly. By that, I mean adding ounces,” Swarthout said.

The Main Corani zone extends over a strike length of 1,500 metres. The original drilling at Main Corani was relatively closely spaced; as a result, a portion of the deposit was classified by SRK as measured and indicated resources, with the balance as inferred. Subsequent drilling at Corani Este and in the Minas Corani area at the north end of the Main Corani zone was more widely spaced, and has been classified as inferred.

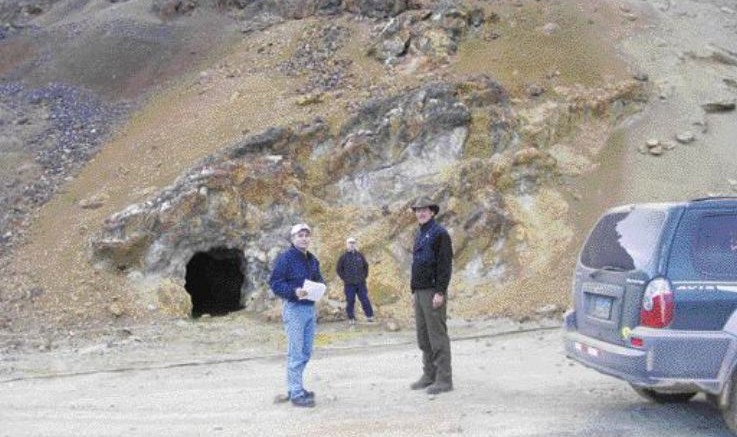

Minas Corani contains an inferred resource of 36.9 million tonnes grading 64.4 grams (1.88 oz.) silver, 1.19% lead and 0.46% zinc, equal to 76.3 million oz. silver, 439,531 tonnes lead and 167,829 tonnes zinc. Minas Corani was worked by underground mining methods during the 1950s and 1960s. Production was fairly small, totalling roughly 100,000 tonnes from narrow, sulphide-bearing silver-lead veins. Historical maps of the underground workings show development on four levels that extend over an area of 500 metres in a north-south direction, and by about 150 metres east-west. Exploration drilling is continuing to step out under the post-mineral cover on the northern end of Minas Corani. Two newly completed holes, 51 and 51A, were collared 70 metres beyond the resource limits and hit what appears to be a stacked sequence of mineralized structures. Hole 51 intersected 16 metres of 49.8 grams (1.45 oz) silver, 0.2% lead and 0.1% zinc, followed by 116 metres of 56 grams (1.6 oz.) silver, 1.1% lead and 0.1% zinc further down-hole.

“As we get further away from outcrop, we don’t have any guides and we’re going to have to fish around until we understand the structure,” Swathout said. “We suspect that in 51 and 51A, we are a bit to the west of the main structure.”

The Main Corani zone hosts a measured and indicated resource of 27.9 million tonnes grading 49.5 grams (1.44 oz.) silver, 0.79% lead and 0.23% zinc, the equivalent of 44.5 million oz. silver, 220,446 tonnes lead and 63,049 tonnes zinc. An additional 8.5 million tonnes grading 34.5 grams (1 oz.) silver, 0.51% lead and 0.37% zinc is inferred.

Starter-pit potential

“There is some significant tonnages near surface, or in many cases outcropping, which are at much higher grades, and will have a significant impact on the project from an economic standpoint, as these constitute significant volumes of material for starter pits,” Swarthout explained.

Using a higher-grade cutoff of 80 grams (2.3 oz.) silver, Corani Este and Minas Corani contain upwards of 113 million oz. silver, 388,275 tonnes lead and 268,073 tonnes zinc based on an inferred 29.3 million tonnes grading 120 grams (3.49 oz.) silver, 1.33% lead and 0.92% zinc.

“We expect these results to continue to the north as we drill,” Swarthout said.

Bear Creek has two rigs devoted to extending the northern boundaries of both Corani Este and Minas Corani.

Going forward, Swarthout is planning to drill another 20,000 metres in order to take most, if not all, of what has been reported as inferred and move it into the measured and indicated category.

“The continuity of mineralization that we have seen in all three deposits is extremely good,” he said.

An additional 15,000 metres of drilling will be aimed at finding other zones that have significant potential for adding ounces.

“We are nine months into this project and we have a long way to go,” Swarthout said, adding that the program is an aggressive one, which he believes will continue to be successful. A scoping study is due to be completed sometime in the second half of 2006.

Bear Creek currently has 38.7 million shares outstanding or 46.7 million on a fully diluted basis. The company held US$15 million in cash as of early March. Fully diluted, the company would have a cash balance of US$28.2 million, which, according to chairman Catherine McLeod-Seltzer, is more than enough to take Corani onto the next stage, as well as to cover the costs of exploration drilling on several other projects in the coming quarters.

Santa Ana

Bear Creek is preparing to drill the Santa Ana property sometime in April or May. Situated roughly 300 km south of Corani, Santa Ana is what originally brought Bear Creek to the area. The company became interested in the property in late 2004, before optioning Corani from Rio Tinto. A grassroots silver prospect that Bear Creek discovered while conducting gold exploration, initial sampling at Santa Ana came back with multi-ounce silver values in outcrop.

“We were amazed; we discovered the property was available for staking, so we acquired it,” Swarthout explained. Bear Creek controls a 100% interest under an application for 63 sq. km of mineral rights covering the mineralization and potential extensions.

Santa Ana represents a near-surface, bulk-tonnage, volcanic-hosted silver-lead-zinc target in a setting very similar to Corani. Swarthout said no drilling has been done in the area.

Old mine workings dating from the colonial era and centred on high-grade silver-bearing structures are found scattered on the property. Sampling of the mine dumps returned an average of 281 grams (8.2 oz.) in 40 samples.

The alteration and mineralization has a footprint measuring 2.8 km long and 600 metres wide. In total, 413 samples from surface outcrops and shallow workings (up to 3 metres deep) average 82.8 grams (2.4 oz.) silver, with some lead and zinc. Seventy-eight of the samples were taken from mineralized structures for an average of 237 grams (6.9 oz.), while the 335 samples represent wall rock and fractured outcrop averaging 43 grams (1.3 oz.).

The silver mineralization correlates with strongly anomalous lead and zinc, averaging 0.37% and 0.32% in 186 of the samples.

The anomalous footprint is open to the south where samples taken from outcrops on 100 metres spacing range from 15 to 574 grams; to the west, where the package extends beneath post-mineral pyroclastics; and to the east, under valley fill bordered by small Spanish-era workings.

Barite mineralization is seen along structures and bedding planes, and commonly floods the adjacent wall rocks in pervasively crackle brecciated wall rocks.

An initial program of 3,000 metres in a couple of dozen holes is planned.

“It’s a very exciting project and it would be incredible if lightning could strike twice in the same company here,” Swarthout said.

Be the first to comment on "Bear Creek defines growing 250M-oz. silver resource at Corani"