Vancouver — a Us$515-Million Financing Plus a C$45-Million private placement means Baja Mining (BAJ-T, BAJFF-O) can start construction at its large El Boleo copper-cobalt-zinc project in Mexico.

A US$475-million term loan and a US$40-million cost overrun loan from Bayerische Hypo-und Vereinsbank, a member of the UniCredit Group, will go a long way towards financing El Boleo’s US$568.4 million in development and working capital costs.

The company also recently announced a non-brokered private placement of 16.1 million units consisting of $1.86 per unit for a total of $45 million. Each unit consists of one share plus 0.65 of a warrant; each whole warrant is good for a common share at $2.50 for five years.

In addition, Baja has secured a US$10-million bridge loan with Endeavour Mining Capital to finance the purchase of long-lead order equipment.

Together, the financings mean Baja is ready to run with El Boleo, a fully permitted polymetallic project on tidewater on the east coast of the Baja Peninsula. In May, the company completed a definitive feasibility study based on the results of two test-mining programs and more than 38,000 metres of infill drilling on the historic site.

The feasibility study predicted average annual production of 55,750 tonnes copper, 1,535 tonnes cobalt, and 6,300 tonnes zinc over a 25-year mine life. The internal rate of return is pegged at 24.7%.

Open-pit reserves are estimated at 17.6 million tonnes grading 0.73% copper, 0.09% cobalt, 0.41% zinc and 2.86% manganese. The underground reserve is 67.4 million tonnes of 1.49% copper, 0.07% cobalt, 0.59% zinc and 2.92% manganese.

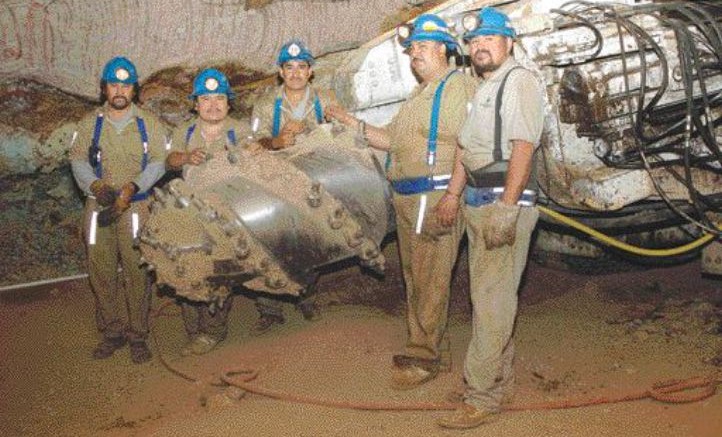

Baja plans to use continuous mining machines in the underground operation. The proposed plant is hydrometallurgical, producing copper and cobalt as cathode metals as well as a hydrous sulphate zinc compound.

The company is considering annual production of some 100,000 tonnes of manganese contained in manganese carbonate.

The French pulled 14 million tonnes of ore grading 5% copper from El Boleo between 1884 and 1934. A number of production attempts over the next 50 years failed. In 1992, Mintec International’s Mexican subsidiary, Minera y Metalugica del Boleo (MMB), staked the claims.

International Curator, the predecessor company to Canadian Gold Hunter (CGH-T, CGHLF-O), optioned the claims for a few years in the late 1990s, spending $23 million on exploration. In 2001, the claims reverted to MMB, which Baja Mining took over in 2004.

In the three years since, Baja has spent US$25 million on the property. In December 2006, the Mexican Federal Environmental Agency approved El Boleo’s environmental impact manifest, a milestone because the project is located within the buffer zone of the El Vizcaino biosphere, a protected area established to preserve the whale nursing habitat roughly 130 km north.

The company aims to be in production in 2009.

Be the first to comment on "Baja Mining Cashed Up for El Boleo"