The equity in Aztec Minerals (TSXV: AZT; US-OTCQB) jumped as much as 41.5% on Tuesday after it announced a deal with private concern Kootenay Silver Inc. to acquire a 100% interest in the Cervantes porphyry copper-gold project in Sonora state of northwestern Mexico.

Aztec has agreed to issue to Kootenay 10 million shares at 25¢ apiece in return for Kootenay’s 35% interest in Cervantes. Kootenay will also retain a 0.5% net smelter return royalty while becoming a fully-owned subsidiary of Aztec.

The transaction is expected to close on Aug. 5, pending regulatory approvals.

“We now look forward to continuing to define the open pit, heap leach gold potential of the porphyry gold oxide cap at the California Zone and evaluating the potential for deeper copper-gold porphyry sulphide mineralization underlying the oxide cap,” Aztec CEO Simon Dyakowski said in a press statement.

The addition in May of Alamos Gold (TSX: AGI) to the shareholder register shows larger companies are taking notice of the company’s exploration results at Cervantes. Alamos took a lead order in its financing of $3 million at 30¢ per unit. Each unit under the offering is set to contain one common share and one whole warrant. Warrants are valid for two years from the date of issuance and contain an exercise price of 40¢ each.

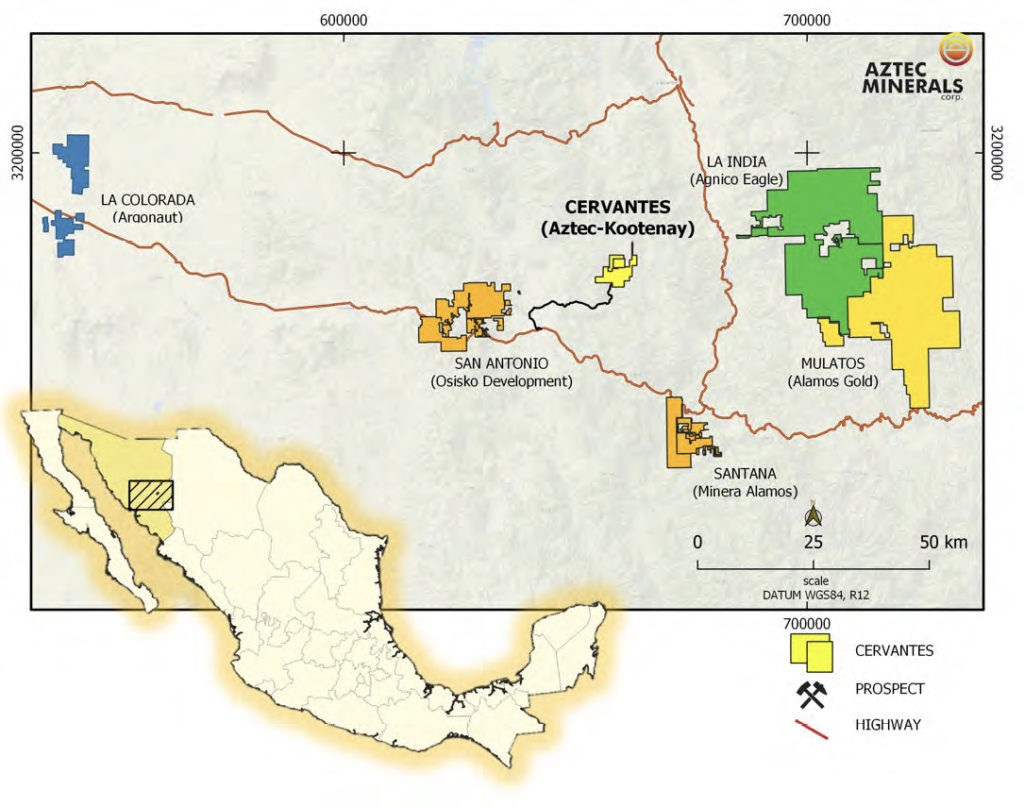

Cervantes project location. Credit: Aztec Minerals.

With its investment, Alamos took a 9.9% interest in Aztec on a post-financing basis. Notably, Alamos’ Mulatos gold mine is just 60 km east of Aztec’s Cervantes project.

Proceeds from the financing are to be used for further exploration of Aztec’s Cervantes project, its Tombstone property in Arizona, and general working capital purposes.

Since exploration started at Cervantes, the California Zone has emerged as a top prospect. In 2018 the company completed the first phase of 2,674 metres of core drilling, and a second phase comprising 5,267 metres followed earlier this year. The California Zone mineralization has been mapped to dimensions of more than 900 by 300 metres.

Aztec reports most holes intersected oxide gold mineralization from the surface, including highlight intervals such as 1.49 grams gold per tonne over 137 metres. Deeper sulphide porphyry gold-copper mineralization has been indicated by significant, strong induced polarization anomalies, which remain to be drill-tested.

At press time in Toronto, Aztec shares last traded at 29¢ apiece, up 9.43% or 2.5¢ after reaching an intra-day high of 37.5¢. Aztec has a market capitalization of $22.15 million. The stock is down 1.7% over the 12-month period.

Be the first to comment on "Aztec shares jump on Cervantes consolidation"